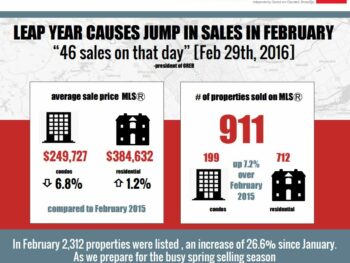

Real Estate Snapshot February 2016

What a difference a day makes! An extra day in February saw 46 sales on that day (February 29th) as per the Ottawa Real Estate Board’s news release March 3rd. See the full Ottawa Real Estate market snapshot for February and the full story from the Ottawa Real Estate Board below. With spring around the corner, we’re starting to see more homes come on the market, if you’re thinking of selling now is a great time to get your home listed with a real estate professional. While statistics are useful in establishing trends they should not be used as an indicator of an increase or decrease in value of specific properties. If you are curious about the value of your home and/or specific neighbourhood statistics we would be happy to provide you with a no cost no obligation market evaluation of your property. Contact any one of our 23 offices or email us at info@teamrealty.ca From the Ottawa Real Estate Board March 3rd, 2016 Extra day in leap year causes jump in sales for February Members of the Ottawa Real Estate Board sold 911 residential properties in February through the Board’s Multiple Listing Service® system, compared with 850 in February 2015, an increase of 7.2 per cent. The five-year average for February sales is 908. “Although the weather was very unpredictable this month, with many highs and lows and several winter storms, the Ottawa resale market only saw activity pick up,” says President of the Ottawa Real Estate Board, Shane Silva. “Residential and condo sales combined increased by 52.3 per cent since last month. However, we need to factor in the leap year, which added an extra day to the month of February, and 46 sales on that day.” February’s sales included 199 in the condominium property class, and 712 in the residential property class. The condominium property class includes any property, regardless of style (i.e. detached, semi-detached, apartment, townhouse, etc.), which is registered as a condominium, as well as properties which are co-operatives, life leases and timeshares. The residential property class includes all other residential properties. “In February, 2,312 homes were listed, up 26.6 per cent since January, and inventory on hand at the end of February rose by 10.7 per cent since January,” says Silva. “We’re starting to see more homes coming onto the market in preparation for the busy spring selling season. If you’re thinking of putting your home on the market, this is a great time to do so.” The average sale price of a residential-class property sold in February in the Ottawa area was $384,632, an increase of 1.2 per cent over February 2015. The average sale price for a condominium-class property was $249,727, a decrease of 6.8 per cent over February 2015. The Board cautions that average sale price information can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of all properties sold. “The highest concentration of properties sold continues to be in the $300,000 to $400,000 price range, followed by the $200,000 to $300,000 range,” says Silva. “These price ranges continue to have the highest concentration of properties sold – residential and condo – while two-storey, bungalow, and one-level condos have the highest concentration of buyers. In addition to residential and condominium sales, OREB Members assisted clients with renting 414 properties since the beginning of the year.” The post Real Estate Snapshot February 2016 appeared first on Team Realty. Source: Blog

7 Deadly Sins of Home Renos

Homeowners who renovate only to boost resale value should aim for a return on investment (ROI) of three dollars for every dollar invested. Resale renos should be neutral in colour and conservative in tone so they appeal to the maximum number of potential buyers. And, cost control always trumps elegance. In fact, some renovations can actually damage your home’s value. These supposed improvements not only add nothing to your bottom line, they may make your home less attractive to potential buyers and bring down its value. Here are seven such expensive mistakes to avoid. Pools A pool will chase away numerous buyers due to maintenance, public liability, insurance and local government laws regarding fencing and safety barriers. Don’t waste the money. Skip the Sunroom Unless you want the exposure to nature, avoid this addition which yielded only 48.7 percent ROI according to Remodelling magazine’s 2015 statistics. Converted Garage Some homeowners see converting a garage as a cheaper way to add more living space than building an addition – and it is. But, many buyers prefer a garage to protect assets from the cold and snowy conditions. And, a garage is much more valuable than an extra room. Fancy Faucets and Lighting Fixtures For kitchen or bathroom renos, avoid ornate fixtures for two reasons. First, you reduce the pool of buyers due to the cost. Second, stylized fixtures will appeal only to a small number of potential buyers, those who share your taste, further reducing your chances to sell. Eliminating a Bedroom or Powder Room In older homes, combining smaller rooms in the public living space might add to the value and appeal to homeowners who like large, open spaces. Eliminating a powder room, however, is a bad idea. And turning a bedroom into a master closet or combining two bedrooms to create a large master suite may not pay. As Kevin Brown Jr., president of Praedium Real Estate Services points out, “You’ve eliminated a whole living space.” Elaborate Landscaping A basic make over is the surest way to make money back from your outdoor outlay. Avoid overspending. Things That Are Invisible Adding insulation, window upgrades, or air conditioning does not increase the value of a property as much as some sellers believe. This type of feature can add to the marketability, not the value. The post 7 Deadly Sins of Home Renos appeared first on Team Realty. Source: Blog

The Do’s and Dont’s of Basement Storage

This article from Bob Vila gives eight handy tips to consider when using your basement for storage. The suggestions include taking advantage of vertical space by building up and not out, using open shelves for frequently-used items and built-in cabinets to conceal toys or cleaning supplies, storing off-season gear in sealed bins to protect from moisture and dust, using a pulley-hoist to store heavy or bulky items from the ceiling, protecting tools stored in the open with a coating of machine oil to prevent rust and running a humidifier in the basement to suck moisture from the air and combat mold or mildew. To read more click here. Source: Blog

