Choosing a Brokerage to Work For

Have you considered a job in a real estate? Choosing a brokerage to work for can be a daunting process. As one of the largest brokerages in the city, Royal LePage Team Realty has a lot to offer our Realtors. Combine all that we have to offer with the resources provided to all Royal LePage agents in Canada, and you will be supported, trained, and taken care of. Real estate can be both a challenging and dynamic career for people with strong interpersonal skills and good business savvy. Whether you are just starting your career or are currently working in real estate and looking to make a change, Royal LePage Team Realty will work with you to achieve your goals! What Sets Us Apart “We are committed to Helping You excel at your profession and achieve the results you want, by supporting you with a strong brand, culture of collaboration and innovation, and leading training, technology and marketing tools and continuously giving back to the community via our efforts with our Royal LePage Shelter Foundation. At Royal LePage, Helping You is What We DoTM.” (link: http://www.teamrealty.ca/real-estate-career-ottawa/) Training Our training is provided to all our agents at no cost to you! You will learn how to build and operate your real estate business resulting in profitable revenue streams. We offer a 4 tier training to all our Realtors. Branch Operations and an introduction to different software applications that you will use regularly. 10 Core Real Estate Courses that are offered every 30 days. In depth training in computer labs on the IT programs you will use everyday! Hand On Mentoring Program on a variety of topics to help you ramp up your business. The training doesn’t end there. We continue to offer experienced agents ongoing professional development training throughout the year. Tools and Services Agent Resource Centre: Tools and resources that are second to none! Benefits Program: Optional group insurance packages are available. Marketing Deparment: We have our own in house marketing department with trained professionals at your disposal! Pay Day is Every Day: Our accounting department ensures that you will paid within 48 hours once they are in receipt of funds after a closing. Start Up Packages: All elements that you may need are covered including training, mentoring, websites, marketing, signage, business cards, tools and props among many others! IT Department: Our team is available Monday to Friday for any IT related questions or concerns. Management Team Available to Help 24-7: You are never alone if you need help! Professional Offices: Our offices are open 7 days a week and staffed by professional administrators. We have offices all over the city! Events: You are invited to our Gala Awards Event and Bi-Annual Productivity Events as a thank you and an opportunity to celebrate your successes. CONTACT US TODAY! Your new real estate career awaits! To find out more contact us by email at yourcareer@rlpottawa.com or call us at 613.667.APPT (2778). We would love to speak with you! To learn more about what we have to offer, check out our Careers page. (link: http://www.teamrealty.ca/real-estate-career-ottawa/) The post Choosing a Brokerage to Work For appeared first on Team Realty. Source: Blog

Finding the Best Neighbourhood for Your Family

A row of a new houses in Ottawa, Ontario Buying a home is arguably one of the biggest decisions we will ever make. The process can often seem a little daunting at first, especially for those who are first-time home buyers: where to buy, what neighbourhood, what to buy, when to buy – all relevant ponderings that can (and will) be answered in time, rest assured. Similarly, when it comes time to choosing a home that is best suited for your family, there are also a lot of factors to consider – some of which can seem a little overwhelming. We do, however, all go through it and the process can, in fact, be a seamless one. How do you choose which neighbourhood is right for you? Of course, it often goes without saying that the further you and your family are from the heart of your city, the lower the crime rates, the larger the lot sizes, and the cheaper the real estate properties will be; and that’s not all you’ll likely find in your “google” search. If you have children who are at that age where you need to start thinking about their education, for example, certain areas will probably be preferred over others. After all, according to the Article Where to live in Ottawa “areas around good schools are often among the best to live anyway”. The Fraser Institute is one of the best resources that you and your family can use when it comes down to finding the right school for your children – and although not all parents will tend to agree with ranking schools based solely on their academic performances, the Institute is a great place to at least start.Living in Canada has put together a list of, what they consider to be, the best neighbourhoods. Among them, West-Carleton March with the lowest crime rate, and home to one of the city’s best secondary schools, West Carleton Secondary School. In addition to West-Carleton, Kanata North is ranked very highly in education, as well as in commercial accommodation in the Kanata Research Park . In fact, Earl of March Secondary School and All Saints Catholic High School are both rated extremely high, according to the Fraser Institute. Always remember that when finding a home in a neighbourhood that is best suited for your family and their needs, it’s important to conduct proper research, and to be sure that what you’re searching for accommodates everyone in your household. With the amount of different neighbourhoods that Ottawa has to offer, there’s bound to be one that’s out there for you. The post Finding the Best Neighbourhood for Your Family appeared first on Team Realty. Source: Blog

Buying Your Retirement Home

For several years now, Canada’s population of 65-and-overs has been increasing at rapid rates. In fact, in 2015, according to Statistics Canada, there were more Canadians over the age of 65 than there were those under the age of 15 – a pace that has only been growing since 2011. Coincidently, as the Canadian population grows older, the number of Canadian retirees will rise. So, are you someone who is approaching the first stages of retirement? More importantly, are you ready to retire? One of the biggest decisions an individual(s) will make upon retirement is purchasing their retirement home. It’s important to consider all of the factors involved. When do you plan to retire? Within the next 5 years? 10? Do you and your spouse share the same retirement dream? Where would you like to retire? Do you have the proper financial plan? There are several options that you and your family can consider if retirement is something that’s in your near future and you’re looking to invest in your home before you retire fully. For more information on the following 3 suggestions, follow this link! Generate income by renting out your retirement home before retiring: income from a rental property can act as a hedge against a low interest rate environment as well as future inflation because you can simply raise the rent to offset inflation when it hits. Location, location, location. If you’re plan is to buy your retirement home before you retire and use it only on occasion for vacation, for example – be sure to choose your location with careful vigilance and perhaps with little-to-low maintenance. Be flexible: if you are 10 years or more away from retirement, you may want to opt to rent a vacation home for a month at a time in order to avoid getting stuck with a permanent decision about your retirement destination. Be sure to have a plan that allows you to comfortably afford where you’d like to live. If you feel financially ready to purchase your retirement home, that’s commendable. Once less step in your retirement process to worry about. This means you’ve had many a conversation with your spouse about “when’s” of planning and preplanning. During these conversations, however, it’s also important to talk about the “where’s” and “how’s”. Location is a key attribute to any retirement plan, as mentioned above. If your dream is to live in the mountains, yet it’s your spouse’s to live on the beach, that’s something you have to talk about in order to find common ground. The same goes for living near your friends, your family, your grandkids – versus, not. Have you tested out your ideal retirement location? What if you long for the mountain air while residing along the beach? According to Market Watch, it’s important to do your research. The post Buying Your Retirement Home appeared first on Team Realty. Source: Blog

