“a Stellar year so far”…Ottawa Real Estate Snapshot June 2017

We are still seeing lower than normal inventory, more multiple offer situations and fewer days on the market which is good for sellers but with prices remaining “relatively steady”, it is also good news for Buyers. Check out the highlights below and send us an email to info@teamrealty.ca for details and info on specific properties, we love to chat about real estate! Below is the latest news release from the Ottawa Real Estate Board Members of the Ottawa Real Estate Board sold 2,162 residential properties in June through the Board’s Multiple Listing Service® System, compared with 1,985 in June 2016, an increase of 8.9 per cent. The five-year average for June sales is 1,818. “We’re having a stellar year so far in 2017. Year-to-date sales numbers for the first half of the year are up in both the residential and condo property classes, combined coming in at a 13.5 per cent increase over the same time period in 2016,” says Ralph Shaw, President-Elect of the Ottawa Real Estate Board. “Average sale price in both the residential and condo class is up in the first half of 2017 compared to last year, although not a significant amount.” June’s sales included 408 in the condominium property class, and 1,754 in the residential property class. “Listings and inventory levels continue to trend downwards, and REALTORS® report an increase in multiple offers on properties in some pockets around the city,” says Shaw. “While some areas within the Ottawa market are very active in sales, there are other areas of the city that remain very balanced and steady.” “Something we hadn’t seen for years, is the recent rise in the lifestyle market in both the residential and condo property class, with 46 over $1 million units sold in June, and 171 units over $1 million sold since the beginning of the year,” says Shaw. “Both numbers are more than double the amount sold last year. It indicates that home buyers are looking beyond their basic needs to check off more boxes from their wish lists such as view, downtown location, or acreage property.” “Since the announcement in April by the Ontario Liberal government of cooling measures in Toronto, it’s no surprise that the Ottawa market has been thriving. Not only is Ottawa an affordable place to live, it’s also very desirable,” says Shaw. “We have a great mix of city life and rural expanses. It’s no wonder MoneySense just named Ottawa as Canada’s best place to live in 2017.” The average sale price of a residential-class property sold in June in the Ottawa area was $434,502, an increase of 8.8 per cent over June 2016. The average sale price for a condominium-class property was $289,905, an increase of 9.4 per cent over June 2016. The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood. “The most active price point in the residential market continues to be the $300,000 to $399,999 range, accounting for 35.1 per cent of the market. Within the condo market, the most active price point was between $150,000 and $249,999, accounting for 50.8 per cent of the market,” says Shaw. “In addition to residential and condominium sales, OREB Members assisted clients with renting 1,496 properties since the beginning of the year.” The post “a Stellar year so far”…Ottawa Real Estate Snapshot June 2017 appeared first on Team Realty. Source: Blog

Selling in the Summer

Selling your home in summer? It can be grueling to prepare a house for sale in the summer heat but many experts believe that summer is one of the best times to sell a house. Why?… People are out and about! Summer holidays mean that people have more time to devote to buying a home and, for parents of school age children, moving in the summer offers an easier transition for families changing neighbourhoods/schools. Selling your home in summer may also give you more time to devote to preparing your home – it’s a win-win! The Ottawa real estate market remains strong and steady with June stats showing an average price increase of over 7% year over year. Inventory is down over 25% from this time last year, and with fewer homes for buyers to choose and an increase in multiple offer situations it’s a great time to get your home on the market. Here are some tips… Look at similar properties Setting the right price for your home can be one of the hardest parts of selling, but fortunately there are resources available to you. Contact a Realtor to provide you with a list of comparable properties. A professionally-prepared current market analysis will include homes that are currently offered for sale and properties that have sold, including the sale price and number of days on market. This information that is essential in determining the list price that will get you top dollar. At Royal LePage, our Realtors provide a complimentary, no obligation consultation for Sellers. Looking at similar properties may also give you a few ideas when it comes to staging. If you see something that works in another house, don’t be afraid to borrow the idea for yours. Pinterest is also an amazing resource for DIY projects and design inspiration. Make your home anyone’s home You surely love all the unique touches that go into making your house a home, but the point of selling it is to have someone else make it their home. When setting up your house for sale, make sure to tone down the elements that you think might turn potential buyers away. De-cluttering, making sure you’re up to date with home maintenance/repairs and a adding a fresh coat of paint, are just a few ways you can make your house a little more welcoming to people who are looking to make it their own. Maximize your outdoor space While the idea of “dressing up” your outdoor space with a garden gnome in every corner might attract some attention (see the “Clown House” for sale earlier this year in Brantford) clean details, practical storage, comfortable seating and a pop of colour are the fundamentals of an inviting outdoor space, simple is best! Easy access from indoor to outdoor can also help make your home feel bigger and brighter! Increase curb appeal More than at any other time, curb appeal is important to selling a house in the summer. When you have a house for sale, make sure you keep the lawn mowed, free of mess, and well pruned. Adding a few bushes, flower beds, or small decorative items is another good way to draw people’s attention. With lots of people out walking, biking, or running during the summer, you want your house to attract the attention of anyone passing by. Be flexible with open houses Although people have more free time during the summer than at other times, they are also likely taking vacations or spending time doing activities around town. Making the hours of your open house showings flexible will let interested people see the property without disrupting their own schedules, and also suggests that you are someone who is truly dedicated to selling your house and is open to communicating with people who want to buy it. These are both things that are attractive to potential home buyers. Make your home “summery” Summer is a great time of year, and you can make your house seem more energized and exciting by keeping summer in mind when you prepare your house for showings. A few, well chosen bright colours can help, as can a few metallic accents. Offering summer drinks or snacks to potential buyers will help them feel comfortable in the house, which makes them more open to the idea of buying it. Possibly the most important thing is to let summer light in, but keep the hot air out. No one wants to buy a house that is hot and stuffy. These tips should help you sell your house quickly in summer, and most of the tips are applicable throughout the year as well. If you have questions or comments we would love to hear from you info@teamrealty.ca Happy summer and happy selling! The post Selling in the Summer appeared first on Team Realty. Source: Blog

Reflections on Canada 150

Canada Day is usually a big event in Ottawa; it is the nation’s capital after all, but this year was an even bigger celebration owing to 2017 being the 150th anniversary of Canada’s founding. In order to celebrate this momentous event, Ottawa pulled out all the stops to throw a Canada Day celebration that people won’t soon forget. The public turned out in record numbers to celebrate Canada Day in Ottawa this year, and the celebrations were also awash in celebrities. Justin Trudeau was in attendance, as were Prince Charles and the Duchess of Cornwall, and Governor General David Johnston (who joined the Prince for a ceremony to mark the end of his term as the Queen’s representative). Other celebrities included Rick Hansen, Chris Hadfield, and musicians that included Bono and The Edge of U2 fame, and Canadian legend Gordon Lightfoot, who performed for the massive crowd of revellers. Besides the star-studded performers and attendees, Canada Day 150 was in many ways a larger version of what people see every year. A citizenship ceremony was held in the afternoon, so that those involved could enjoy the festivities as full Canadian citizens. The celebration included many food trucks that were offering Canadian favourites such as beaver tails and poutine. There were even Tim Horton’s trucks on site to deliver a much needed dose of hot coffee for tired or cold revellers. Besides the ubiquitous food trucks there were activities for all ages, and the night was capped off with an enormous fireworks display that was one of the largest in Ottawa’s history. Fifteen thousand individual fireworks were launched from five different locations across the city, lighting up the sky in an unparalleled pyrotechnic display. That doesn’t count the many fireworks that were fired skyward by enthusiastic citizens across the country of course, each determined to add their own lights to the celebratory glow. Despite the impressive spectacle, not all was “sunny ways” this Canada Day. In fact, the sun was barely in attendance, and rain was a constant and unwanted companion to people who were out to celebrate the 150th. The drizzle created puddles and ponds throughout Parliament Hill, and this combined with very long security lines to dampen the enthusiasm of some attendees. There were a few non-weather related faux pas as well, including the prime minister seeming to forget the province of Alberta during one of his speeches, and groups of protestors there to denounce the celebrations. However, despite the issues most of those who attended the celebration had a good time, and are likely looking forward to next year’s big Canada Day bash with enthusiasm. The post Reflections on Canada 150 appeared first on Team Realty. Source: Blog