What You Need to Do When Saying Goodbye to Your Home

Although you’re excited about moving, there are easy ways to reduce the ache you feel when thinking about leaving the old abode. According to this Realtor.com post by Lisa Davis you could throw a going away party with the neighbours who shared your journey over the years. Toast your soon-to-be former residence. Leave a reminder of your presence for future generations like a signature on a rafter in the attic. To read more click here. Source: Blog

Reno Investments Providing the Highest Returns

This detailed Home Inspection Network post provides useful data to anyone who is considering a home renovation. Author Bev Siciliano begins by explaining what many do not realize – we might not fully recoup our investment when the home is sold. For that reason alone, home renovations should be analyzed individually to ensure we get the highest return on investment (ROI). Generally, renovations that provide the best return on resale are superficial upgrades, like painting and decorating, with limited capital outlay and maximum impact. According to the Appraisal Institute of Canada’s latest Home Renovation Survey, renovations with the highest return potential are kitchen and bathroom renos at 75 -100%, followed by interior and exterior painting at 50 – 100%. Skylights rate the lowest potential return on investment (ROI) at 0 – 25%, with swimming pools at 10 – 40% and landscaping, fences and interlock at 25 – 50%. Central air, decks, window/door upgrades, fireplace installs, rec room or garage additions, new flooring, and basement renos have a potential ROI of 50 – 75%. To read more click here. Source: Blog

The 3 Most Common Reasons a Home Inspection Kills a Deal

In this Redfin.com post, home inspector Dylan Chalk underscores the importance of a home inspection by identifying how they can prevent a potential sale. The most common reason is the home is not what it appears to be, especially in the case of a “flipped home”, one purchased and updated with the intention of making as much profit as possible. The inspection reveals there are more repairs and updates than the buyer expected. Problems with the core systems of a “fixer” house (foundation, frame, roofline, floor plan, drainage and access) add cost and complexity to the new homeowner’s projected budget making the deal less attractive. To read more click here. Source: Blog

5 Questions to Ask Before Replacing Your Roof

Most of us have little or no experience with re-roofing, so this post by home reno expert Bob Vila is a valuable guide to the questions a homeowner should ask before hiring a roofer. First, ask for an estimate that is comprehensive enough (permits, inspections, materials, labour, contingency) to establish a firm budget. Discuss the proposal in detail with the contractor. Find out what materials are being used and get the specifications in writing. Avoid cheaper, low quality materials, especially the shingles, because sub-standard materials reduce a roof’s life expectancy costing you more over the long term. Inquire how the project will be accomplished – installing shingles on top of the existing materials may seem cheaper, but removing the existing roof materials will provide a chance to inspect the roof deck in case repairs are needed. Ask if your contractor is licensed, insured, and bonded so you aren’t liable for any accidents during the project. Finally, check how long the roof will last and ask about warranty coverage for materials (Owens Corning shingles are guaranteed for 50 years) and installation (most small contractors do NOT warrant workmanship). To read more click here. Source: Blog

An Economist’s Letter to Millennials Who Can’t (Yet) Buy a Home

This post from Jonathan Smoke, chief economist at realtor.com, explains what Millenials can do to help themselves along the path to home ownership. For example, a high debt burden will restrict their ability to qualify for a mortgage, and the amount they can get, so they need to limit their total debt payments (student loans, credit cards, car loans, etc.) to less than 15% of their income. Smoke also covers the importance of improving their credit score, saving as much as they can for a down payment and creating an emergency fund for unexpected bills. To read more click here. Source: Blog

8 steps to getting started in property investment

This propertyinvestment.com post from Nila Sweeney is an excellent primer for those who want to start a property portfolio. First, check your finances to see how much you can invest and get mortgage pre-approval. Then, define what success means for you, as well as the level of risk you are comfortable with, and set your goals. Next, start budgeting and create a purchase plan. Finally, research the market for opportunities that meet your criteria and approach them as business transactions, applying logic rather than being swayed by your emotional attachment. To read more click here. Source: Blog

Don’t tax my dream campaign succeeds

The efforts of the Ontario Real Estate Association (OREA) and the Progressive Conservatives were recently rewarded when the provincial government decided they would NOT be expanding the municipal land transfer tax program. Liberals keep election promise In an unexpected announcement during the legislature’s question period, Municipal Affairs Minister Ted McMeekin ended concerns that the Liberals would break their election campaign promise and allow other cities and towns to introduce the tax. “There has been no call, at all, for a municipal land transfer tax,” he said, “nor is there any legislation before the House that would allow this.” Toronto will remain the only Ontario city where homebuyers have to pay thousands of dollars in local land transfer taxes, in addition to the provincial levy. But, McMeekin kept the door open to a future tax by offering to look at “what possibilities exist” for other new sources of revenue to help strained municipal budgets. Ontarians opposed to tax grab OREA had been exerting pressure on the government with its “don’t tax my dream” campaign which allowed the voices of thousands of Ontarians opposed to the tax to be heard through email, letters and social media platforms. They were arguing the additional tax could push house prices further out of reach for many families and delay or kill their dream of home ownership. “Ontario home buyers are already charged a provincial land transfer tax, so by adding a municipal tax, they’re essentially doubling the tax burden on Ontario families,” said Patricia Verge, president of OREA. “If the Ontario Liberals follow through with this plan, home buyers will be forced to pay $10,000 in total land transfer taxes on the average priced home in Ontario, starting as early as next year.” Tax would have negative impact on local economies OREA also cited a 2014 study conducted by Altus Group Economic Consulting showing that the combined negative impact of the tax in four Ontario cities—Mississauga, Hamilton, Ottawa and London—would be a loss of $1 billion in economic activity and more than 10,000 jobs. The confrontation has been ongoing since 2008 when Toronto implemented its municipal land transfer tax and, as recently as October, it appeared the government was poised to grant permission for other municipalities to impose the tax. Source: Blog