Checklist for Home Buyers

When buying a home, there are always a series of questions that run through a home buyer’s mind. At Royal LePage Team Realty, we encourage you to ask them, we try to think of everything for you … including a checklist to keep track of the important details about homes we show you! Of course your Real Estate agent will be there every step of the way to help you find the right home, but falling in love with a property is not the only factor to consider when purchasing a home. We’ve put together a checklist that outlines details that are important to many buyers and will help in your decision to make an offer on a property or move on to the next. It includes such attributes as the structure of your home (examples: detached, semi-detached, condominium, etc.), the type of construction of your home (examples: wood, brick veneer, or block), as well as several detailed inquiries regarding your furnace, your plumbing, and your home’s electrical wiring. Furthermore, it’s important to know what your home comes equipped with. For example, what’s already included in the price of the home? Are the appliances up to date? Are there any additional features such as a fireplace or a pool? Some of the biggest questions you may find asking on your checklist are those regarding the location of your home. If you are someone who travels to and from work every day, it’s essential to make note of nearby transportation routes (examples: bus routes, highways, traffic volumes etc.). Do you have kids? If so, parks, schools, and other amenities such as shops and restaurants will be features you’d like to check-off your list. You’re almost there, you’re about to sign the papers. In addition to the above mentioned features, it’s important to ask about any additional estimated costs that will come with your home upon purchase, as well as the condition of such attributes as your floors, roof, windows, and so on. What are the property taxes? Are there any imminent repairs? Does your home require a parking permit? Download our checklist below, it will put your mind at ease from submitting an offer to move-in day! Like what you see? Subscribe to our Blog. The post Checklist for Home Buyers appeared first on Team Realty. Source: Blog

Homeowners Can Earn Extra Income Using Airbnb

Congratulations, you’re a homeowner! With all of the joys of home-ownership also comes the task of paying off your mortgage, paying property taxes and keeping up with regular maintenance as required. While you’ve purchased a home within your means, paying off a mortgage can be daunting; however, there are ways in which you can make your payments a little more manageable. If you’ve decided to purchase a home, you’ve put down a certain percentage as a down payment, and you’ve agreed to pay into a mortgage (over the course of x-amount of years with an interest rate of x-percent). You can’t help but to ask yourself, “what can I do to reduce the costs associated with being a homeowner?” Airbnb might just be the answer you’re searching for. With Airbnb you’re able to rent out your home (or second home, depending on whether or not you’ve decided to take out a second mortgage on a retirement property, for instance) to people who are traveling from around the world and need a place to temporarily stay. According to their site, as an Airbnb host you can earn $182 CAD by sharing a single, private room in Ottawa in only 1 week and $331 CAD by sharing your entire home in Ottawa in the same amount of time. And the best part? It’s easy! Simply visit their website, select the “become a host” button, and answer a few basic questions. It’s an extremely reasonable option for you to earn a few extra dollars while renting out your home for only a few short stints at a time, rather than for a full season (or vice versa depending on which home you choose to rent out). Before renting out your home through Airbnb, or any other related service, it’s wise that you first do your homework. Check with your bank: more often than not, you must inform them of the intended use of your property. It goes without saying that receiving a little extra help in lessening your mortgage will undoubtedly feel awesome, but simply make sure you’re providing diligence where it’s due – throughout the entire process. The post Homeowners Can Earn Extra Income Using Airbnb appeared first on Team Realty. Source: Blog

5 Awesome Innovations on the Frontier of Home Automation

Remote home control system on a digital tablet or phone. In today’s digital world — recently dubbed “The Age of the Internet of Things” — technology is changing everything. From wearable health tracking devices to cars that drive themselves, tech has made day-to-day life easier, more convenient and also more fun. One area in which technology is having a huge impact is in the home. Recent inventions have made maintaining, taking care of and enjoying domestic life better than ever before. The following five home automation innovations represent some of the most cutting edge technologies that are shaping the way humans experience their homes. Connected Refrigerators There’s a good chance you’ve run to the grocery to pick a few things up — only to return home and find out you’ve forgotten one essential item. You can avoid that annoyance now that there are smart refrigerators, which not only help you regulate the energy that your fridge uses, but also help you keep track of what is inside them. Smart refrigerators have a Wi-Fi connection, and are equipped to take photos of the inside each time it opens and closes so you can check and see what is in them, even remotely. Some smart fridges even have capability to play videos and songs, while others allow you to pull up recipes or order groceries from a touchscreen. Two of the most popular smart refrigerators on the market right now are the Samsung Family Hub and the LG Smart ThinQ. Connected Washers and Dryers Connected appliances don’t only make cooking easier — they make laundry better, too. Internet-connected washers and dryers now allow you to stop and start cycles via an app remotely, as well as to monitor how much energy you’re using. Many smart laundry appliances also allow you to “download” special cycles for certain clothing items in order to make sure you are washing and drying your garments just the right way. Whirpool’s Smart Cabrio Washer and Smart Cabrio Dryer are two of the most popular smart laundry devices on the market. Self-Learning Thermostats Keeping the temperature regulated in your home is key to making sure you and your family are comfortable. Now, you can use a self-learning, self-regulating thermostat, like the popular Nest device, to keep the air feeling just right. Nest’s thermostat does a whole host of things, including learning your schedule after you use it for a week, then automatically changing the temperature by itself — both to make sure that you’re comfortable when you’re at home, and that you’re not using excess energy when you’re not. Smart Locks Keeping your home locked means that you can keep your family and your belongings safe. But locks can also cause challenges, such as when people get locked out, or when you leave your house and forget to lock up. Thanks to smart locks, however, you can control the security of your home via a remote app, which allows you to lock, unlock and check the status of a lock, whether you’re at home or far away. Many smart locks, like August locks, also have doorbell cameras, so you can see who is at the door from your smartphone. Leak and Moisture Detection Another home automation innovation designed to keep you safe is the leak and moisture detection device. Devices like Wally Home can detect whether there is excess moisture in your residence — letting you know about a potential leak or flood as they are happening. Leak and moisture detection innovations can help you avoid dangerous things like mold or rotting flooring or walls, and they can help you avoid having to make frustrating and expensive home repairs by catching small problems before they become big ones. The post 5 Awesome Innovations on the Frontier of Home Automation appeared first on Team Realty. Source: Blog

Strong Fall Real Estate Market in Ottawa

No fall(ing) back in Ottawa’s resale market: News release from the Ottawa Real Estate Board October 5th, 2016 OTTAWA, October 5, 2016 – Members of the Ottawa Real Estate Board sold 1,371 residential properties in September through the Board’s Multiple Listing Service® System, compared with 1,241 in September 2015, an increase of 10.5 per cent. The five-year average for September sales is 1,171. “Again this month, we have broken the record for residential and condominium units sold, with 200 more units sold than the five-year average for September sales,” says Shane Silva, President of the Ottawa Real Estate Board. “With average sale prices remaining virtually unchanged since the beginning of the year, this could be an indication that prices have adjusted to market expectations and sales have rebounded as a result.” September’s sales included 269 in the condominium property class, and 1,102 in the residential property class. The condominium property class includes any property, regardless of style (i.e. detached, semi-detached, apartment, townhouse, etc.), which is registered as a condominium, as well as properties which are co-operatives, life leases, and timeshares. The residential property class includes all other residential properties. “Units listed in both residential and condominium property classes continue to decline,” indicates Silva. “From 2,076 listed in September 2015 to 1,822 listed in September 2016 for residential properties, and from 637 listed in September 2015 to 588 listed in September 2016 for condominium sales. With fewer listings coming on to the market, combined with recent higher unit sales, overall inventory is declining. The basic economics of supply and demand at play will continue to have an impact on the Ottawa resale market.” The average sale price of a residential-class property sold in September in the Ottawa area was $383,793 a decrease of 0.1 per cent over September 2015. The average sale price for a condominium-class property was $252,136, a decrease of two per cent over September 2015. The Board cautions that average sale price information can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of all properties sold. “The hottest segments in our market for September continue to be two-storey and bungalow residential homes in the $300,000 to $400,000 price range, followed by one-level and two-storey condos in the $200,000 to $300,000 and the $100,000 to $200,000 price range” says Silva. “In addition to residential and condominium sales, OREB Members have assisted clients with renting almost 2,500 properties since the beginning of the year.” The post Strong Fall Real Estate Market in Ottawa appeared first on Team Realty. Source: Blog