Summer Showings

Selling your house can be an exhausting process, and selling during the summer brings its own special challenges. One of the most noticeable is that you may be away on vacation when people want to attend a house showing. Fortunately, you can turn this challenge into an opportunity. If you plan to hold house showings while you are away, the first thing you need to do is ensure that your home is cleaned up. You should go through the house to make sure it is clean and tidy, just as you would before any showing. The only difference is that you will need to do this before you head out on vacation. This means that preparing for your vacation will involve more work, but it also means that you can host a number of showings without having to clean the house again. After all, if you aren’t at home you can’t make any messes. The second thing you will need to do is ensure that steps are taken to make sure the house is made welcoming for each potential buyer. This can involve some pre-planning, but it is worth it to show your house at its finest. Here is a checklist of steps to take to keep your home showing-ready when you aren’t there. Keep the house cool – Leaving the AC on and set to 20 or 21 degrees will turn your home into a welcome retreat from the summer heat. It will also be pleasant for any animals you may be leaving at home. Animal clean up – If you are leaving animals at home, ask a friend to come in to clean their cages, beds, and bowls, pick up leavings in the yard, and take free-roaming animals away during the showing. An even better alternative it so have the animals stay with a friend or at a kennel while you are gone, so there is one less worry to clean up. Keep your home bright – When you leave on vacation, leave the lights on and the blinds open to let light in. If you have a timer or are willing to buy one, you can set it so that your lights are on during the day and evening, and off at night when there won’t be showings. Keep the air fresh – You want the inside of your home to be full of fresh air, so make sure to clean out anything that might kick up a stink while you’re gone. It is also a good idea to ask a friend to come by and open some windows before a showing, in order to let the air in and freshen up the place. If you aren’t able to do that, a good alternative is to buy some air fresheners with very faint scents and place them in discrete areas. You don’t want to leave them out in the open, since that serves as a signal to your visitors that the house usually smells worse. Have a playlist – Having quiet, non-intrusive music playing while people visit your home is a nice touch, and there are a few easy ways to do that while you are away. Turning the radio on to a calm channel or having a TV stereo tuned to a classical or jazz station and keeping the sound low can help make your visitors feel at ease without the music intruding. Playing a custom playlist can have the same effect. Keep the yard fresh – Curb appeal is your first chance to impress potential buyers, so make sure your lawn and gardens stay watered and cut while you are gone. Wilting flowers and dry grass make a house look uncared for, and that turns buyers away. If you’re going to be away for a while, make sure to hire someone to come take care of this. The post Summer Showings appeared first on Team Realty. Source: Blog

Housing Trends in 2017

The New Year is officially underway and we are ready to reflect on the year that has passed, as well as plan for the year that’s to come. With the housing market being consistently ever-changing, new trends tend to surface as old ones seem to fade. 2016 was a big year for the housing market and, as a result, we saw some pretty impressive reports, results, and trends. This year, the housing forecast and its trends will predictably be as follows: The Canadian Real Estate Association has released recent information on Canada’s housing trends and how they’ve evolved since last September. For starters, Ontario’s sales are set to continue to grow and set records “despite an unprecedented supply shortage in the Greater Toronto Area and surrounding regions“. With this being said, and with the Canadian Government tightening down and implementing new mortgage regulations in 2016, it’s predicted that 2017 will see less first-time home buyers who “qualify for mortgage financing, particularly in the pricier markets where there is a severe shortage of lower-priced listings”. On the other hand, however, these mortgage rules and lending guidelines will likely boost “capital costs for lenders, resulting in modest increases in mortgage interest rates in the New Year”. For more information about the 2017 housing forecast, visit The Canadian Real Estate Association’s website at www.crea.ca. Moreover, with the renovation “boom” that is supposedly underway in 2017, and with residents in Ontario having spent approximately $25 billion renovating their homes in 2016, people are expanding on their current homes – and downsizing less. According to CBC, “aging Canadian homeowners are increasingly deciding to stay where they are and renovate instead, especially since more adult children are still living under their roof”. In fact, with Ontario’s housing stock aging with each passing year (and with this year marking the majority of Ontario’s home’s 40th birthdays) homeowners and landlords are more inclined spend their money on renovations to expand on or improve their homes rather than on selling or downsizing. “With a larger share of young adults staying home longer due to economic and academic considerations, the need for space will remain important”, says the Canadian Mortgage and Housing Corporation. Besides, “it’s hard to downsize out of the family home is the nest isn’t quite empty yet”. With home renovations almost always being a topical conversation to be had with homeowners and designers alike, the New Year tends to inspire its residents with new design trends as they surface. According to the Ottawa Citizen, “homeowners are looking to incorporate in-home retreats where they can escape from technology and the world around them”. Essentials for these rooms are, of course, comfort, quiet, and neutral surroundings. Furthermore, these trendy areas of “escape” are being seen in several residential developments as well. “Brigil’s Petrie’s Landing I, for example, will incorporate an outdoor deck complete with a cooking area and swimming pool for condo owners to use”. Great spaces, of course, for enjoying time spent on your own, or as a means to connect with your neighbours. Moreover, 2017 will see hidden kitchen appliances (i.e. dishwashers and refrigerators), to be replaced by illusionary cabinets to give the appearance of a larger space, bold kitchen colours, and “natural materials, such as rough stone and reclaimed wood”. Needless to say, 2017 is shaping up to be a rather significant year for the housing market. For more information about the past year, and what we see for the New Year, you can contact us! We’ll gladly inform you on what will shape the unforgettable year that is to come. The post Housing Trends in 2017 appeared first on Team Realty. Source: Blog