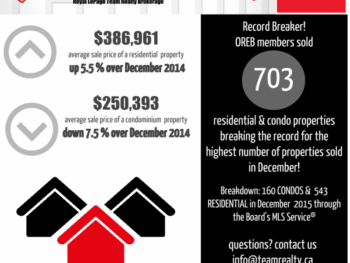

Record-breaking December, contributes to a strong 2015

Record-breaking December, contributes to a strong 2015 – Latest News from the Ottawa Real Estate Board Ottawa, January 6, 2016 – Members of the Ottawa Real Estate Board sold 703 residential properties in December through the Board’s Multiple Listing Service® System, compared with 638 in December 2014, an increase of 10.2 per cent. The five-year average for December sales is 653. The total number of residential and condo units sold through the Board’s MLS® System throughout all of 2015 was 14,658, compared with 13,919 in 2014, an increase of 5.3 per cent. Separately, residential and condounit sales each outperformed the 2014 numbers. “Looking back at the 2015 market, we started the year off with extreme cold temperatures in the first quarter of the year, but that didn’t stop homebuyers,” says new President of the Ottawa Real Estate Board, Shane Silva. “We saw the busy spring selling season pick up as early as March this year, and continue well throughout the summer, with a small dip in July, followed by record-breaking sale numbers in September. Three months later, December broke the record for the highest number of residential and condo properties sold at 703 units, only comparable to 2011, when 699 properties sold.” December’s sales included 160 in the condominium property class, and 543 in the residential property class. The condominium property class includes any property, regardless of style (i.e. detached, semi-detached, apartment, stacked etc.), which is registered as a condominium, as well as properties which are co-operatives, life leases and timeshares. The residential property class includes all other residential properties. “The listing inventory for both residential and condos trended higher all year, showing signs of tapering off in October,” says Silva. “Increased inventory levels contributed to the market favouring Buyers for much of the year; however as the inventory levelled out in the fall, we moved into more balanced conditions. Cumulative days on market increased to 109 days in December, while the average for the year comes in at 86 days. Average residential sale prices are up slightly over last year, which is great for the Ottawa market. All combined, these indicators point to a stable real estate market.” The average sale price of a residential-class property sold in December in the Ottawa area was $386,961, an increase of 5.5 per cent over December 2014. The average sale price for a condominium-class property was $250,393, a decrease of 7.5 per cent over December 2014. The year-to-date numbers for the average residential sale price in 2015 was $391,940, an increase of 1.9 per cent over 2014. While the average condominium sale price was $259,691, a decrease of 1.5 per cent over 2014. The Board cautions that average sale price information can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of all properties sold. “A trend all year long, the hottest segments of our market are properties sold in the $300,000 to $400,000 price range, with 31.6 per cent of the year’s sales, followed by the $200,000 to $300,000 range, with 26.2 per cent of the year’s sales” says Silva. “In addition to residential and condominium sales, OREB Members assisted clients with renting 181 properties in December, and over 3,000 properties this year.” Source: Blog

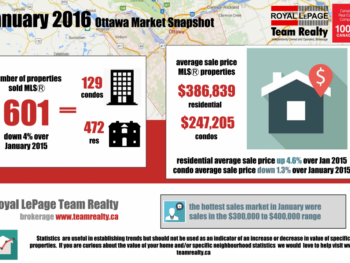

Ottawa Real Estate Market Eases off with Cooler January Weather

Ottawa Real Estate “Market Snapshot” January 2016 Statistics are useful in establishing trends but should not be used as an indicator of an increase or decrease in value of specific properties. If you are curious about the value of your home and/or specific neighbourhood statistics we would be happy to provide you with information, no obligation, please contact us at info@teamrealty.ca if you have any questions. We look forward to hearing from you! _________________________________________________________________________________________________________ *provided by the Ottawa Real Estate Board Members of the Ottawa Real Estate Board sold 601 residential properties in January through the Board’s Multiple Listing Service® system, compared with 626 in January 2015, a decrease of four per cent. The five-year average for January sales is 618. “The market momentum gained from the warmer weather in the latter part of 2015 has eased off with the arrival of typical winter weather in January,” says President of the Ottawa Real Estate Board, Shane Silva. “We are seeing a drop in the number of residential and condo properties listed this January over the year before. However, the number of properties listed almost doubled the amount listed in December – a normal occurrence at the beginning of the year as people begin to plan for the year ahead.” January’s sales included 129 in the condominium property class, and 472 in the residential property class. The condominium property class includes any property, regardless of style (i.e. detached, semi-detached, apartment, townhouse, etc.), which is registered as a condominium, as well as properties which are co-operatives, life leases and timeshares. The residential property class includes all other residential properties. “Residential unit sales this month were down, while condominium unit sales were up, over last year,” says Silva. “Residential two-storey and bungalow homes continue to have the highest concentration of buyers, with three-storey homes increasing in sales by over 50 per cent since this time last year. Two-storey condominium properties had a similar increase, showing the same amount of unit sales as one-level properties.” The average sale price of a residential-class property sold in January in the Ottawa area was $386,839, an increase of 4.6 per cent over January 2015. The average sale price for a condominium-class property was $247,205, a decrease of 1.3 per cent over January 2015. The Board cautions that average sale price information can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of all properties sold. “A possible explanation for the increase in residential average sale price this month over last year is that the amount of properties sold over $1 million doubled that of last year, with six properties sold this month,” notes Silva. “Nevertheless, the hottest segments of our market in January were sales in the $300,000 to $400,000 range, followed closely by the $200,000 to $300,000 range. In addition to residential and condominium sales, OREB members assisted clients with renting 200 properties in January.” Source: Blog