Millennials Bring the Big City to the Suburbs

Small businesses in suburban neighbourhoods bring a sense of the big city to smaller towns The high cost of downtown living in big Canadian cities like Ottawa, Toronto, and Vancouver are driving more and more people out of city centers and into the suburbs. However, millennials say they don’t want to miss out on the look and feel of the big city when they move to the outskirts. Some suburbs have heard these desires, and are trying to find ways to change and better promote the amenities they offer in order to attract more young people. The amenities offered vary depending on the particular suburb, but many neighbourhoods are promoting specialty shops, independent restaurants, trendy cafes, and other small businesses in order to bring the feeling of living right downtown into suburban areas. Perhaps surprisingly, one of the major features that draws younger people to particular suburbs is the presence of walking and bike paths. The percentage of teenagers and young adults who have driver’s licenses has dropped in recent years as more people choose to bike, walk, or take the bus in order to get around, and suburban areas that promote these transportation methods are reaping the benefits. In some areas, homes that are close to bike or walking paths can see a price boost of 5-10%! Many of the most successful suburbs are now being built, or remodelled, to be easily walkable and hold a mix of residential and shopping areas. Overhauling main streets to be more easily walkable and installing footpaths and bike trails is becoming common in many suburban areas as part of this trend. Although providing the downtown feeling with a suburban price tag is a huge draw for young people, it is not the only one. Many companies and business are moving away from the downtown core of major cities and into suburban areas in order to save money, and this draws millennials who wish to work or shop at these locations into the suburbs. The reverse is also true, as younger people moving into suburbs creates reasons for old businesses to move and new ones to start up in order to cater to them. As more and more young people gravitate to the suburbs, and suburban areas change in order to make themselves more attractive to these prospective buyers, it will be interesting to see what kinds of changes occur and how well they are received by long-term residents and new arrivals alike. The post Millennials Bring the Big City to the Suburbs appeared first on Team Realty. Source: Blog

Key Qualifying Questions

If you’re thinking of buying a home, but not sure on how or where to begin, let us be the ones to help you! What’s important is to ask the right questions in order to make the right decision – the one that’s best for you. First, if you’re a first-time home buyer, it’s important to get pre-approved for a home. This should typically be step one. Once approved, the rest of the home-buying experience can successfully follow. You can then answer such questions as how soon you’re looking to move, how quickly of a time-frame you’re willing to move in, or if you’re simply browsing your options, you can get a clear idea of what’s out there that’s within your price range. Are you looking for a home for yourself, for someone else, or for your family? What you answer to this specific question will, of course, determine a multitude of follow-up inquiries including location, size of home, and the accessibility to transit routes, highways, schools, hospitals and so on. Pets? What type of yard do you need? Or, how about the structure of your home? Having a pet might, depending, have an input in whether or not you purchase, say, a condominium versus a detached home. Upon answering these such questions, it’s important to consider the reasons why you’re choosing to move in the first place. At the end of the day, there’s always a reason – don’t lose sight of that. With this in mind, keep track of the homes you’ve seen and the features of each that you have liked. Take a look at more of our Key Qualifying Questions – our goal is to help you as best as we can so that you can make the decision that’s best for you. The post Key Qualifying Questions appeared first on Team Realty. Source: Blog

How to Choose the Perfect Realtor for You

How to Choose the Perfect Realtor for You How to Choose the Perfect Realtor for You Whether you’re a first-time home buyer or are selling your house yet again, you need a realtor that understands your needs. The home buying or selling process can be complicated as it is, and there is no need to cause yourself additional angst by picking a less-than-qualified realtor. Read on to discover a few traits you need to look for when selecting a real estate agent so you can confidently move through the buying or selling process. Qualifications A realtor with no qualifications won’t get you very far. You need a real estate agent that knows the process through and through and has a certification so you can be certain he or she knows how to do the job. Check to make sure the realtor you are considering is a member of an upstanding organization, such as the Canadian Real Estate Association, and you can be confident that he or she will be up to snuff. Broad Knowledge-Base Your real estate agent needs to be able to walk you through the entire process. The agent needs to know about financing, pricing a house, home inspections and all the other steps involved in buying or selling a home. This is crucial if you’re a first-time home buyer and are unfamiliar with the proceedings. Thoroughly vet your agent before you sign on with him or her, ask questions about the system itself and any concerns you have. If the agent is able to answer your questions clearly and give you up-to-date tips and information, you’ll know you have found a good one. If, however, the agent leaves you feeling more confused than before, he or she is probably not right for you. Good Track Record How many homes has your agent sold in the past few months? A high success rate is a sign of a good agent. Ask the potential realtors how many homes they have sold out of all their listings so you can get a good idea of their effectiveness. Sympathetic to Your Needs Do you have a specific area that you want to buy in, or are you looking for a particular type of home? Your agent needs to fully understand your needs and be willing to dig to help you find the perfect property. No one knows your needs and desires better than you do, so avoid any agent that tries to upsell you for no reason or doesn’t seem to grasp what you want. It may seem like a difficult task, but finding the ideal realtor can save you a lot of time and hassle. Take your time selecting an agent and you’ll be able to move through buying or selling your home with ease and certainty. Like what you see? Subscribe to our Blog. The post How to Choose the Perfect Realtor for You appeared first on Team Realty. Source: Blog

Let us help you find “Your Perfect Life”

Whether you are looking for a neighbourhood with young families, an urban lifestyle or a quiet place to retire, “Your Perfect Life” could help you find your sweet spot. By way of entering a simple postal code, you are able to match your lifestyle and neighbourhood preferences in a relatable and engaging way. A first in Canadian real estate Fun, engaging content to share on your social channels With detailed demographic information about income level, life stage, household structure, employment types and education Ideal for clients who are considering relocating and want to learn more about prospective communities How it works… The post Let us help you find “Your Perfect Life” appeared first on Team Realty. Source: Blog

Ottawa Real Estate Update | Condo sales lead the way to best October on record!