Beating the Winter Blues

It’s winter time in our Nation’s Capital! The New Year is well underway, and as we’ve carefully selected our resolutions (and have spent the majority of these last few weeks trying to abide by them) we reminisce on the post-joys of Christmas and the excitement of a New Year. However, regardless the amount of joy in our hearts and happiness in our homes, the cold weather tends to overstay its welcome far too often. Admit it, we’ll soon catch ourselves wishing for less snow, warmer weather, and oodles upon oodles of sunshine. Wishful thinking, I’ll say. Truth is, we live in Ottawa – and let’s face it – Ottawa is just simply cold. This said, however, our City just so happens to be celebrating its 150th Anniversary this year, and has planned for an endless list of fun-filled, family-friendly, wintery activities that are sure to help kick those winter blues. We’re very lucky to be home to the largest outdoor skating rink in the world: The Rideau Canal Skateway. Measuring a whopping 7.8KM in length, this skateway is a great way to spend your mornings, your afternoons, or even your late evenings with family and friends. With its location being so centralized in the heart of our beautiful City, it’s both an “ideal place for a romantic stroll or a playful day with the kids”. Don’t have skates? Don’t worry! Skate rentals are one of the many services that the Canal has to offer alongside, of course, it’s many change rooms and food/beverage kiosks where you can indulge in what many of us consider to be our City’s dynamic duo: a beavertail and warm cup of cocoa. (Touring the ByWard Market instead? Awesome. Keep an eye out for these delectable goodies around town!) After a good skate or two, why not enjoy the rest of the activities that our Capital has to offer at our largest winter celebration: Winterlude. Officially underway, Winterlude has been a “unique way to celebrate Canada’s unique northern climate and culture since 1979”. You’ll welcome the Ice Hog Family as they travel once again to our City, as they do each year. Bring your family along and pay them a visit at the Snowflake Kingdom in Gatineau. From there, you’ll walk among the many ice sculptures that are created for the ice sculptor competitions, and frolic in what’s considered to be North America’s largest winter playground. Winterlude 2017 wraps up on February 20th – won’t want to miss out! Follow this link to the event’s website for more details. Maybe you and your family appreciate a good, healthy challenge or two once the snow falls – kudos to you! If your family is one for the slopes (and perhaps even a small weekend getaway) then you’re in luck! Ottawa is surrounded by multiple snow hills and downhill skiing sites that are bound to keep you and your loved ones busy and buzzing with adventure this winter. Pack up the car and head to Mont Cascades, Mont Saint-Marie, Mount Pakenham, or even Camp Fortune this weekend. Take your pick! The temperatures are perfect, and the snow is just right. And if the downhill slopes aren’t exactly your forte, why not feed your outdoor passion for skiing cross-country style at one of two of “Ottawa’s treasured parks: Gatineau Park and/or Greenbelt Park” (Link: http://www.albertatbay.com/location/things-to-do/winter-activities). Ottawa has reached an exciting milestone. This year, our Country will celebrate its 150th Anniversary. Needless to say, it’s time to celebrate. Keep an eye out for ongoing activities around our City by following this link! Stay safe, have fun, and happy celebrating! The post Beating the Winter Blues appeared first on Team Realty. Source: Blog

2017 is off to a great start!

Update below from the Ottawa Real Estate Board 2017 resale market off to a great start OTTAWA, February 3, 2017 – Members of the Ottawa Real Estate Board sold 667 residential properties in January through the Board’s Multiple Listing Service® system, compared with 598 in January 2016, an increase of 11.5 per cent. The five-year average for January sales is 614. “The year is off to a great start, with sales up over this time last year, and well above the five-year average,” remarks Rick Eisert, President of the Ottawa Real Estate Board. “Residential-class resales supported this increase, with a 16.6 per cent growth over January 2016. The number of properties listed in January has doubled the amount listed in December, which is very typical of sellers getting a jump start on the spring selling season.” January’s sales included 119 in the condominium property class, and 548 in the residential property class. The condominium property class includes any property, regardless of style (i.e. detached, semi-detached, apartment, townhouse, etc.), which is registered as a condominium, as well as properties which are co-operatives, life leases and timeshares. The residential property class includes all other residential properties. “While the numbers indicate a positive trend for Ottawa as a whole, we emphasize that all real estate is local, and prices and conditions will vary from neighbourhood to neighbourhood,” explains Eisert. “We encourage buyers and sellers to talk to a REALTOR® for more information about the housing market outlook where they live, or want to live.” The average sale price of a residential-class property sold in January in the Ottawa area was $394,001, an increase of 1.9 per cent over January 2016. The average sale price for a condominium-class property was $288,655, an increase of 16.8 per cent over January 2016. The Board cautions that average sale price information can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of all properties sold. “The average sale price for the condominium class saw a big increase over last year,” Eisert says. “It’s important to note that three properties sold for over $1 million this January, while none were sold in January 2016. This needs to be taken into consideration when looking at the overall increase in average condo sale price.” “In the residential market the most active price point was the $300,000 to $399,999 range for the month of January, accounting for 35.2 per cent of the market. The condominium market was most active in the $150,000 to $249,999 price range, accounting for 58.7 per cent of the market,” says Eisert. “In addition to residential and condominium sales, OREB members assisted clients with renting 201 properties in January.” The post 2017 is off to a great start! appeared first on Team Realty. Source: Blog

Canada Celebrates 150 Years!

The milestone has arrived – our country’s 150th year. What better time than now to stand proud and represent our Nation as a united community? We are very fortunate to be living in Ottawa – our Capital. We’ve certainly come a long way since our founders first settled here 190 years ago. Originating as Bytown, Ottawa was initially built to house labourers who had been recruited to help build the Rideau Canal. Times have changed between then and now. We are no longer considered the “town that fun forgot” nor are we solely known for being “the highway to Montreal“. We are a thriving, united, Capital with an approaching 1 million residents – and that’s just the beginning. In fact, according to Mayor Jim Watson, “we’re going through one of the most significant transformations in our history“. It’s only a matter of time that we see these spoken of – and otherwise unimaginable to longtime residents – changes come to fruition. With the countless short-term and long-term transformations that are predicted to be completed around our Capital City between now and the next 25-30 years, Ottawa is nothing short of booming. We are an ideal place to live – one that is family-friendly, employment-friendly, restaurant-friendly as well transportation-friendly. There is an “unprecedented number of major redevelopments in the works: LeBreton Flats, the islands around Chaudiere Falls, the former Canadian Forces Base Rockcliffe, the Oblate lands on Main Street, parts of Natural Resources Canada’s Booth Street Complex, Tunney’s Pasture and the shopping centres at Lincoln Fields and Westgate” (to name a few). And that’s not to mention the most current of projects that will transform our city’s way of transportation: the highly anticipated Light Rail System, with its first phase Confederation Line to open in 2018. Moreover, Ottawa has an incredibly steady real estate market; one that’s only predicted to move upward over the next several years. According to the Ottawa Business Journal, January of this year brought in an 11.5% increase in home sales. Kick-starting 2017 at a five-year high says a lot for this time of year, and with the continued anticipation of changes being made within our City in the next coming years, along with members of the Ottawa Real Estate Board selling 667 homes in the last month alone, it is expected to only increase further. If you’re one to enjoy a lot of hype within our city, then 2017 will definitely make your heart sing. Ottawa will be hosting several high-profiled events this year including (but not limited to) the Juno Awards, the Grey Cup, and the Red Bull Crashed Ice event. Mayor Jim Watson “looks to 2017 as a year that will reshape the City’s tourism image” with the hope that Canadians and tourists alike will “identify Ottawa as the place to celebrate the 150th“. In fact, our City is expected to see an increase of 20% in tourists throughout the year, and is targeting both youth as well as new Canadians as a means for improving several areas of programming: arts and culture, sports and physical activity, business, and social life. The many changes as well as countless events that are to come to our City this year will be nothing short of exciting! We should be very grateful to be such an intricate part of our home and of our country. Let’s spread the word, and stay involved – happy birthday Canada. Cheers to 150 more years! The post Canada Celebrates 150 Years! appeared first on Team Realty. Source: Blog