Your Guide to 10 Popular Landscape Paving Materials

If you are considering landscape paving, this excellent Houzz.com post by landscape architect Falon Mihalic includes guides to 10 of the most popular materials. Focused on cost, climate, maintenance and functional application, the guides explain the pros and cons of cast-in-place concrete, the cheapest option, pre-cast concrete, gravel, limestone, brick, slate, tile, bluestone, granite, and travertine. Mihalic also notes that many of the materials can be reused and suggests where the cost and/or environmentally conscious consumer can find them. To read more click here. Source: Blog

Your Complete Guide to Pest-Proofing This Fall

To prevent an onslaught of pests from occupying your house as the weather cools, simply follow the National Pest Management Association guidance presented in this post from Bob Villa. Seal cracks in the exterior envelope, especially where utility pipes enter, with silicone caulking. Fill larger gaps inside your home with steel wool. Pests avoid the roughness of the steel fibers and rodents cannot gnaw through it. Repair ripped window screens, door sweeps and loose mortar in the basement foundation, screen dryer vents and chimneys and replace weather stripping to seal these ideal entry points. If you suspect an infestation, hire a licensed pest control professional to assess the situation. To read more click here. Source: Blog

Ottawa Named 3rd Best City in the World for Quality of Life; Here’s Why

In this Point2Homes post, Nadia Balint attributes Ottawa’s stellar, but unsurprising (to locals), ranking in the recent Numbeo Quality of Life Index to three characteristics: Ottawa is young and fun with almost half the population under 35, it promotes and supports family life and the housing is relatively affordable. The Index rates factors like purchasing power, safety, property price to income ratio, and pollution. To read more click here. Source: Blog

9 Bad Habits That Are Killing Your Appliances

This slide show from Bob Villa is an excellent visual representation of how NOT to treat your appliances. For example, an overloaded washing machine stresses the bearings and misaligns the drum. Overfilling the freezer can block air vents, restrict the flow of cold air and overtax the condenser. Clean spills right after using the oven as they can damage the heating coils. To read more click here. Source: Blog

Higher electricity costs: how to circumvent them

Because the cost of electricity is expected to rise as a result of the federal Liberals’ green energy policies, prudent investors should pay attention to the energy consumption of their rental properties. This Canadian Real Estate Magazine post advises landlords to find ways to become more energy efficient such as installing programmable thermostats and motion sensor lights. More important is to pass the higher cost of hydro on to their tenants, whenever possible, and to implement an energy consumption ceiling for their all-inclusive leases. To read more click here. Source: Blog

Not Only Millennials Want Walkable Communities

A walkable community is well-planned, compact and designed for people to walk to work, school, parks restaurants and activities as a form of everyday transportation. According to a National Association of Realtors survey, more and more buyers want to live in walkable communities. The study found that fully 12% more Millennials, the generation born between the mid 1980′s and early 2000′s, would rather walk to their destination than drive. But, fitness enthusiasts and eco-friendly individuals also desire walkable neighbourhoods. Aging In Place Older Canadians want neighbourhoods that better fit their changing requirements. As baby boomers enter their retirement years, they will increase demand for senior housing and neighborhoods where they can more easily reach amenities, take care of daily needs, and access health care. The physical and/or financial requirements of maintaining their homes may be too much. Many cannot, or choose not to drive, so a development that is condensed, diverse, and walkable, with convenient public transport, gives them the ability to “age in place” (in the same home). Features of Walkable Communities a blend of shops, businesses and homes destinations (schools, stores, workplaces) within walking or biking distance sidewalks, pathways, green space, parks and infrastructure to support physical activities bike lanes and speed calming controls on roads trails and street crossings designed to make walking safe and accessible for everyone a variety of social, recreational, cultural, artistic and commercial activities public transport options to outlying destinations Benefits of Walkable Communities a more active, healthier population, no matter their age, income, gender or ability level safer neighbourhoods (i.e. fewer cars on the road, less accidents and injuries) improved air quality due to reduced greenhouse gas emissions a smaller environmental footprint reduces negative environmental impact positive social, recreational, cultural, artistic and commercial activities fosters a strong sense of place and give greater potential for social health lower combined housing and transportation costs , Real Estate Market Demand According to a U.S. Environmental Protection Agency report considering existing housing stock and consumer preferences, demand for new homes through 2025 might be almost exclusively for multi-family, attached and small-lot, single-family, detached homes. A 2010 analysis of real estate trends notes that “the two largest demographic groups in the country, the baby boomers and their children—together comprising half the population—want homes and commercial space in neighborhoods that do not exist in anywhere near sufficient quantity.” Another survey found that future demand for homes in compact neighborhoods could exceed 140 percent of the current supply. Conclusion With these demographic, lifestyle and development trends it is clear that diverse, attractive, healthy walkable communities will increase in popularity and not just for Millennials. Source: Blog