While temperatures are dropping, the fall real estate market in Ottawa remains steady with another record breaking month! Recently released statistics from the Ottawa Real Estate Board below show that the condo sales soared in October, up 27.2% over last year! While these statistics are useful in establishing market trends they should not be used as an indicator that specific properties have increased or decreased in value. If you’re interested in a property evaluation or statistics for specific neighbourhoods please email info@teamrealty.ca or contact one of our offices, or professional real estate representatives, we would be delighted to assist. Released by OREB, November 3rd, 2016 OTTAWA, November 3, 2016 – Members of the Ottawa Real Estate Board sold 1,214 residential properties in October through the Board’s Multiple Listing Service® System, compared with 1,159 in October 2015, an increase of 4.7 per cent. The five-year average for October sales is 1,130. “October’s sales continued the record-breaking resale trend for the third straight month,” says Shane Silva, President of the Ottawa Real Estate Board. “While residential sales are identical to that of October 2015, condominium sales have soared – up by 27.2 per cent over last year. Lower inventory levels, combined with adjusting prices, may be creating these higher than normal activity levels in the condo property class.” October’s sales included 257 in the condominium property class, and 957 in the residential property class. The condominium property class includes any property, regardless of style (i.e. detached, semi-detached, apartment, townhouse, etc.), which is registered as a condominium, as well as properties which are co-operatives, life leases, and timeshares. The residential property class includes all other residential properties. “The new mortgage rules announced at the beginning of October have yet to have an effect on the Ottawa market, as the announcement only came two weeks prior to implementation,” says Silva. “It’s too early to tell what kind of impact the new mortgage rules will have on the Ottawa market going forward. We know that right now Ottawa continues to be a desirable city to live and work, and consumer confidence and job growth remain positive.” The average sale price of a residential-class property sold in October in the Ottawa area was $392,579 an increase of 3.3 per cent over October 2015. The average sale price for a condominium-class property was $251,465, an increase of .01 per cent over October 2015. The Board cautions that average sale price information can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of all properties sold. “The hottest segments in our market for October continue to be two-storey and bungalow residential homes in the $300,000 to $400,000 price range, followed by one-level and two-storey condos in the $200,000 to $300,000 price range” says Silva. “In addition to residential and condominium sales, OREB Members have assisted clients with renting almost 2,700 properties since the beginning of the year.” The post Ottawa Real Estate Update | Condo sales lead the way to best October on record! appeared first on Team Realty. Source: Blog

A Breakdown of Canada’s New Lending Rules

House made from Canadian polymer $100 dollar bills.Related Images: There has been a lot of topical chatter about the significant changes our government has recently put in place on Canada’s housing rules. Over the last several years, our government has been known to change the mortgage requirements on numerous occasions which has (and continues to) deeply affect anyone who, is not only looking to perhaps qualify for government-backed insured mortgages, but also those who may be looking to purchase their first home and/or are looking to refinance their existing mortgage. We needn’t be too concerned, however. According to Phil Soper, President and CEO of Royal LePage, “Nationally, our real estate markets remain healthy, with home values showing modest to strong (yet rational) price appreciation in almost every Canadian city … Even in the hardest hit oil patch regions, prices have held up well, with small single-digit declines, year-over-year” As it stands, the current rules state that buyers with a down payment of at least 5 per cent of the purchase price (but less than 20 per cent) must be backed by mortgage insurance – otherwise known as “high loan-to-value” or “high ratio” mortgages. On the other hand, in such situations that the buyer has 20 per cent or more for a down payment, the lender or borrower could obtain “low-ratio” insurance that covers 100 per cent of the loan in the event of a default . This said, if you and/or your family fall into such aforementioned categories, it’s important that you become well aware of the details, as well as the logic behind such recent changes. After all, obtaining a mortgage on your home isn’t a lost cause – all you need is the right advice and some solid support. The Globe and Mail published an article that outlines the four most prevalent changes in the housing market. They are as follows: Extending a “mortgage rate stress test” to all insured mortgages in order to ensure affordability. This particular change will primarily affect those who seek to buy government-backed insurance for low-ratio mortgages, as mentioned above. Launching “consultations on lender risk sharing” in order to limit the governments financial obligations if there just so happens to be a surplus of mortgage defaults. This rule, though affecting most home buyers, will also affect such mortgage lenders as banks as it will be putting them at a much higher risk. Implementing new restrictions on when the government “will provide insurance for low-ratio mortgages”. This rule will be taken into effect on November 30th, and will be aimed at lowering the government’s exposure to residential mortgages for properties worth $1 million or more. The “primary residence capital gains exemption” rules now requires you – as the seller of your primary residence – to report the details of the sale to the CRA. However, it’s been made clear that this rule is primarily aimed at preventing foreign buyers who buy and sell homes from claiming a primary residence tax exemption for which they are not entitled. Needless to say, there are ample amounts of new information that is to be discovered as it is extremely relevant to current and future home buyers. The attached article definitely acts as a useful resource, and we encourage you to read its content. The post A Breakdown of Canada’s New Lending Rules appeared first on Team Realty. Source: Blog

Winterizing Your Home

It seems like only yesterday that we were out enjoying the great (warm) outdoors at our cottages, lakes and so on. The days were sunny, the evenings were cool; we’d admire the gradual change in scenery as each tree in sight became more and more vibrant with time. And then without warning, as it does every year, it just hits us: winter. We feel it coming, we know it’ll be here in a quick blink of an eye, but it still somehow manages to sneak up on us. We ask ourselves if we’re even ready for winter, if we can prepare for it in such little time, and so on (if only we could just call a seasonal time-out!). The good news, however, is that we won’t need to. Getting ready for winter isn’t as complex and bone-chilling as it may seem. In fact, here are a few things you can do in order to protect and prepare your home for the winter: Make sure your furnace is either replaced or cleaned: It’s advised that you change your furnace filter at least once a month during the winter months to avoid resistance of airflow. If, by chance, you feel this step may occasionally slip your mind month-to-month, try adding a recurring reminder on your phone or in your calendar. It works! You can also try “switching to a permanent filter, which will reduce waste and hassle”. Perhaps consider upgrading to a furnace that’s considered to be more efficient – it’ll save you even more money year after year. Turn down your water heater: Most water heaters are automatically set to about 140 degrees Fahrenheit by installers upon placement into your home. In actuality, however, most of us don’t particularly need that high of heat, nor do we need that much steam. Avoid paying for an excess amount of heat by turning your water heater down to about 120 degrees Fahrenheit. Fact: doing so will reduce your water heating costs by 6 to 10%. You can also consider insulating your water pipes in order to avoid them from freezing during our colder months. Install storm doors and/or windows: This is a simple (albeit maybe a pain for some) task that can increase energy efficiency by 45%. How? “By sealing drafts and reducing air flow”. This said, an installation such as this will be well worth the work. Seal your air ducts: It pays to have a technician come into your home and assess your ductwork. He/she will test your system and fix any problems accordingly. Did you know that, according to studies, “10 to 30% of heated (or cooled) air in an average system escapes from ducts”? Protect your home from mold and dust this winter, and save a few dollars too! For more information, follow this link. It’ll give you even more advice (and an extension of the aforementioned tidbits posted above!) on how you and your family can prepare your home for when winter comes. And remember: change your clocks and check your smoke alarms – they should go hand in hand! The post Winterizing Your Home appeared first on Team Realty. Source: Blog

Winterizing Your Yard

Winterizing your home for the cold snap is one thing; winterizing your yard, however, is another. And as much as most of us would like to avoid prepping our yards for the inevitable cold that is to come, it’s something that’s simply unavoidable – especially if we’re looking to save both time and energy when spring and summer rolls around next year. Rest assured, however, winterizing your yard is not as complex as most of us may think it is, in fact, it’s actually quite simple. We’ve provided a list of ways below that will help you and your family maintain the quality of your yard, regardless of how cold it gets this winter: Move your hoses into a shed or a garage: It’s advised that we unhook and empty out all the water in our hoses and store them in a warmer place (for example, in your shed or in your garage). You certainly don’t want to leave your hose out in the cold as they can “suffer from [the cold’s] exposure” – a common misconception that can lead to us having to replace them more frequently. Take care of your BBQ and its grills: If you have either of these installed in your backyard, make sure that you move them indoors before winter hits. A garage, storage shed, or storage unit works great for your BBQ when they’re not in use. Keep in mind that your propane tanks stay outdoors – we wouldn’t want you putting your home and your family in danger! Tear down your lawn furniture and its accessories: Sturdier lawn furniture (wrought iron, for example) can be left covered outdoors over the winter months. If, however, your furniture set is less sturdy and/or plastic, it might be a good idea to bring it indoors – cushions too! A helpful hint: give your set a good cleaning before putting it away, it’ll save you some hassle come spring/summer. Prepare your swimming pool: “Winterizing your swimming pool protects it from damage due to the water freezing and keeps it clean for the next swimming season”. You’ll want to check the water chemistry, the alkalinity, the calcium hardness, and the chlorine levels in addition to covering your pool to avoid winter “debris”. To read an extended version of this article, follow this link and learn more. All elements in/of your backyard should be given the proper care and attention they deserve before the cold snap of winter falls upon us. Follow these tips, make a check list – anything that will help you and your family prepare and preserve your backyard for the winter season. The post Winterizing Your Yard appeared first on Team Realty. Source: Blog