The Bank of Mom and Dad: Living as Millennials

It’s no secret: the cost of living is expensive. Regardless of who we are and what we do, we live and breathe steep living costs day in and day out. It’s a fact of life: if we’re not saving our pennies, we’re spending them; if we’re not paying off one bill, we are another. It’s the never-ending cycle of our (financial) lives. Enter: mom and dad. For the vast majority of us, mom and dad means home; and home is where the heart is, after all. It’s become a common trend among many baby boomers to take part in one of two things: either move back in with their parents to help save money, or assist in the renovations or expansions of their parent’s current home in order to accommodate their living requirements under the same roof. A circumstance such as the latter would be to avoid downsizing for mom and dad, and, of course, cut the costs of living for all parties involved. For some, this is simply how it’s always been; for others, it’s become a necessity. Today, we’re seeing a similar trend skyrocket among another popular generation: the millennials. Leaning on the bank of mom and dad is something that isn’t quite out of the ordinary in this day and age as living costs are expensive and are only estimated to get higher. Therefore, young adults are moving out of their parent’s homes a lot later in life than perhaps they had originally mapped out for; and when they do, they’re receiving an increasingly large amount of financial support from their families so that they can. Ratehub.ca, a company who interviewed about 1000 people from across our country between September and November of 2016, conducted a survey to shed light on the approximate percentage of millennials who are are obtaining family financing in order to become a homeowner. The results? 35% of buyers received help from relatives while 38 per cent were able to put down 20 per cent or more on their homes in our province alone. Of course, with several regulatory changes and rising home prices in 2016, these results are only expected to increase and reach new records in 2017 – creating potential hurdles for those entering into the market for the first time. Needless to say, adults – both young and old – often rely on mom and dad, and there isn’t anything wrong with that. “With a larger share of young adults staying home longer due to economic considerations, the need for space will remain important”, says the Canadian Mortgage and Housing Corporation. And sure, a loan arrangement with a family member is far better than one from a financial institution, but “a financial plan should [always] come before home ownership, and affordability should [always] fit into that plan”. The post The Bank of Mom and Dad: Living as Millennials appeared first on Team Realty. Source: Blog

Why Move? A Look into Canada’s Homebuyers

How many times have you moved (so far) in your lifetime? Once? Twice? For a brief time while in school? Work? Or have you moved far too many times to even count? What about those times that you have moved from one place to another, were they on your own? Were they with your family? Your partner? A few friends? And did you live in these homes for long enough to consider it a home? Sure, the vast majority of us may answer differently to each of these questions, but we do share one common factor: the overall experience. Truth be told, moving from one home to another is not a simple task. Take the multitude of varying questions asked above, for instance. The process of moving can, unmistakeably, be that of a strenuous, complex task that requires much consideration and absolute certainty. So choose wisely and with reason in mind. Canadians tend to, on average, move every 5 years; but there is that 14% of us who get that 12-month itch and move every year. This is where the aforementioned advice of having a reason to move comes into play. Here’s a small breakdown of why Canadians move according to ComFree Living: Job relocation (53%) Increase in family size: marriage, kids etc. (42%) Family size decrease: divorce, empty nest etc. (20%) Retirement (18%) Came into more money (14%) Home was in need of renovations (14%) Evidently, we move as life happens. Young, old, together, and apart – we move. Homeowners acting on their urge to move every five years, however, could result in financial hardships. Over a span of 60 years, this could equate to as much as $180,000 [and above] in traditional real estate agent commissions and, of course, other required real estate fees. Needless to say, decipher a plan that works for you. Moreover, the real estate market undoubtedly foresees a hefty increase in both first-time homeowners, as well as new buyers within the next several years due to the growing millennial generation. According to Dana Senegama, market analyst for the Canada Mortgage and Housing Corp, “[millennials] are going to be a force to be reckoned with over the next decade, especially as they move into their prime child-rearing years and [in need of] more space”. This said, it is with these 15-34 year-olds that new jobs, larger families and more spacious homes will be pursued, obtained, and thus required in the next coming years. Moving can be quite overwhelming for some. However, if you look to your future and sit down with your family in order to plan your move accordingly, the process will become that much more seamless. So come up with a strategy – a roadmap of where you see yourself growing and building a home – and live in that home for as long as you see fit. The post Why Move? A Look into Canada’s Homebuyers appeared first on Team Realty. Source: Blog

Getting Your Home Ready to Sell in the Spring Market

Selling your Home in Spring The spring real estate market is quickly approaching and if you’re selling your home, now is the time to start getting ready! It may seem like a daunting task but there are things that you can do to make sure that your house is prepared for the droves of spring buyers this upcoming season. Remember, there will be many houses on the market at the same time as yours so you want to make sure that your property is ready and sticks out for buyers! Contact a Realtor®. Real estate agents are professionals. A great real estate agent will not only ensure your property is priced right, they’ll also be your guide through every step of the process in the weeks and months leading up to listing, during the time your home is listed, the closing of your property sale and beyond. Prioritize Repairs One of the first things you will want to ask yourself when selling your home is whether your property needs any repairs, as it can be the most time consuming. The best way to do this is to walk through both your home and property and “write down anything that doesn’t function or is unsightly”. Start at one end of your home and work your way through each room carefully, looking for potential problems. Try to put yourself in the shoes of a potential buyer and be picky. This could be everything from a small hole in the wall, chipped paint, or leaky faucet all the way up to larger fixes like a leaky roof or cracked foundation. Once you have your list, it’s time to prioritize, “List out first the small things that will repair quickly and inexpensively, with an extra focus on items that will be seen first by potential buyers.” And last but not least, come up with a plan. Hiring someone to do the work for you may be the most time effective, but it may not be within your budget. If you plan on doing it yourself, schedule the time you will need right away and make sure to leave some extra in case things don’t go as planned. Stage Your Home Next comes decluttering, depersonalizing, and staging your home. If you look at photos of real estate listings, you’ll notice one thing; the houses are generally neat and tidy and have an airy feel to them. The reason for this is that the day to day clutter of living in a home has been removed. “You might like the stack of magazines on the table, buyers don’t. They don’t want to know what you read”. Start purging, and if you have lots of stuff, you may even want to consider renting a storage locker to house it while your house is on the market. You will also want to remove as many personal items from your home as possible. Take your family photos off the wall, and remove any items that are personal in nature; buyers want to picture themselves living in the home, not you and your family. When it comes to staging, make sure that your home is not jammed with furniture; you want it to look spacious, not crowded. You can also try incorporating some bright spring colours and patterns to make your home pop! Get Your Paperwork in Order Start getting your paper work in order. If you’re selling your home, you will need to go somewhere so now is the time to visit the bank to find out your budget should you choose to buy again. If you’ve done any major renovations or maintenance on the home, get the receipts, building permits, and other relevant documents together; while these are not necessary, they certainly can be of interest to some buyers. Collect all your bills; a recent property tax amount is required to list a house but many agents would also like estimates on all utilities that they can share with potential buyers and on their websites. Remember, it is never too early to contact a realtor! The post Getting Your Home Ready to Sell in the Spring Market appeared first on Team Realty. Source: Blog

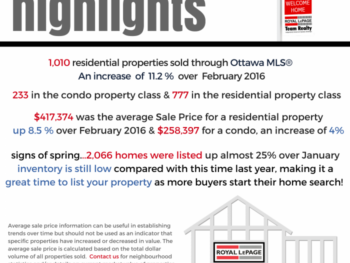

Ottawa Real Estate February Highlights – “Primed for a Competitive Spring Market”