Ottawa Real Estate Update: November 2015

Mild weather and post-election enthusiasm spurs on home buyers! Statistics are useful in establishing trends but should not be used as an indicator of an increase or decrease in value of specific properties. If you are curious about the value of your home and/or specific neighbourhood statistics we would love to help. Contact us. Information below provided by the Ottawa Real Estate Board December 3rd, 2015 Members of the Ottawa Real Estate Board sold 990 residential properties in November through the Board’s Multiple Listing Service® System, compared with 891 in November 2014, an increase of 11.1 per cent. The five-year average for November sales is 944. “Mild temperatures in November, combined with increased activity post-election, were key factors in the Ottawa resale market performing exceptionally well in November,” says David Oikle, President of the Ottawa Real Estate Board. “The positive increase in condo sales may be explained by buyers moving to Ottawa to accept positions with the new government. There may have also been some pent up demand of people who chose to sit on the sidelines until after the election was over.” November’s sales included 199 in the condominium property class, and 791 in the residential property class. The condominium property class includes any property, regardless of style (i.e. detached, semi-detached, apartment, stacked etc.), which is registered as a condominium, as well as properties which are co-operatives, life leases and timeshares. The residential property class includes all other residential properties. “The condo market has picked back up over the past few months – a very positive change from the first half of the year, and now year-to-date condo sales have surpassed the numbers of units sold in 2014,” says Oikle. “Inventory levels are balancing out, cumulative days on market increased to 104 days, and average residential sale prices remain steady. This is very typical of a market that’s heading into the winter season.” The average sale price of a residential-class property sold in November in the Ottawa area was $380,761, a decrease of 0.4 per cent over November 2014. The average sale price for a condominium-class property was $275,332, an increase of 9.9 per cent over November 2014. The Board cautions that average sale price information can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of all properties sold. “The highest concentration of properties sold remains in the $300,000 to $400,000 price range, followed very closely – behind by only 26 properties – the $200,000 to $300,000 range,” says Oikle. “In addition to residential and condominium sales, OREB members assisted clients with renting 247 properties in November, and over 2,800 since the beginning of the year.” Source: Blog

Why Cleaning Window Screens Should Be Part of Your Winter Strategy

Should removing and cleaning the window screens be part of your winter maintenance routine? According to this houzz.com post, there are several benefits to be gained. Simply put, dirty mesh blocks light, heat and the view. For example, you get 30 to 40 percent more light coming in without screens on the windows. More sunshine means you need less artificial light and can save on energy costs. In addition, removing the screens increases the solar energy getting through to the windows. Improved solar heat gain reduces the need for mechanical heating saving on heating bills. Also, during a storm, snow gets caught between the window and screen which can damage the frame. Wait until after the first freeze, to avoid bugs, and take the opportunity to inspect and repair the screens, where necessary. To avoid damage, vacuum the screens with a brush attachment. Then, use a soft brush or sponge to gently scrub them with a solution of dish soap and water. Don’t push too hard or the screen will be damaged. Rinse the windows with a hose, wipe them down on both sides and let them dry in the sun. Remember to mark each screen with its corresponding window to make spring installation easier. Finally, store them in a dry place where they won’t get damaged. To read more click here. Source: Blog

Create a beautiful bathroom for the ages

As people age, reduced mobility, impaired balance, failing vision and muscle weakness make them more susceptible to injuries in their home, and bathrooms are no exception. This Consumer Reports article tells how the latest design trends are helping owners upgrade their bathrooms with changes that enhance safety while retaining their beauty and avoiding an institutional look. In addition, subtle name changes have made useful improvements like shower rails (formerly called grab bars) and higher-seated toilets (“comfort height”) more acceptable. By widening the bathroom doorway, removing the raised sill and replacing knobs with easier-to-open handles you improve access. Installing slip-resistant tile or vinyl and/or shower bars will reduce the risk of falling. To reduce glare, mount lights on the side of your mirrors, not above, and bring in natural light with windows or skylights. Design the sink area to be suitable for all ages and abilities. Wall mount sinks provide room for someone who wants to sit, dual-level countertops help the youngsters and faucet levers are easier to turn than knobs. Open or glassed-in shelves make things easier to find. People with mobility issues can choose from curbless showers with seating and walk-in tubs with entry doors, sliding sides or wide edges to sit on while swinging their legs over the side. To read more click here. Source: Blog

Underwriting insights! What Every Homebuyer Should Know Before Applying for a Mortgage

This homeownership.ca post tells why an understanding of underwriting is a key advantage for home buyers seeking a mortgage. Work with a mortgage professional to get pre-approved for a mortgage so you know your price range and can make an offer instantly. The pre-approval process determines the size of mortgage and type of home you can afford. You will need to assemble your credit report and other documentation (financial and employment history, creditworthiness, income) the lender or mortgage insurer needs to process the application. The documentation required varies depending on individual circumstances. For example, self-employed applicants should be prepared to prove a consistent level of income over at least two years. To read more click here. Source: Blog

Machu Picchu Challenge for Shelter

Machu Picchu Challenge for Shelter August 2015 in Machu Picchu, Peru In support of the Royal LePage Shelter Foundation people from Royal LePage offices across Canada have started the trek to Machu Picchu to help restore hope for women and children escaping violence. “For eight days, 70 enthusiastic supporters are trekking at high altitude, camping in tents, and forgoing running water, electricity and cellphone service to raise funds and awareness for the Royal LePage Shelter Foundation. Each participant was required to raise $5,000 and will be covering their own travel expenses.” …read more Royal LePage Team Realty is proud to have our sales representative Hanna Browne representing our company and supporting this amazing cause! Good luck to Hanna and all of the participants we can’t wait to hear about your adventures. Source: Blog

Should you let children choose their bedroom paint colours?