Using a Buyer’s Agent

Royal LePage offers optimal customer service in order to deliver the best possible results to its clientele. Contrary to the way real estate was (years ago when real estate brokerages represented only the seller), you now have the option of being represented by a buyer’s agent, who’s responsibility is to protect you, your family, and your best interests all while providing you with the essential information needed in order for you to make an informed decision when it comes time to buying a home. A buyer’s representative will locate the best homes that fit your needs. This will work in your favour, not only as a saver of time, but also in such a way that will deter you from those homes that just aren’t right for you. This said, among these suitable homes, research is done by your representative in order to foresee any potential issues that lie with the selected properties so that when it comes time to sign papers, your decision has been made in an informed manner. With a buyer’s agent, you will have someone to accompany you on showings, familiarize you and your family with the selected neighbourhoods and what they have to offer, assist you in securing your financing, and recommend appraisals as well as home inspections, among many additional trustworthy duties. Royal LePage offers some of the best commitment on the market, and our buyer’s representatives will thoroughly represent you throughout the entire home-buying process in order to make your experience with us a memorable one. The post Using a Buyer’s Agent appeared first on Team Realty. Source: Blog

Real Estate Update: Latest news in Ottawa Real Estate

As snow hits Ottawa, November sales slowed slightly, while “Condo sales continue to bolster Ottawa resale market“ Highlights: Ottawa condo market appears to be on the upswing 14,825 homes were sold in the first 11 months officially making 2016 a record breaking year for number of sales Average prices were up, $405,320 in the residential class, an increase of 6.5% over 2015. While these statistics are useful in establishing market trends they should not be used as an indicator that specific properties have increased or decreased in value. If you’re interested in a property evaluation or statistics for specific neighbourhoods please email info@teamrealty.ca or contact one of our offices, or professional real estate representatives, we would be delighted to assist. News Release from the Ottawa Real Estate Board: Condo sales continue to bolster Ottawa resale market OTTAWA, December 6, 2016 – Members of the Ottawa Real Estate Board sold 995 residential properties in November through the Board’s Multiple Listing Service® System, compared with 986 in November 2015, an increase of 0.9 per cent. The five-year average for November sales is 939. “After a few breakaway months, the Ottawa resale market has come back down with sales typical of November,” says new Ottawa Real Estate Board President, Rick Eisert. “The condo market appears to be on the rise now, a welcome change compared to earlier in the year, with sales coming in at 16.2 per cent higher than November 2015. Several factors could have contributed to this increase – inventory levels trending downwards, steady prices, or buyers affected by the newly changed mortgage rules.” November’s sales included 230 in the condominium property class, and 765 in the residential property class. The condominium property class includes any property, regardless of style (i.e. detached, semi-detached, apartment, townhouse, etc.), which is registered as a condominium, as well as properties which are co-operatives, life leases, and timeshares. The residential property class includes all other residential properties. “Year-to-date unit sales to the end of November have now surpassed all previous year-end totals,” explains Eisert. “This year has been an exceptional year for sales for Ottawa Real Estate Board Members, and the year isn’t even over yet. The cumulative days on market have shown a steady decline for the first six months of the year, then has shown the same steady increase, so that the cumulative days on market in November (105 days) essentially mirrored that of January (110 days).” The average sale price of a residential-class property sold in November in the Ottawa area was $405,320 an increase of 6.5 per cent over November 2015. The average sale price for a condominium-class property was $277,650, an increase of one per cent over November 2015. The Board cautions that average sale price information can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of all properties sold. “In the residential market the two most active price points were $300,000 to $399,999 and then $400,000-$499,999 for the month of November, accounting for 50.3 per cent of the market. The condominium market was most active in the $150,000 to $249,999 price range, accounting for 55.2 per cent of the market,” says Eisert. “In addition to residential and condominium sales, OREB Members have assisted clients with renting over 2,900 properties since the beginning of the year.” The post Real Estate Update: Latest news in Ottawa Real Estate appeared first on Team Realty. Source: Blog

The Perks of Buying a Home in the Winter

There is a great majority of people who think that winter is not the best time to shop for a home. Contrary to popular assumption however, buying a home over the winter months may, in fact, be something worth considering. Sure, there might arguably be less homes for you to choose from, but the sellers might also be more motivated – playing to your advantage. You see it’s likely that, “the sellers will want to get the deal closed, especially for tax purposes. It’s the end of the year and they want to tie up loose ends. This is an advantage for buyers, especially if there are points to negotiate”. What’s more is that a smaller selection of homes to choose from can save you and your family a lot of time, allowing for you to find a home you love much sooner. According to Realtor.com, “it may be simpler to view the handful of homes that are for sale in the winter and choose the one that best suits your needs”. In addition to having a smaller selection of homes, there are also less buyers – leaving you with much less competition. What a lot of winter buyers might also tell you is that by shopping for a home in the off-season, you’re able to gain full insight into how your future potential home will hold up in the colder months. It goes without saying that there are homes out there that tend to weaken in the cold – depending, of course, on the age of the home, the location of the home, and/or the build of the home among other factors. It’s best to check for cold drafts, functioning heat and water systems, as well as the quality of windows and weather stripping. Buying a home in the winter time might be favourable to you and your family. Though most of us may prefer to shop when the trees are in full bloom and the yards are trimmed and at their finest, a winter wonderland that’s filled with snow and decorated festively could also leave you feeling inspired. So perhaps treat yourself and your family this Christmas by buying yourselves the home of your dreams! The post The Perks of Buying a Home in the Winter appeared first on Team Realty. Source: Blog