“Spring market primed for a competitive season ahead!” FEBRUARY 2016 MARKET HIGHLIGHTS: 1010 Residential properties were sold through Ottawa MLS® (including 233 in the Condominium class and 777 residential properties) Average Sale Prices: $417, 374 (Res +8.5%) and $258,397 (Condo +4%) Increased number of residential properties selling in the $750K-1Million resulted in a higher Average Sale Price. 2066 homes listed, up almost 25% over January 2017 Most active price point was in the $300K-$399K range, followed by the $400,000 to $499,999 range, accounting for 54.6 per cent of the market (combined) Information below taken from OREB OTTAWA, March 3, 2017 – Members of the Ottawa Real Estate Board sold 1,010 residential properties in February through the Board’s Multiple Listing Service® System, compared with 908 in February, an increase of 11.2 per cent. The five-year average for February sales is 872. “Numbers continue to indicate a positive trend for Ottawa as a whole,” says Rick Eisert, President of the Ottawa Real Estate Board. “Even with the additional day in February last year due to the leap year, sales this year are up in both the residential and condo property classes. Keep in mind though, that all real estate is local, and that prices and conditions will vary from neighbourhood to neighbourhood.” “A total of 2,066 homes were listed this month, up almost 25 per cent from January, while inventory on hand still remains low compared to last year,” explains Eisert. “Now is a great time to list your home in anticipation of the increase of buyer interest in the spring that will pick up as early as March.” February’s sales included 233 in the condominium property class, and 777 in the residential property class. The condominium property class includes any property, regardless of style (i.e. detached, semi-detached, apartment, townhouse, etc.), which is registered as a condominium, as well as properties which are co-operatives, life leases and timeshares. The residential property class includes all other residential properties. The average sale price of a residential-class property sold in February in the Ottawa area was $417,374, an increase of 8.5 per cent over February 2016. The average sale price for a condominium-class property was $258,397, an increase of four per cent over February 2016. “This month revealed a larger average price gain in the residential property class than usual due to an increase in the number of properties sold in the $750,000 to $999,999 and over $1 million price range, similar to what occurred with condo prices last month,” explains Eisert. “For example, in the over $1 million price range alone, there was a significant increase in sales over last year; 20 units sold in 2017 versus 6 units in 2016. It is important to note that dramatic changes in the average sale price is not indicative of all property values. We encourage buyers and sellers to talk to a REALTOR® for more information about the housing market outlook where they live, or want to live.” “In the residential market the most active price point was the $300,000 to $399,999 range for the month of February, followed by the $400,000 to $499,999 range, combined accounting for 54.6 per cent of the market. The condominium market was most active in the $150,000 to $249,999 price range, accounting for 54.9 per cent of the market,” says Eisert. “In addition to residential and condominium sales, OREB members assisted clients with renting 392 properties since the beginning of the year.” The post Ottawa Real Estate February Highlights – “Primed for a Competitive Spring Market” appeared first on Team Realty. Source: Blog

Getting Ready to Buy in the Spring Market

Maybe you are a first-time home buyer, or maybe you will be selling a home and looking for something new, either way the spring real estate market is fast and approaching and you want to be ready. This is an exciting time of year in the real estate industry and for everyone buying and selling homes. It can be a little crazy though, so here are some tips to help you be prepared. It’s not too early to start getting ready. Get Mortgage Pre-Approval You will want to start off by setting up a meeting with a mortgage broker or your bank. They will be able to provide you with a mortgage pre-approval. This is very important for a few reasons. First, this is your budget for your new home. It will give you financial parameters to work within; maybe you can’t afford as much as you thought and this is very good to know before you begin your search. Second, in a competitive market, this may be crucial in ensuring your offer is considered on your dream home. “Sellers won’t wait for a prospective bidder without mortgage pre-approval when there are plenty of other bidders out there with their financing buttoned down.” Picture Your Dream Home Once you have your budget, start thinking about what your dream home would be. This can include location, size, features and many other factors. The key here is to think about what is most important to you, not others; “It’s easy to get caught up in other people’s ideas of the perfect starter home – design magazines and TV programs sell you on what’s hot now. Ignore the hype and sit down to itemize what’s most crucial to you and your family.” The next step is to take a look at your list, and determine which items are deal breakers and which could be classified as wishes. This list will help guide you through your search and narrow down prospective properties. Start Looking at Listings Start looking at real estate listings right away. Get a feel for the neighbourhoods that you are interested in and what is available. With the advancement of technology, it is now possible to do a large part of your search from the comfort of your own home. Don’t forget to use social media as well as it can be an important tool. Even if you have no intentions of buying until later in the spring, this research can be invaluable when that time comes. Line Up Your Team One step that is often overlooked is lining up the rest of your real estate team. It’s obvious that you need a real estate agent and a mortgage broker, but there are a few other people to consider. To buy a home you will need a real estate lawyer. Your lawyer will look over all agreements, titles, and documents to be sure that everything is legal and that there are no surprises. Lawyers also collect and disperse the money in the sale of a home. A home appraisal is by no means mandatory to buy a home, it is smart to do your due-diligence before making a purchase of this magnitude. Find a good home appraiser ahead of time so you are not scrambling once your conditional offer has been accepted. Ask your friends and family members for referrals for both lawyers and inspectors and you will likely find that you have numerous recommendations to work from. Find a Realtor The most important step you can take right now is to find yourself a realtor. A buyer’s agent will work with you on everything mentioned above (and more) to help you find the perfect home for you and your family. The buyer’s agent’s sole “responsibility is to protect you, your family, and your best interests all while providing you with the essential information needed in order for you to make an informed decision when it comes to buying a home”. And remember, as a buyer, you don’t pay for the agent’s services; it is taken as a percentage of the commission from the seller. The post Getting Ready to Buy in the Spring Market appeared first on Team Realty. Source: Blog

Pets and Real Estate

Pets are a very important part of many Canadians lives. In 2014, it was estimated that 57% of Canadians owned pets which equates to approximately 7.5 million households. In many cases, our pets become part of our families to the point where terms like “pet parent” and “fur baby” are used to define this unique relationship. But what impact do pets have when it comes to real estate? Buying a Home with our Pets in Mind Pets affect our choices in real estate. When we buy a home, we consider the needs of our family, which often enough includes our pets. In a recent survey, 81% of respondents said that animal-related considerations play a role in deciding their next living situation, 52% undertook a renovation to accommodate their pet, and 89% would not give up their animal because of housing restrictions or limitations. For example, dog owners may choose a house because it has a larger fenced property for the dog to run, or cat owners may choose a house with a basement to house the unsightly litter box. And like homebuyers who are planning for a family, some are choosing properties in anticipation of one day having a pet. Pets Depreciate a Home? So, is it safe to say that some “pet friendly” features will make your home more appealing if you’re trying to sell? Perhaps, but the pets themselves may depreciate the value of your home. Pets can affect a home’s “cleanliness and smell” and this can deter potential buyers. And it is also important to remember, that a significant number of people are allergic to pets and may not even consider viewing a home that has housed animals. “But it’s not just odour or pet hair that’s a problem. Yellow or dying grass in the front or backyard, half-chewed toys littered in yards or across rooms, as well as open or smelly litter boxes can prompt concerns, even in pet-loving buyers.” Keep in mind that prospective buyers may love their own pets but that doesn’t mean that they love yours, so you want to rid your home of all signs of your beloved animals. But rest assured, there are a few steps you can take that don’t involve saying goodbye to your beloved family friend in order to maintain the value of your investment: You will want to thoroughly clean your home before putting it on the market, with extra attention paid to your floors. It may also be wise to call in a professional to help you with this task. As pet owners, we often don’t notice the odours from our own animals within our home; we have gotten used to them so it is wise to have someone else come in and check for noticeable odours. If your animal has urinated in the house, replace the affected carpeting or flooring. Sometimes the smell can be difficult to remove otherwise. Stains and smells will devalue your home. Remove pets from the home while it is on the market, or at least for showings and open houses. Also, remove all litter boxes and animal toys before anyone comes into the home. Pets are part of our lives; we make decisions around them and they affect the environment around us. At the end of the day, if deciding to get a furry friend, do what’s right for you. The post Pets and Real Estate appeared first on Team Realty. Source: Blog