Should you let children choose their bedroom paint colours? In this Canadian Living post, Brett Walther suggests a way to let your child participate when deciding what colour(s) to paint their room while also avoiding a choice that is unacceptable to you, or one that they will want to change next week. The key is to guide their choice by presenting a few options that appeal to them while also meeting your own criteria. To read more click here. Source: Blog

CMHC announces new rules to make it easier for homeowners to rent out property

In this Financial Post article, Garry Marr discusses the impact of upcoming changes from Canada Mortgage and Housing Corp (CMHC) that will permit homeowners to count 100% of the income from their secondary units when qualifying for a loan. Currently, homeowners with legal units can only count 50% of the income from legal rentals. By making it easier to borrow money, Marr suggests CMHC will be bringing more people into the market, and that is expected to boost affordable housing, especially in hot markets like Vancouver where secondary units make up almost 20% of the city’s rental stock. To read more click here. http://www.financialpost.com/m/wp/blog.html?b=business.financialpost.com//personal-finance/mortgages-real-estate/cmhc-announces-new-rules-to-make-it-easier-for-homeowners-to-rent-out-property Buying a property with a rental unit is a great way to own a home while someone else helps pay your mortgage! Please contact us for info & available income properties. Source: Blog

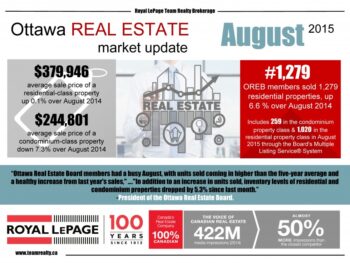

Strong summer performance for Ottawa’s resale market

Check out the latest Ottawa Real Estate Statistics from the Ottawa Real Estate Board The summer real estate market has been strong in the Ottawa area, as we head into fall we’ll keep you updated on the latest Ottawa Real Estate market news! Are you interested in a specific neighbourhood? Please contact us! We have the latest Ottawa neighbourhood statistics available. _____________________________________________________ Members of the Ottawa Real Estate Board sold 1,279 residential properties in August through the Board’s Multiple Listing Service® System, compared with 1,200 in August 2014, an increase of 6.6 per cent. The five-year average for August sales is 1,234. “Ottawa Real Estate Board members had a busy August, with units sold coming in higher than the five-year average and a healthy increase from last year’s sales,” says David Oikle, President of the Ottawa Real Estate Board. “In addition to an increase in units sold, inventory levels of residential and condominium properties dropped by 5.3 per cent since last month, and cumulative days on the market was an average of 89 days.” August’s sales included 259 in the condominium property class, and 1,020 in the residential property class. The condominium property class includes any property, regardless of style (i.e. detached, semi-detached, apartment, stacked etc.), which is registered as a condominium, as well as properties which are co-operatives, life leases and timeshares. The residential property class includes all other residential properties. The average sale price of a residential-class property sold in August in the Ottawa area was $379,946, a decrease of 0.1 per cent over August 2014. The average sale price for a condominium-class property was $244,801, a decrease of 7.3 per cent over August 2014. The Board cautions that average sale price information can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of all properties sold. “It is important to note that the increase in units sold is for both residential and condominium properties,” says Oikle. “Also, we continue to see an increase in the number of condominium units sold in comparison to 2014, and the year-to-date condominium sales are now close to on par with last year.” “The majority of buyers in Ottawa continue to buy properties in the $300,000 to $400,000 price range, closely followed by the $200,000 to $300,000 range,” says Oikle. “In addition to residential and condominium sales, OREB members assisted clients with renting 295 properties in August, and over 2,000 since the beginning of the year.” Source: Blog