Staging Your Home for Home Buyers Over the Holidays

Selling your home in the (often dreaded) winter months of November-January, can render itself to be quite difficult for some. And although, for the most part, we tend to agree that our homes are more “visibly appealing” – on the outside – in the spring and summer months, there are several perks to selling your home and making it quite charming – on the inside – for homebuyers around the holidays! We can all admit to sometimes going a little overboard with our holiday decorating from time to time – and if we’re not a person who does, we know of someone who will. However, if you’re looking to sell your home around this celebratory time of year, it might be a good idea to hold back on the decorating (just a little bit). With homes arguably looking their best around Christmas time, it’s easy to get carried away when trying to appeal to a buyer’s eye, but “adornments that are too large [or simply having too many of them] can crowd your home and, in fact, distract buyers”. When you think about it, being mindful of this particular change will encourage shoppers to still notice your home rather than what’s in it. Remember, simplicity is key. It’s also been advised by HGTV in their article on selling-tips for your home during the holidays, to avoid offending buyers by decorating your home with too many religious themed items. Instead, try “opting for general fall and winter décor”. Something else that you should certainly consider when prepping your home for buyers in the winter months is to stage it so that they can imagine themselves potentially living it. “Make your home feel cozy and inviting during showings by cranking up the heat, playing soft classical music and offering homemade holiday treats. When you encourage buyers to spend more time in your home, you also give them more time to admire its best features”. This form of staging, along with the initial steps of subtle decorating, opens up a great opportunity to take good quality photos/videos of your home in order to help in with selling process. It is very possible for homebuyers to gravitate toward the appearance of a home during the holiday season (just as much as they will come spring and summer) if you work toward making your home just the right amount of festive. If you need assistance in the staging process, don’t worry – most realtors will offer you help by referring you to a reliable, professional stager. We hope that you have a safe and memorable holiday season. Happy staging! The post Staging Your Home for Home Buyers Over the Holidays appeared first on Team Realty. Source: Blog

Costs on Your Home Over the Christmas Season: Trimming the Holiday Stress

Christmas is indeed a time for many things. It is time well spent with our families and our friends, a time for celebration, a time for passing down holiday traditions (as well as creating new ones); and, of course, with the end of year approaching, it is a time of reflection and resolution. Moreover, with the abundance of festivities that our communities offer over the holidays, it’s a time to try new things, and to collect memories with your loved ones. With the joys of Christmas comes, of course, the stresses of the season. It’s only natural. We host parties, allow for relatives to spend a night (or two), and typically spend a little more money on maintaining our homes, among other things. This said, it’s important to plan accordingly. One of the biggest factors that tend to impact our pocketbooks is our hydro usage. And with all the hustle and bustle that is the holiday season, we must be cautious with when and how often we use it. Luckily, Hydro One has set, off-peak hours (that include weekends and holidays) with set, off-peak prices. What this means is that on Christmas Day, on Boxing Day, and even on New Year’s Day, these off-peak prices, when you utilize your main hydro sources between 7:00 PM and 7:00 AM, will apply. Furthermore, being mindful of your guest’s access/usage of such amenities as cable and/or WiFi is also key. It’s important to be diligent with whom you share your passwords with, and cautious as to how often you turn on your television in order to entertain. Failure to keep track can result in a relatively hefty bill at the end of the month. Less money spent, and less stress to be had. With respect to controlling your stress levels over the holidays, there are several ways that you can host and entertain your guests inexpensively and effectively. To avoid the cable costs of perhaps always having the game on, why not host a movie night instead? There’s nothing like reminiscing over the classics that we all grew up with. Games are also a great way to create memories on a low budget. They allow for us to bond with our friends and our families, all while creating new traditions along the way. Want to transform your home into the winter wonderland you’ve always imagined? Tree-trimming parties are an excellent way to decorate your home for the holidays, and host an unforgettable evening filled with laughs and creativity. So turn on those catchy Christmas tunes that we all (secretly) admire and enjoy, sing aloud to the words you know and love, cook up some munchies and capture all that this holiday season has to offer. Lastly, and above all else, remember the importance of togetherness. Volunteer. Donate to your local charities. At Royal LePage, we are committed to strengthening the communities we live in – that’s why we have The Shelter Foundation – our very own charitable foundation that helps women and children escape from violence and rebuild their lives. Contributing to a good cause is another great way to alleviate added stress over the holidays. To find out how you can donate, follow this link. Have a safe and happy Christmas! The post Costs on Your Home Over the Christmas Season: Trimming the Holiday Stress appeared first on Team Realty. Source: Blog

Top Housing Trends of 2016

The year is coming to a rapid close, and – as comparable to most facets in our lives – we choose to reflect on the 12 months that have passed, and are committed to planning for the next dozen that is to come. In the exciting world of real estate, there are many trends that tend to surface with each passing year. In 2016, some of those trends were as follows: One of the most recent housing trends that we saw in 2016 (and arguably one of the most talked about) were the changes to Canada’s housing rules. Over the last several years, our government has been known to change the mortgage requirements on numerous occasions which has (and continues to) deeply affect anyone who, is not only looking to perhaps qualify for government-backed insured mortgages, but also those who may be looking to purchase their first home and/or are looking to refinance their existing mortgage. We needn’t be too concerned, however. According to Phil Soper, President and CEO of Royal LePage, “Nationally, our real estate markets remain healthy, with home values showing modest to strong (yet rational) price appreciation in almost every Canadian city … Even in the hardest hit oil patch regions, prices have held up well, with small single-digit declines, year-over-year”. With ample amounts of new information to be discovered, it’s important that we all continue to become familiar with the details of these changes as they are extremely relevant to current and future homebuyers. We’ve also seen a shift in the amount of homes for sale in the resale market vs. those that are for sale as new builds. In other words, over the past year, we’ve seen a rather lacking inventory in the resale market, and a major increase in the construction and interest of newer homes. According to the Canada Mortgage and Housing Corporation (CMHC), we currently stand at a record-breaking total of 14,014 homes sold in 2016, compared to an all-encompassing total of 13,129 homes sold in 2015. At this growth rate, it is predicted that homes sold in 2017 could reach 15,400. What’s interesting is that with new homes being built quite consistently across our City, inventory increases, and more people tend to buy. In fact, single home new builds have increased in sales by 8%, and townhomes by a whopping 57%. Of course, much of the focus of these aforementioned housing trends have been quite logistical; and, although these rules and these numbers are evidently quite important, we mustn’t discount the several design trends that 2016 has brought to the forefront of our interior décor. We’ve seen such trends surface as the bold pops of paint colour (thanks, Benjamin Moore!) to the purity of white kitchens, to rusticity of barn-board sliding doors. Moreover, according to real estate professionals, homebuyers have been relatively persistent in requesting open layouts, multigenerational floor plans, first-floor master suites (with large closets), and extra-large garages. 2016 was a big year for the housing market and, as a result, we saw some pretty impressive reports, results, and trends. For more information about the year in a glance, you can contact us! We’ll gladly inform you on what has shaped our unforgettable year. The post Top Housing Trends of 2016 appeared first on Team Realty. Source: Blog

