“The waterfront real estate market around Ottawa continues to be hot this summer. Area residents have always loved their summer cottages, but these days more people are also choosing a more permanent lake or river view. According to Jason Ralph, Broker of Record and President of Royal LePage Team Realty, waterfront properties are in high demand. “We’ve seen […]

It’s Prime Curb Appeal Season! Ottawa is a city full of natural beauty. From the outskirts to the city centre, you’re guaranteed to find green spaces and gardens full of colour around almost every corner. Now that summer is in full swing, it’s time to start thinking about your own curb appeal. It doesn’t […]

Your First Home is a Big Deal. Buying your first home is monumental. It’s a huge financial investment and a major life milestone. Unfortunately, nowadays it’s more difficult than ever to make the purchase by yourself. Luckily, in a market as diverse and ever-evolving as ours, there are many resources available for first-time homebuyers. […]

Everything You Need to Know About Trees With the recent Ontario wide storm so many trees were toppled over and caused a lot of property damage. So we thought it would be a good time to talk about how to properly care for your new trees, if you’ve chosen to replant some of the […]

The June 2022 Ottawa Real Estate Board Stats are out! Market Snapshot: With more modest price increases in the resale market we saw a more traditional seasonal cycle for June. An increase of inventory allowed for more selection and less pressure on buyers. If you’re considering a move we’re here to help answer any questions […]

4 Great Ways to Invest in the Ottawa Market Ottawa is a city with a variety of real estate in thriving, large neighbourhoods. In an appreciating market like Ottawa, real estate investments can provide significant financial benefits. There are a number of ways through which you can invest in real estate, each with its own […]

BIG vs. Small-Scale Real Estate Firms: Why Team Realty is Ottawa’s #1. Real estate transactions are some of the biggest and most significant financial decisions you will ever make. Whether you are buying, selling, or using real estate as an investment, ensuring you have the backing of a brokerage with tenured experience at hand […]

Over the past 20 years, everything has grown for Royal LePage Team Realty. Their families, the business, and Ottawa itself all look much different than they did back in 2002. What hasn’t changed is the team’s commitment to serving the community and helping Ottawans buy, sell, and lease properties. According to Royal LePage Team Realty […]

Buying Commercial Properties in this Economy Buying commercial real estate requires much thought and planning. After all; it could either be “home base” for your growing business, or simply a very large financial investment. As the market continues to diversify and expand, you may wonder how it could affect your ability to buy commercial […]

Giving Your Kids the Best Chance at Homeownership With housing markets across the country skyrocketing in recent years, it’s becoming a challenge for up-and-comers and young families to plant their roots in homeownership. This is currently affecting younger Millennials the most, but Generation Z is beginning to experience the same roadblocks. The solution: many […]

Ethnic Diversity Among Agents in a Multicultural Ottawa From coast to coast to coast, Canada is a beautiful country that residents and visitors alike enjoy exploring, many with hopes of putting down roots in their favourite corner of our home and native land. In a recent survey, Royal LePage found that newcomers represent a […]

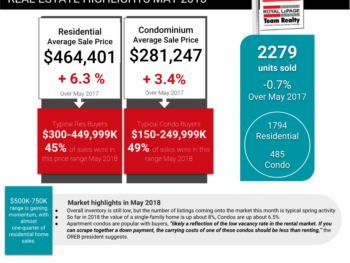

The May 2022 Ottawa Real Estate Board Stats are out! Market Snapshot: Traditionally a high performing month, May’s resale market has shifted its pace in comparison to 2021. The aftermath of the recent derecho storm stirred up both Ottawa’s landscape and listing inventory. If you’re considering a move we’re here to help answer any […]

Why Summer is a Good Time to Buy “Summertime” means that the grass is at its greenest, the trees are at their fullest and gardens at their most vibrant. Although spring may be touted as the best time to buy, that doesn’t mean it’s the only time you’ll be able to do so. Summer […]

After an intense few years, the local real estate market is showing a very slight shift towards calmer waters. Jason Ralph, Broker of Record and President of Royal LePage Team Realty, explains, “The market was so overheated that even a small shift seems drastic, even though it isn’t going back to pre-2020 levels. We are starting […]

5 Things You Need to Know About Buying in Ottawa 5 Things You Need to Know About Buying in Ottawa: Ottawa is a beautiful city with much historical significance. The national capital region is home to a wide variety of diverse, thriving neighbourhoods that see growth each year. There are many schools and businesses […]

I Have Just Inherited Property. What Should I Do? Do Your Homework Inheriting property can be an exciting time in your life. There can also be mixed emotions depending on the circumstances. The number of older Canadians is growing. This has caused the most significant number of inheritances Canada has ever seen. This trend is […]

Everything you Need to Know About Buying Older Homes Buying a 20th century home may fit your real estate needs, but there are many things to consider when exploring an older market. Buying an older home comes with numerous advantages. They are often less expensive compared to newer builds, with no construction required […]

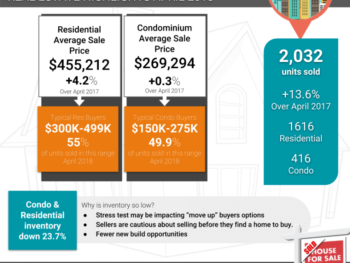

The April 2022 Ottawa Real Estate Board Stats are out! Market Snapshot: With supply remaining under one month we continue to be in a seller’s market. Prices are continuing to climb but at a slower, more moderate pace than what we saw earlier in the pandemic. If you’re considering a move […]

Beyond the Sign: Moving time! 8 tips to help your move go smoothly. Moving can be a daunting experience, especially if it’s your first time doing so. Whether you are planning an upcoming move to or within the city of Ottawa, there are certain steps that you can take to ensure that the process goes […]

James Dean

Sales Representative

Royal LePage Team Realty

1335 Carling Avenue

Ottawa, Ontario

K1Z 8N8

Office: 613-725-1171

Direct: 613-293-2088

Fax: 613-725-3323

Toll Free: 1-800-307-1545

James@JamesDean.ca