Your Annual Home Maintenance Schedule

Following an annual maintenance schedule is an essential step in protecting the value of what will probably be the largest investment of your life – your home. First time home owners, or those lacking experience may struggle with this task and overlook important elements. Here are some guidelines to help you create a maintenance program that suits your needs. Benefits of Home Maintenance Regular preventive maintenance identifies minor repairs before they become expensive, major repairs. It also preserves your home’s market value. One study found that “greater than $5 return for every $1 spent on preventive maintenance is not unusual”. Other rewards include: extended life for your home’s components, equipment and operating systems; improved energy efficiency and a reduced environmental footprint; lush, healthy vegetation and attractive landscaping; assurance that your living space is safe and comfortable; improved presentation and continuing exterior appeal; and avoiding home inspection shockers when you sell. Monthly Home Maintenance Routines Clean or change all filters; test fire extinguishers and smoke alarms; inspect switch boxes and electrical cords; vacuum heat registers/vents; check that air vents are clear; flush the water heater to remove sediment; and clean the garbage disposal. Fall Home Maintenance Routines Inspect roof, siding and foundation; clean the chimney; winterize/store yard furniture and tools; service the snow blower; cover your air conditioner and any vegetation that needs protection; service furnaces/stoves; get firewood and de-icers; clean gutters and downspouts; clean the dryer vent; check the water heater for leaks; “close” the pool. Winter Home Maintenance Routines Periodically shovel snow away from the foundation; check the basement for leaks during thaws; remove excess snow and ice dams from roofs/gutters; vacuum bathroom exhaust fan grills; vacuum refrigerator and freezer coils and empty and clean drip trays; service the lawnmower; clean drains in sinks, tubs, showers, and dishwashers; hang holiday decorations early (milder weather and replacements are in stock). Spring Home Maintenance Routines Inspect roof, siding, foundation and chimney; flush hot water heaters; fertilize/seed lawn; wash and check caulking and weather stripping for windows/doors/screens; clean gutters and downspouts; wash interior walls/ceilings and inspect the paint; seal holes or cracks that invite insects or pests; service the air conditioner; “open” the pool; inspect the driveway; Summer Home Maintenance Routines Service the garage door and operating system (chain, hinges, opener); inspect exterior paint for cracking or blisters; ensure exterior sockets and fixtures are working and bulbs light; clean dryer vent, kitchen exhaust-fan filter; defrost/clean freezers and fridges including the coils; check plumbing (sinks, showers, toilets, dishwasher) for leaks; seal tile grout; clean the garage and seal the floor; “open” the pool; prune trees and shrubs. Bottom line: spend a little now on scheduled preventive maintenance or spend a lot later and risk catastrophic damage to yourself and/or your home. Source: Blog

The Inside Scoop on the Best Season to Sell Your Home

Think you need to wait until Spring to sell your home? You may want to think again if you’re ready to sell now. In this HGTV.com post, Gavin Chen challenges conventional wisdom that the best time to sell is spring and the best time to buy is fall. Statistically, spring has the most competing sellers in the market, so you might have to stage your home to get an advantage. Chen suggests it is important to highlight the sellable features of your home in any season. Although there are fewer buyers in the December – January period (holidays, travel), the warmth of a showpiece fireplace will make a favourable impression during winter viewings, in summer, creating inviting outdoor spaces is a great way to help your house stand out. The article suggests avoiding early summer listings because people are relishing the seasonal change, but in recent years the Ottawa Real Estate market in June and July have proven to be strong and stable…click here to read the full story from HGTV Source: Blog

How Google Sunroof is Changing Homeowners’ Costs

How Google Sunroof Works Employing the high-resolution aerial mapping used by Google Earth, Project Sunroof calculates the amount of sunlight reaching your roof to assess its potential for solar power. It takes a variety of factors into account including local weather conditions, shade from nearby trees and buildings and sun positions throughout the year. The tool combines this information with data from your household’s monthly electricity bill, factors in panel orientation and tilt to the roof surface to calculate average monthly and annual solar radiation, recommends the size of solar installation needed and estimates the cost to purchase or lease the hardware as well as the amount that could be saved with solar panels. The tool is only available in the San Francisco Bay Area, Fresno and Boston, however, should Google decide to expand that coverage, they have ample capital reserves to act quickly. They might offer serious competition to the Australian Photovoltaic Institute’s Live Solar Potential Tool, which currently provides similar services. How Google Sunroof is Changing Homeowners’ Costs Photovoltaic (PV) solar panels harness the power of the sun by allowing photons, or particles of light, to knock electrons free from atoms, generating a flow of electricity. The electric current can power your home’s appliances or be put back into the grid. Google Sunroof has developed a tool to help homeowners assess the solar power potential of their roof. Improvements to Photovoltaic Technology In the 1980′s photovoltaics consumed more energy than they produced over their lifetime. Now the energy return ratio (ERR) on solar panels has improved exponentially. According to Professional Engineering magazine, the energy payback times (EPBT), the time it takes to produce all the energy used in their lifespan, is currently are between 6 months and 2 years. And, with life cycles of 30 years, their ERR is 60:1 and 15:1. In other words, solar panels produce 15 – 60 times the energy required to make them. Advantages of Net Metering Since their energy source is the sun, solar panels produce “clean” electricity, without emitting carbon. And, many locations, including Ontario, offer “Net Metering” which means the utility credits a homeowner for solar energy that is not consumed by the home. You send the excess electricity you generate to the local distribution system for a credit toward future energy costs. In essence, it’s a “trade” of electricity you supply against electricity you consume. Source: Blog

Home Buyers: Working with a REALTOR®

Real estate has undoubtedly become one of the biggest industries in the world. Buying and selling of real estate property are obviously major financial undertakings for anyone and these transactions need to be executed in a professional way. With this in mind, working with a REALTOR® is crucial in selling or buying deal of real estate property. In Ottawa, REALTORS® have their own professional association known as the Ottawa Real Estate Board. From this association, our fully trained REALTORS® have insider access to MLS statistics about real estate activity, sales of property, the median price and market conditions. Since the interpretation of these statistics is best known to them, then REALTORS® are crucial professionals in any buying or selling deal. This is because they assist a client in proper interpretation of these coded statistics and their proper implementation. For Home Buyers, Real estate agents provide credible information about potential real estate property matches. A great real estate agent will ask the right questions to help buyers choose the right home at the right price, in a neighbourhood that will work best for them. They spare clients a lot of time by linking them to potential properties and sellers quickly. REALTORS® also help buyers to acquire property at the best possible price. Since Real Estate agents in Ottawa know the prices in the market, they are able to negotiate with sellers for the lowest prices possible. Ultimately, buying property becomes an easy job as realtors seal deals competently and professionally. Realtors are therefore very important parties in buying or selling deals due to their vast knowledge of real estate business. Thinking of Buying in the Ottawa area? Once of our trained Real Estate Representatives would be delighted to assist. Please contact us for details. Source: Blog

Best September on record for number of Ottawa Real Estate resales!