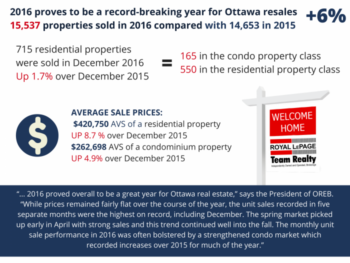

Ottawa Real Estate Update: December 2016

2016 was a record breaking year for Ottawa real estate resales! 715 sales in December brought the total number of properties sold throughout the year through Board’s MLS® to 15,537, a 6% increase over 2015. With more properties selling over $500K December also had the highest average sale price ever recorded $420,750, considerably higher than the 2016 average sale price of $371,987. Information below from the Ottawa Real Estate Board’s Latest new’s release on January 5th, 2017. 2016 proves to be a record-breaking year for Ottawa resales OTTAWA, January 5, 2017 – Members of the Ottawa Real Estate Board sold 715 residential properties in December through the Board’s Multiple Listing Service® System, compared with 703 in December 2015, an increase of 1.7 per cent. The five-year average for December sales is 656. The total number of residential and condo units sold through the Board’s MLS® System throughout all of 2016 was 15,537, compared with 14,653 in 2015, an increase of six per cent. Separately, residential and condo unit sales each outperformed the 2015 numbers. “No matter what is said in the history books about 2016, it proved overall to be a great year for Ottawa real estate,” says Rick Eisert, 2017 President of the Ottawa Real Estate Board. “While prices remained fairly flat over the course of the year, the unit sales recorded in five separate months were the highest on record, including December. The spring market picked up early in April with strong sales and this trend continued well into the fall. The monthly unit sale performance in 2016 was often bolstered by a strengthened condo market which recorded increases over 2015 for much of the year.” December’s sales included 165 in the condominium property class, and 550 in the residential property class. The condominium property class includes any property, regardless of style (i.e. detached, semi-detached, apartment, stacked etc.), which is registered as a condominium, as well as properties which are co-operatives, life leases and timeshares. The residential property class includes all other residential properties. “The listing inventory for both residential and condos trended lower all year, however units sold trended higher most months, outpacing 2015 by a fair margin,” says Eisert. “Cumulative days on market increased to 123 days in December, while the average for the year stayed steady at 91 days. Average residential sale prices remained virtually unchanged over last year, however we are seeing an increase in December compared to 2015, which could be a result of a higher concentration of properties sold in the $500,000 and up range.” The average sale price of a residential-class property sold in December in the Ottawa area was $420,750, an increase of 8.7 per cent over December 2015. The average sale price for a condominium-class property was $262,698, an increase of 4.9 per cent over December 2015. The year-to-date numbers for average residential sale price in 2016 was $397,778, an increase of 1.5 per cent over 2015. While the average condominium sale price was $260,982, an increase of 0.4 per cent over 2015. The Board cautions that average sale price information can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of all properties sold. “Looking at the whole year, the two most active price points in the residential market were $300,000 to $399,999 and then $200,000-$299,999, accounting for 54.6 per cent of the market. While the condominium market was most active in the $150,000 to $249,999 price range, accounting for 55.4 per cent of the market,” says Eisert. “In addition to residential and condominium sales in 2016, OREB Members have assisted clients with renting 3,053 properties, the sale of 19 farms units, and the sale of 340 commercial properties.” The post Ottawa Real Estate Update: December 2016 appeared first on Team Realty. Source: Blog

Canada’s Housing Rules in Full Swing

Happy New Year, folks! 2017 has finally arrived, and for the real estate world, change is in sight. As most of us already know, 2016 brought forth a lot of chatter about several significant changes (decided upon by our government) toward our country’s mortgage and housing rules. Those who will primarily be affected by these implementations will be anyone who, is not only looking to perhaps qualify for government-backed insured mortgages, but also those who may be looking to purchase their first home and/or are looking to refinance their existing mortgage. Having said that, the Government of Canada has been known to make multiple changes to our mortgage requirements in years past which, in turn, reassures us all that there is nothing to be too concerned about. In fact, we are reminded of what Royal LePage President and CEO, Phil Soper had to say about our real estate markets in a recent interview: “Nationally, our real estate markets remain healthy, with home values showing modest to strong (yet rational) price appreciation in almost every Canadian city … Even in the hardest hit oil patch regions, prices have held up well, with small single-digit declines, year-over-year”. We understand that, though the New Year has only just begun, some of us may need to be reminded of such aforementioned changes. Not to worry, here’s a quick summary that closely analyzes the changes to Canada’s housing rules, now in effect: Extending a “mortgage rate stress test” to all insured mortgages in order to ensure affordability. Launching “consultations on lender risk sharing” in order to limit the governments financial obligations if there just so happens to be a surplus of mortgage defaults. Implementing new restrictions on when the government “will provide insurance for low-ratio mortgages”. New rules that have been put in place regarding the “primary residence capital gains exemption” and how you – as a seller of your primary residence – are now obligated to report the details of the sale to the CRA. If you’d like to read up on more information about each housing rule, The Globe and Mail published an article that outlines the four most prevalent changes in more detail. Good news for First Time Home Buyers Furthermore, and in light of all these recent changes to our housing market, it had been announced in 2016 that our land transfer tax rebate program for first time home buyers would be doubling (from $2000 to $4000) as of this month, January 2017. So now that this program is in full effect, it comes as great news for those who are looking to purchase their first home. Buyers who purchase a property in the next few months will no longer be required to pay a land transfer tax on the first $386,000 of the cost of their homes. Needless to say, there is an ample amount of new information that is to be discovered this New Year as it is extremely relevant to current and future home buyers. It’s important that we become well aware of the details of these new changes and new rules, as well as the logic behind such recent changes. Your real estate representative and mortgage broker are a great resource for the latest information. If you have questions or you would like to speak with a real estate professional about how these new housing rules will impact your next real estate transaction please contact us at info@teamrealty.ca. We are here to help! The post Canada’s Housing Rules in Full Swing appeared first on Team Realty. Source: Blog

Your Home and Winter Travels

January is often a time to make travel plans. In fact, the winter months are quite possibly the most traveled; holiday visits to family members aside, some of us just simply need to get away and enjoy a little warmth in the sunny south. So if all the shoveling, ice scraping and bundling has got you down, it might be time for you to pack those bags! With all the excitement of travel plans, we mustn’t forget to consider the safety of our homes. Especially for “snowbirds”, there are periods of time where we might not be home for weeks at a time. As part of travel preparation, we should make certain that our homes are safe while we are away. It’s important to keep a few significant safety precautions front of mind when planning out your getaways, beyond the routine locking of your doors. Creating the illusion that someone is home is key. A few tips to keep your home safe while away: Set your lights on a timer so that your home is never in complete darkness. “You can also set the television and radio on a timer to create the typical noise and flickering lights of an average family home at night”. Arrange for a snow removal. Whether it’s a neighbour, a close friend or a snow removal service, this is an important part of keeping up the illusion that someone is home. Have someone check your mailbox regularly. An alternative to this would be to forward your mail. Canada Post has mail forwarding programs so that, if you’re away from your home for long periods of time, you can “rest easy, knowing you’re not missing important mail”. Invite a close friend or family member stay at your home while you are on vacation. Especially if you have pets, if you have someone you absolutely trust, this can be an awesome way to keep your home safe and save money on kennel or animal boarding. Traveling over the winter months should be something that you look forward to, stress-free (at all costs); and it’s doable if you plan accordingly and are diligent in taking the necessary precautions toward safeguarding your home. Happy travels! The post Your Home and Winter Travels appeared first on Team Realty. Source: Blog

New Year Reno-Resolutions

A new year tends to go hand in hand with a New Year’s resolution (or two). We’ve all been there: eat healthier, get healthier, save more, sleep more etc. etc. So what about the expansions, the over-hauls, and/or the restorations of our current homes? Typically, there are a large handful of us who include home renovations in their list of New Year’s to-dos, and we’re not necessarily talking about the sporadic spring clean and/or the occasional winter prep; but, instead, the opportunity to really do something for the structural improvement and/or visual well-being of our homes. So where do you stand on the home renovation scale? Perhaps this is the year to make it a part of your resolution list. According to CMHC, “Ontarians spent an estimated $25 billion on renovations last year, a figure that the housing agency says is forecast to keep increasing in the coming years”. In a recent article, courtesy of CBC, these increases in home renovations are because “the housing market itself is booming, and most buyers typically undergo some sort of renovation job within the first 12 months after they buy”. And if you think that the above statistic is high, consider the fact that there are even more people who choose to renovate their homes years after they’ve moved in a settled. That’s an extremely large portion of us who, at one point in time or another, will work toward truly making their home their own. What are your go-to’s when prioritizing your reno projects? In the latest Statistics Canada poll, some of the most popular have been to upgrade your basement, to paint and/or wallpaper, to improve your heating and/or air conditioning, and to landscape your front and/or back yard. After all, the majority of homes that currently stand in the province of Ontario were constructed in the 1980s and are just about due for “a few licks of paint – or more”. Renovating your home can be a fun way to challenge yourself to complete a few projects around the completion of your home. As years come and go, so do design trends, your home’s structural stability, and even family members. Don’t be afraid to make your home feel like new – personalize it and make it your own! It’s never too late. The post New Year Reno-Resolutions appeared first on Team Realty. Source: Blog