“Oh I Forgot to Tell You…”

Picture this, you have just taken possession of your dream home. You did your due-diligence; the property passed the home inspection with flying colours and your research shows the neighbourhood is safe and has great schools. You are chatting with a new neighbour only to find out that your brand new home was once the site of a violent crime or a drug operation, or that it is thought to be haunted! Would this bother you? What can you do? Did the previous owners fail to disclose something that they were legally obligated to? When selling a home, known physical defects must be disclosed by the listing agent. A home inspection should spot any that are unknown to the seller which gives buyers confidence in the property they are purchasing. Where this gets complicated though is when you consider other non-tangible factors for which the term “stigma” is used. “They describe it as a non-physical, intangible attribute of a property that may elicit a psychological or emotional response on the part of a potential buyer.” The key to this is that there is nothing physically observable or measurable with this; stigma is based on something that may have happened in the home in the past. What Falls Under Stigmas? There are many examples of events that may be bothersome to potential buyers but are not legally necessary to disclose. They can include: A death in the home (natural, suicide, or murder) The belief that the home may be haunted If the home was once frequented by gangs or drug dealers If the home was once the site of a brothel If the home was once the site of a meth lab or grow op (unless there is an actual latent defect from the home’s prior use for drug production) What can you do to make sure that you know everything you want to know? If certain stigmas concern you, there are steps you can take to try to find out as much as possible about a property before purchasing it. But keep in mind, none of these methods can be completely accurate especially if you are concerned about events that may have occurred outside of recent memory. Go to housecreep.com and search the address. This website is essentially a free database that compiles news stories and first hand personal experiences by address. It has quite a few addresses in Ottawa with information attached to them so it’s worth a look. It lists violent crimes, ghosts, suicides, and drug operations among other things. You can also search by neighbourhood with their map function which is helpful if you are looking at multiple properties. If a death in the home is an absolute deal breaker for you for cultural or personal reasons, you could also consider adding a clause to the Agreement of Purchase and Sale “that the vendors would declare to the best of their knowledge that no death had occurred in the home”. This clause would obviously make no guarantees, especially in older homes, as the current sellers may be unaware of situations that happened generations before; but if they are aware of something and fail to disclose it, they could then be held liable. Ask the neighbours! Don’t be afraid to knock on a few doors. The neighbours may be more forthcoming with information or they may have been around longer than the sellers. Ultimately, as the buyer you are responsible for doing your due-diligence. There is no way for the seller to know what will be of concern to a potential buyer. If this is something that would bother you about a home, make sure to take the time to find out what you can. The post “Oh I Forgot to Tell You…” appeared first on Team Realty. Source: Blog

6 Spring Maintenance Tips for Homeowners

As the snow finally melts after what has seemed like a never-ending winter, it’s time to start thinking about all the spring maintenance tasks that you will need to around your home. Spring always feels like a fresh start so use that as motivation as you work around your yard and home! Here are 6 spring maintenance tasks for homeowners: Check the roof There is no need to pull out a ladder at this point; stand back from your home and do a visual inspection: “with binoculars and a keen eye, you can probably spot trouble.” Winter snow and ice can be very tough on roofs, so look for shingles that have shifted or are lifting. If you notice anything, it is always advisable to call in a professional. Check your outside faucets You hopefully took the time in the fall to shut off the water and drain outside faucets properly, but it is always wise to check them carefully to ensure that the pipes did not freeze and crack. There are a few simple things you can do to check them. Turn the water on and block the faucet with either your thumb or finger; if you can stop the flow, there is likely a leak inside your home. Also, with the water on, check the pipes inside for leaks. Clean your air conditioner Be ready for that warm summer weather by cleaning your air conditioner now. Make sure that it is clear of any debris (leaves etc.) and vacuum out any dust or dirt that might have settled in it over the winter months. Trim back any trees or bushes “Spring is a good time to trim branches of shrubs and trees away from your house —get an early start before leaves grow and while you can see individual limbs.” Small jobs can generally be handled by homeowners but know your limitations; hiring a professional arborist is always the best idea for larger tasks. Clean up your lawns Rake away any of the debris left behind from winter; this will allow your lawn to grow better. Examine your lawn for spots that may need to be seeded, you will want to do this soon as grass seed doesn’t do well in the hot summer sun! Clean the Gutters Get the ladder out and clean those gutters! They are probably full of leaves and other debris from the fall and winter. Remember, gutters are very important for the drainage around your home and this often neglected task should be done twice a year! The post 6 Spring Maintenance Tips for Homeowners appeared first on Team Realty. Source: Blog

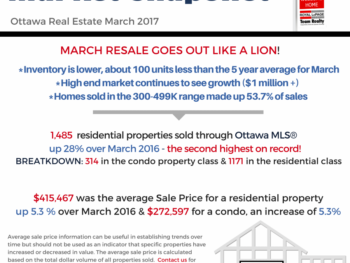

Ottawa Real Estate Update | March Goes Out Like a Lion

Second best March on record for units sold, multiple offers, fewer days on the market and the average price for a residential home over $415K , spring has definitely sprung in the Ottawa Real Estate Market! From the Ottawa Real Estate Board April 5th, 2017 OTTAWA, April 5, 2017 – Members of the Ottawa Real Estate Board sold 1,485 residential properties in March through the Board’s Multiple Listing Service® System, compared with 1,160 in March 2016, an increase of 28 per cent. The five-year average for March sales is 1,240. “The busy spring selling season descended upon Ottawa early this year,” remarks Rick Eisert, President of the Ottawa Real Estate Board. “Unit sales for March marked the second-best on record, only 13 units down from the record set in March 2010. We’re also starting to see properties move faster, with the average cumulative days on market sitting at 82 days. With all these positive numbers, it’s still important to emphasize that price and conditions vary from neighbourhood to neighbourhood.” March’s sales included 314 in the condominium property class, and 1,171 in the residential property class. The condominium property class includes any property, regardless of style (i.e. detached, semi-detached, apartment, townhouse, etc.), which is registered as a condominium, as well as properties which are co-operatives, life leases, and timeshares. The residential property class includes all other residential properties. “We’re seeing a lot more multiple offers than we’ve experienced in a while, mostly due lower inventory levels,” says Eisert. “The number of properties listed in March also experienced a decrease over last year, and is about 100 units shy of the five-year listing average for March.” The average sale price of a residential-class property sold in March in the Ottawa area was $415,467, an increase of 5.3 per cent over March 2016. The average sale price for a condominium-class property was $272,597, an increase of 5.3 per cent over March 2016. The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. “We’re seeing a trend since the beginning of the year, with 50 properties sold over $1 million in the first quarter of 2017, compared to only 22 in the first quarter of 2016,” explains Eisert. “Again this month, a higher number of properties in the over $1 million price range were sold. These gains were in both the residential and condominium property classes, with seven more residential units and four more condo units sold this year over last year. These high-end property sales are taking place throughout the market with Rockcliffe Park, The Glebe, and Westboro leading the way.” “The two most active price points in the residential market in March were the $300,000 to $399,999 and the $400,000 to $499,999 range, accounting for 53.7 per cent of the market. Within the condo market, the most active price range was in the $150,000 to $249,999, accounting for 51.2 per cent of the market,” says Eisert. “In addition to residential and condominium sales, OREB Members assisted clients with renting 639 properties since the beginning of the year.” The post Ottawa Real Estate Update | March Goes Out Like a Lion appeared first on Team Realty. Source: Blog