What a great month for Ottawa Real Estate! See below a snap shot of what’s happening in the Ottawa Real Estate Market from the Ottawa Real Estate Board published October 5th, 2015 Interested in a specific neighbourhood? We have access to all of the latest real estate statistics at our fingertips! Please contact us and we will send you a no-cost report on the areas you want to know about. From OREB news: Members of the Ottawa Real Estate Board sold 1,244 residential properties in September through the Board’s Multiple Listing Service® System, compared with 1,131 in September 2014, an increase of 10 per cent. The five-year average for September sales is 1,137. “Ottawa Real Estate Board members continued their active summer into a busy fall,” says David Oikle, President of the Ottawa Real Estate Board. “In fact this September marks the best September on record for the number of units sold in the Ottawa resale market. There was a possibility that the federal election campaign might affect the local real estate market, but this does not appear to have been the case thus far.” September’s sales included 221 in the condominium property class, and 1,023 in the residential property class. The condominium property class includes any property, regardless of style (i.e. detached, semi-detached, apartment, stacked etc.), which is registered as a condominium, as well as properties which are co-operatives, life leases and timeshares. The residential property class includes all other residential properties. “Inventory levels continued to decline; by over 4 per cent since last month, bringing the Ottawa resale market into balanced territory,” says Oikle. “Cumulative days on market increased slightly to 93 days, up from 89 days in August. In addition, the average sale price remains steady.” The average sale price of a residential-class property sold in September in the Ottawa area was $385,142, an increase of 0.5 per cent over September 2014. The average sale price for a condominium-class property was $257,303, an increase of 1.3 per cent over September 2014. The Board cautions that average sale price information can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of all properties sold. “The highest concentration of properties sold continues to be in the $300,000 to $400,000 price range, followed closely, again, by the $200,000 to $300,000 range,” says Oikle. “In addition to residential and condominium sales, OREB members assisted clients with renting 250 properties in September, and over 2,300 since the beginning of the year.” Source: Blog

Income Properties: What You need to Know about Buying an Investment Property

“Don’t wait to buy land, buy land and wait” – Will Rogers Income Properties: Are you Ready? Owning a rental property may seem like a licence to print money. Interest rates are low, the Ottawa Real Estate Market is stable …what could be easier? Buy a property, lease it, collect cheques and plan your retirement. But…before purchasing an income property, you should be aware of the benefits and drawbacks. Advantages of Income Properties: You pay less tax. Because your secondary property is a business, you can deduct certain expenses from your income (mortgage interest, property taxes, insurance, maintenance/upgrades, property management and utility bills) and reduce your taxes. Meet with an accountant or financial adviser to discuss your situation. Rental cheques provide a steady monthly income Other kinds of investments may pay out less often or income may be less predictable. For a rental property, answer this question: when you subtract your mortgage and operating costs, will the property generate a steady monthly income? The value of your investment can increase Historically, property values rise and the rental income increases over time. Don Campbell, senior analyst at the Real Estate Investment Network in Vancouver, believes “a good piece of real estate is like a blue chip stock. It won’t make you rich overnight, but it will perform well.” You may be able to deduct losses for tax purposes If expenses exceed rental income, you may be able to deduct that loss from other sources of income. An accountant can help you figure out the tax and estate planning repercussions. Income Properties: Make sure you’re ready! You accept the responsibilities and challenges of property management Rentals need regular maintenance and repairs – sometimes on an emergency basis. Filling vacancies can be expensive and time consuming. Tenants can be challenging, especially if they don’t pay their rent and you need the money. You have to decide if you want to invest “sweat equity” and manage the property or hire a landlord. Real Estate Prices and Setting Realistic Expectations The rental property market can be volatile. “If the unemployment rate spikes or real estate prices collapse, then your income property investment might run into difficulties as well,” says Mr. Milevsky of York University’s Schulich School of Business. The key is location, location, location. Select an area that is expecting employment and population growth to ensure long term demand is good. Talk to your realtor about neighbourhood demographics and average rent in the area to ensure anticipated rental income is appropriate for the location. Home buyers can save money on their mortgage buying a multi-unit building such as a duplex or triplex, living in one unit and renting out the others. If you are considering downsizing in the coming years, buying a condo or townhouse as a rental property can be a great way to plan for the future. It may be difficult to finance the purchase In most cases you must have a down payment of at least 20% when you buy a second property. Meet with your mortgage broker before you start hunting for an investment property, it will save you precious time and energy in the long run! Questions? Talk to one of our experienced realtors, we’re here to help. Source: Blog

James Dean

Sales Representative

Royal LePage Team Realty

1335 Carling Avenue

Ottawa, Ontario

K1Z 8N8

Office: 613-725-1171

Direct: 613-293-2088

Fax: 613-725-3323

Toll Free: 1-800-307-1545

James@JamesDean.ca