Buying Old Versus New Properties – Pros and Cons

When buying any commodity, new is often better than used. In the housing market, though, your best opportunity can come from an old home or, as in Ottawa, where the inventory of new homes is overstocked, you may be able to purchase a new home for the same price buyers paid years ago. Here are some advantages and risks of both options. Advantages of Buying Old Properties you can physically walk through and inspect the home similar listings have sold or are currently available to use for comparative market analysis when establishing price antique homes appeal to a large group buyers, renters and investors builders and developers can try to maximize land value by subdividing investors can renovate the property to increase profitability do-it-yourself enthusiasts can invest sweat equity to reduce repair or upgrade costs Advantages of Buying New Properties they have all the latest technology and comply with the Ontario Building Code you can choose custom finishings rather than inheriting someone else’s choice new homes come with a warranty new properties are generally lower maintenance low energy ratings make them cheaper, reducing ongoing operating costs financing may be easier since builders often arrange mortgages as part of the sale for investors, tax depreciation benefits could reduce the holding costs of the property Risks and Concerns of Buying Old Properties existing properties can have structural or mechanical issues so check the age of major components and employ a building inspector to identify hidden concerns if you need repairs or upgrades, a building inspection will help during negotiations easements or caveats on the title may affect your plans for the property check ownership on title and vendor warranties to ensure a smooth closing if renovating or sub-dividing, make sure your plans comply with zoning regulations competing, emotional buyers can drive up property prices during negotiations or auctions Risks and Concerns of Buying New Properties risk of construction delays and possible cost overruns that increase the price you pay HST/GST on a new home, which adds to your costs in a new subdivision, little, if any, infrastructure exists similar properties, in the same area, may be slow to grow in value apartments in a recently zoned area could be in over-supply and tough to rent out beware of growth corridors because you could have a long wait for profits choose developers carefully and run background checks on associated parties The post Buying Old Versus New Properties – Pros and Cons appeared first on Team Realty. Source: Blog

Financing Your Home Purchase – Mortgage Broker or Bank?

When it comes time to purchase a new home, where should you go for financing? You may have a relationship with a bank from past transactions (RRSPs, savings accounts, car loan), so it’s the first option that comes to mind. But, mortgage brokers are licensed specialists who have access to many lenders and mortgage rates, so they may be a better choice. Here are some pros and cons for each. Advantages of Mortgage Brokers do all the negotiating for you to find the lowest rate have knowledge of, and access to, the entire mortgage market have exclusive deals not available on the open market buy large quantities of mortgage products, so they can pass on volume discounts their commission is paid by the mortgage lender can advise which lenders will consider your case and which will not (useful for people with poor credit ratings) have access to lenders who specialize in servicing people with poor credit can sometimes negotiate a better interest rate or lower application fee from the lender may pay for inspections or appraisals to close the deal (they get less commission but gain word of mouth advertising and potential client loyalty) are highly mobile and flexible so they can meet in person, when and where you want work for themselves so they are not aligned to one institution Disadvantages of Mortgage Brokers some people are uncomfortable with a less familiar option first-time home buyers would not have pre-existing relationships with them lenders that offer good rates are often smaller, with unfamiliar names and reputations greater flexibility may lead to a mortgage you cannot actually afford (more risk) Advantages of Banks can combine services at the bank you’ve worked with, and learned to trust can meet face to face, on your own time, even at your home may have lower closing costs because they’ll pay for some of the costs sometimes they pay the appraisal fee can give you perks within the bank like waiving account or safety deposit box fees have home equity lines of credit loan officers are paid salary, commission or salary plus commission by the bank easier to make mortgage or line of credit changes if all products are with one bank Disadvantages of Banks can only access and offer their own rates and products often their rates are not as good as a mortgage broker’s rates only give discounts on their posted rates if you ask if your credit score is poor, they might not take you on you have to be able to negotiate or you’ll only get the standard deal with no extras you spend time and effort “shopping” for a good rate you may overlook the best rate The post Financing Your Home Purchase – Mortgage Broker or Bank? appeared first on Team Realty. Source: Blog

Time To Get Out The Spring Maintenance Checklist

In Ottawa, there are two sights that remind homeowners it’s time for spring maintenance: bikes on the road and geese in the sky. With the recent double-digit temperatures, it seems spring has won its annual wrestling match with winter. And, as spring fever sets in, you may want to store your parka and get at those spring maintenance chores. A great place to start is making sure the melting snow and runoff flows freely off your roof and away from your home instead of seeping in or collecting at the foundation. Improper drainage can cause problems like foundation flooding, soil erosion, water in the basement or leaks in the attic crawl space. Water damage is an expensive nightmare every homeowner wants to avoid. Here are some tips to take advantage of the weather and get a head start on spring. The Roof System A record-breaking snowfall dropped over 50 cm one February day, so Ottawa homeowners are well advised to perform a roof inspection in case the sheer weight of the snow caused damage. Depending on moisture content, snow weighs about 1.25 lbs/sq ft for each inch of depth, so 50 cm is a heavy load. Avoid a dangerous climb and use binoculars to survey the roof. Identify damaged shingles, soffits, fascia and flashing. If the roof is metal, check for corrosion. Inside the house, check the attic and roof deck for any structural deformations. Examine walls and ceilings for water stains or cracks. Nature can leave more garbage in spring than in fall, so gutter cleaning is high priority. Clear all debris from eaves troughs and downspouts. Check for water stains, especially under eaves and near gutter downspouts. Water stains can mean that your gutters are not containing the roof runoff and they should be repaired or replaced. Make sure downspouts drain away from your home’s foundation. If necessary, add extensions to carry water at least 3 to 4 feet away. If you have a masonry chimney, check the joints between bricks or stones for signs of water infiltration. Also, look for efflorescence which indicates groundwater is “wicking” into the masonry and it could need replacement. The Foundation Unblock the drainage paths around your home so the snow melt flows away from your foundation. Open access to sewer drains that are on the street in front of your property. Check inside the basement, inspecting the walls for evidence of a leaking foundation. If your home is on a slope, you may need to install a sump pump or an exterior drain pipe leading away from the foundation. Smooth low areas in the yard or near the foundation with compacted soil. Spring rains can cause yard flooding, which can lead to foundation flooding and costly damages. Also, when water collects in these depressions in summer, it creates a perfect breeding ground for insects. Although winter may still rear its blustery head, you’ll be happy you switched to spring fever mode and started the chores. The post Time To Get Out The Spring Maintenance Checklist appeared first on Team Realty. Source: Blog

Why Appreciate Your Real Estate Agent