5 Reasons To Sell Your Home in the Spring

With the busy spring market upon us (it actually started early this year!), let’s take a look at why this season is often seen as the best time of year to sell a home. With a large percentage of the year’s sales occurring in just a few short months, homes also tend to sell for more and spend less time on the market. And don’t worry, you’re not too late; statistics show that May is the best month of the year to list a home. Here 5 reasons spring is so popular: Homes show better in spring: Let’s face it, spring is beautiful time of year! The grass is green, the flowers are blooming, and that brightness can carry through your home. “Homes appear more appealing when the weather is warming up and buyers tend to be in high spirits.” Moving in late spring or early summer is far more appealing: Let’s face it, no one gets excited about moving in the winter time. Snow makes everything more complicated. The same is true for the hot summer months. Buying in spring can avoid all of that. Buyers have likely just received their tax refund: Saving for a home these days can be a long process, but tax refunds can often provide buyers with the extra cash they need. The influx of money also makes spring buyers more likely to pay full price. The move won’t interrupt the school year: For families with children, this can be one of the biggest factors that draw them to the spring market. Buying a home in spring, and closing in early summer means that their children won’t have to switch schools halfway through the year, which can often be a big adjustment for little ones. There’s something in the air: There is something about spring that makes us all feel like starting fresh; this is why “spring cleaning” is a thing. “After a long winter, the first hints of cherry blossoms and crocuses seem to trigger the “moving bug” in many people.” If you are thinking of selling your home this spring, don’t delay! It’s time to start getting it ready and don’t forget, it’s never too early to contact a Realtor! The post 5 Reasons To Sell Your Home in the Spring appeared first on Team Realty. Source: Blog

Choosing a Brokerage when Buying or Selling a Home

When it comes time to buy or sell a home, finding the brokerage to work with is a very important step to take. You need to find a company that will work with you to make this the most positive experience possible. “At Royal LePage Team Realty we commit to delivering high quality, industry leading and innovative real estate products and services on a complete cost-effective basis. Our business relationship will be characterized by the highest degree of honesty, credibility and fair dealing. We are committed to setting the pace in service excellence. We commit to delivering a level of real estate professionalism that contributes to the overall well being of the community.” With a large share of the Ottawa real estate market, Royal LePage provides outstanding services to all of our clients. Let’s take a look at what we can do for you: Why Buyers Should Choose Royal LePage Team Realty: If you want to find the right home, in the right place, at the right price, with minimum hassle, we are here to help! Our buyers agents are here to support and represent you every step of the way. Whether you are buying a resale or new construction home, we can advise you as you make the biggest purchase of your life. Here are just some of the services that a Royal LePage Sales Representative will provide: An extensive knowledge of local neighbourhoods and real estate values will allow your representative to find the perfect home to fit your lifestyle and budget. This knowledge will also make it easier to narrow your search so as not to waste time! A guide to take you through properties and to help identify potential problems through observation and research to help you make an informed decision. Advise you through the process of making an offer and negotiate on your behalf. Make recommendations for securing finances, legal options, and finding appraisers, home inspectors, and contracting services. An educated professional to represent YOU every step of the way! Why Sellers Should Choose Royal LePage Team Realty: Royal LePage Team Realty Realtors have the training, experience, and resources necessary to help you sell your home. “Selling a home takes more than just putting a “for sale” sign out front.” We want to help you sell your home for the right price and quickly, and we know that effective marketing, problem solving, and research can help ensure that. Here are just some of the services that a Royal LePage Sales Representative will provide: Knowledge and research to help you price your home right through a home evaluation and a comparative market analysis. Step by step guidance through the whole process from listing to closing. Customized marketing plan using our extensive resources. Recommendations and consultations with you through every step of the process. Guidance through the transaction process and careful review of all documents to ensure that you are protected, even after closing. Extensive training to negotiate on your behalf while looking out for your best interest. An educated professional to represent YOU every step of the way! The post Choosing a Brokerage when Buying or Selling a Home appeared first on Team Realty. Source: Blog

Choosing a Brokerage to Work For

Have you considered a job in a real estate? Choosing a brokerage to work for can be a daunting process. As one of the largest brokerages in the city, Royal LePage Team Realty has a lot to offer our Realtors. Combine all that we have to offer with the resources provided to all Royal LePage agents in Canada, and you will be supported, trained, and taken care of. Real estate can be both a challenging and dynamic career for people with strong interpersonal skills and good business savvy. Whether you are just starting your career or are currently working in real estate and looking to make a change, Royal LePage Team Realty will work with you to achieve your goals! What Sets Us Apart “We are committed to Helping You excel at your profession and achieve the results you want, by supporting you with a strong brand, culture of collaboration and innovation, and leading training, technology and marketing tools and continuously giving back to the community via our efforts with our Royal LePage Shelter Foundation. At Royal LePage, Helping You is What We DoTM.” (link: http://www.teamrealty.ca/real-estate-career-ottawa/) Training Our training is provided to all our agents at no cost to you! You will learn how to build and operate your real estate business resulting in profitable revenue streams. We offer a 4 tier training to all our Realtors. Branch Operations and an introduction to different software applications that you will use regularly. 10 Core Real Estate Courses that are offered every 30 days. In depth training in computer labs on the IT programs you will use everyday! Hand On Mentoring Program on a variety of topics to help you ramp up your business. The training doesn’t end there. We continue to offer experienced agents ongoing professional development training throughout the year. Tools and Services Agent Resource Centre: Tools and resources that are second to none! Benefits Program: Optional group insurance packages are available. Marketing Deparment: We have our own in house marketing department with trained professionals at your disposal! Pay Day is Every Day: Our accounting department ensures that you will paid within 48 hours once they are in receipt of funds after a closing. Start Up Packages: All elements that you may need are covered including training, mentoring, websites, marketing, signage, business cards, tools and props among many others! IT Department: Our team is available Monday to Friday for any IT related questions or concerns. Management Team Available to Help 24-7: You are never alone if you need help! Professional Offices: Our offices are open 7 days a week and staffed by professional administrators. We have offices all over the city! Events: You are invited to our Gala Awards Event and Bi-Annual Productivity Events as a thank you and an opportunity to celebrate your successes. CONTACT US TODAY! Your new real estate career awaits! To find out more contact us by email at yourcareer@rlpottawa.com or call us at 613.667.APPT (2778). We would love to speak with you! To learn more about what we have to offer, check out our Careers page. (link: http://www.teamrealty.ca/real-estate-career-ottawa/) The post Choosing a Brokerage to Work For appeared first on Team Realty. Source: Blog

Finding the Best Neighbourhood for Your Family

A row of a new houses in Ottawa, Ontario Buying a home is arguably one of the biggest decisions we will ever make. The process can often seem a little daunting at first, especially for those who are first-time home buyers: where to buy, what neighbourhood, what to buy, when to buy – all relevant ponderings that can (and will) be answered in time, rest assured. Similarly, when it comes time to choosing a home that is best suited for your family, there are also a lot of factors to consider – some of which can seem a little overwhelming. We do, however, all go through it and the process can, in fact, be a seamless one. How do you choose which neighbourhood is right for you? Of course, it often goes without saying that the further you and your family are from the heart of your city, the lower the crime rates, the larger the lot sizes, and the cheaper the real estate properties will be; and that’s not all you’ll likely find in your “google” search. If you have children who are at that age where you need to start thinking about their education, for example, certain areas will probably be preferred over others. After all, according to the Article Where to live in Ottawa “areas around good schools are often among the best to live anyway”. The Fraser Institute is one of the best resources that you and your family can use when it comes down to finding the right school for your children – and although not all parents will tend to agree with ranking schools based solely on their academic performances, the Institute is a great place to at least start.Living in Canada has put together a list of, what they consider to be, the best neighbourhoods. Among them, West-Carleton March with the lowest crime rate, and home to one of the city’s best secondary schools, West Carleton Secondary School. In addition to West-Carleton, Kanata North is ranked very highly in education, as well as in commercial accommodation in the Kanata Research Park . In fact, Earl of March Secondary School and All Saints Catholic High School are both rated extremely high, according to the Fraser Institute. Always remember that when finding a home in a neighbourhood that is best suited for your family and their needs, it’s important to conduct proper research, and to be sure that what you’re searching for accommodates everyone in your household. With the amount of different neighbourhoods that Ottawa has to offer, there’s bound to be one that’s out there for you. The post Finding the Best Neighbourhood for Your Family appeared first on Team Realty. Source: Blog

Buying Your Retirement Home

For several years now, Canada’s population of 65-and-overs has been increasing at rapid rates. In fact, in 2015, according to Statistics Canada, there were more Canadians over the age of 65 than there were those under the age of 15 – a pace that has only been growing since 2011. Coincidently, as the Canadian population grows older, the number of Canadian retirees will rise. So, are you someone who is approaching the first stages of retirement? More importantly, are you ready to retire? One of the biggest decisions an individual(s) will make upon retirement is purchasing their retirement home. It’s important to consider all of the factors involved. When do you plan to retire? Within the next 5 years? 10? Do you and your spouse share the same retirement dream? Where would you like to retire? Do you have the proper financial plan? There are several options that you and your family can consider if retirement is something that’s in your near future and you’re looking to invest in your home before you retire fully. For more information on the following 3 suggestions, follow this link! Generate income by renting out your retirement home before retiring: income from a rental property can act as a hedge against a low interest rate environment as well as future inflation because you can simply raise the rent to offset inflation when it hits. Location, location, location. If you’re plan is to buy your retirement home before you retire and use it only on occasion for vacation, for example – be sure to choose your location with careful vigilance and perhaps with little-to-low maintenance. Be flexible: if you are 10 years or more away from retirement, you may want to opt to rent a vacation home for a month at a time in order to avoid getting stuck with a permanent decision about your retirement destination. Be sure to have a plan that allows you to comfortably afford where you’d like to live. If you feel financially ready to purchase your retirement home, that’s commendable. Once less step in your retirement process to worry about. This means you’ve had many a conversation with your spouse about “when’s” of planning and preplanning. During these conversations, however, it’s also important to talk about the “where’s” and “how’s”. Location is a key attribute to any retirement plan, as mentioned above. If your dream is to live in the mountains, yet it’s your spouse’s to live on the beach, that’s something you have to talk about in order to find common ground. The same goes for living near your friends, your family, your grandkids – versus, not. Have you tested out your ideal retirement location? What if you long for the mountain air while residing along the beach? According to Market Watch, it’s important to do your research. The post Buying Your Retirement Home appeared first on Team Realty. Source: Blog

Checklist for Home Buyers

When buying a home, there are always a series of questions that run through a home buyer’s mind. At Royal LePage Team Realty, we encourage you to ask them, we try to think of everything for you … including a checklist to keep track of the important details about homes we show you! Of course your Real Estate agent will be there every step of the way to help you find the right home, but falling in love with a property is not the only factor to consider when purchasing a home. We’ve put together a checklist that outlines details that are important to many buyers and will help in your decision to make an offer on a property or move on to the next. It includes such attributes as the structure of your home (examples: detached, semi-detached, condominium, etc.), the type of construction of your home (examples: wood, brick veneer, or block), as well as several detailed inquiries regarding your furnace, your plumbing, and your home’s electrical wiring. Furthermore, it’s important to know what your home comes equipped with. For example, what’s already included in the price of the home? Are the appliances up to date? Are there any additional features such as a fireplace or a pool? Some of the biggest questions you may find asking on your checklist are those regarding the location of your home. If you are someone who travels to and from work every day, it’s essential to make note of nearby transportation routes (examples: bus routes, highways, traffic volumes etc.). Do you have kids? If so, parks, schools, and other amenities such as shops and restaurants will be features you’d like to check-off your list. You’re almost there, you’re about to sign the papers. In addition to the above mentioned features, it’s important to ask about any additional estimated costs that will come with your home upon purchase, as well as the condition of such attributes as your floors, roof, windows, and so on. What are the property taxes? Are there any imminent repairs? Does your home require a parking permit? Download our checklist below, it will put your mind at ease from submitting an offer to move-in day! Like what you see? Subscribe to our Blog. The post Checklist for Home Buyers appeared first on Team Realty. Source: Blog

Homeowners Can Earn Extra Income Using Airbnb

Congratulations, you’re a homeowner! With all of the joys of home-ownership also comes the task of paying off your mortgage, paying property taxes and keeping up with regular maintenance as required. While you’ve purchased a home within your means, paying off a mortgage can be daunting; however, there are ways in which you can make your payments a little more manageable. If you’ve decided to purchase a home, you’ve put down a certain percentage as a down payment, and you’ve agreed to pay into a mortgage (over the course of x-amount of years with an interest rate of x-percent). You can’t help but to ask yourself, “what can I do to reduce the costs associated with being a homeowner?” Airbnb might just be the answer you’re searching for. With Airbnb you’re able to rent out your home (or second home, depending on whether or not you’ve decided to take out a second mortgage on a retirement property, for instance) to people who are traveling from around the world and need a place to temporarily stay. According to their site, as an Airbnb host you can earn $182 CAD by sharing a single, private room in Ottawa in only 1 week and $331 CAD by sharing your entire home in Ottawa in the same amount of time. And the best part? It’s easy! Simply visit their website, select the “become a host” button, and answer a few basic questions. It’s an extremely reasonable option for you to earn a few extra dollars while renting out your home for only a few short stints at a time, rather than for a full season (or vice versa depending on which home you choose to rent out). Before renting out your home through Airbnb, or any other related service, it’s wise that you first do your homework. Check with your bank: more often than not, you must inform them of the intended use of your property. It goes without saying that receiving a little extra help in lessening your mortgage will undoubtedly feel awesome, but simply make sure you’re providing diligence where it’s due – throughout the entire process. The post Homeowners Can Earn Extra Income Using Airbnb appeared first on Team Realty. Source: Blog

5 Awesome Innovations on the Frontier of Home Automation