Winterizing Your Yard

Winterizing your home for the cold snap is one thing; winterizing your yard, however, is another. And as much as most of us would like to avoid prepping our yards for the inevitable cold that is to come, it’s something that’s simply unavoidable – especially if we’re looking to save both time and energy when spring and summer rolls around next year. Rest assured, however, winterizing your yard is not as complex as most of us may think it is, in fact, it’s actually quite simple. We’ve provided a list of ways below that will help you and your family maintain the quality of your yard, regardless of how cold it gets this winter: Move your hoses into a shed or a garage: It’s advised that we unhook and empty out all the water in our hoses and store them in a warmer place (for example, in your shed or in your garage). You certainly don’t want to leave your hose out in the cold as they can “suffer from [the cold’s] exposure” – a common misconception that can lead to us having to replace them more frequently. Take care of your BBQ and its grills: If you have either of these installed in your backyard, make sure that you move them indoors before winter hits. A garage, storage shed, or storage unit works great for your BBQ when they’re not in use. Keep in mind that your propane tanks stay outdoors – we wouldn’t want you putting your home and your family in danger! Tear down your lawn furniture and its accessories: Sturdier lawn furniture (wrought iron, for example) can be left covered outdoors over the winter months. If, however, your furniture set is less sturdy and/or plastic, it might be a good idea to bring it indoors – cushions too! A helpful hint: give your set a good cleaning before putting it away, it’ll save you some hassle come spring/summer. Prepare your swimming pool: “Winterizing your swimming pool protects it from damage due to the water freezing and keeps it clean for the next swimming season”. You’ll want to check the water chemistry, the alkalinity, the calcium hardness, and the chlorine levels in addition to covering your pool to avoid winter “debris”. To read an extended version of this article, follow this link and learn more. All elements in/of your backyard should be given the proper care and attention they deserve before the cold snap of winter falls upon us. Follow these tips, make a check list – anything that will help you and your family prepare and preserve your backyard for the winter season. The post Winterizing Your Yard appeared first on Team Realty. Source: Blog

Using a Buyer’s Agent

Royal LePage offers optimal customer service in order to deliver the best possible results to its clientele. Contrary to the way real estate was (years ago when real estate brokerages represented only the seller), you now have the option of being represented by a buyer’s agent, who’s responsibility is to protect you, your family, and your best interests all while providing you with the essential information needed in order for you to make an informed decision when it comes time to buying a home. A buyer’s representative will locate the best homes that fit your needs. This will work in your favour, not only as a saver of time, but also in such a way that will deter you from those homes that just aren’t right for you. This said, among these suitable homes, research is done by your representative in order to foresee any potential issues that lie with the selected properties so that when it comes time to sign papers, your decision has been made in an informed manner. With a buyer’s agent, you will have someone to accompany you on showings, familiarize you and your family with the selected neighbourhoods and what they have to offer, assist you in securing your financing, and recommend appraisals as well as home inspections, among many additional trustworthy duties. Royal LePage offers some of the best commitment on the market, and our buyer’s representatives will thoroughly represent you throughout the entire home-buying process in order to make your experience with us a memorable one. The post Using a Buyer’s Agent appeared first on Team Realty. Source: Blog

Real Estate Update: Latest news in Ottawa Real Estate

As snow hits Ottawa, November sales slowed slightly, while “Condo sales continue to bolster Ottawa resale market“ Highlights: Ottawa condo market appears to be on the upswing 14,825 homes were sold in the first 11 months officially making 2016 a record breaking year for number of sales Average prices were up, $405,320 in the residential class, an increase of 6.5% over 2015. While these statistics are useful in establishing market trends they should not be used as an indicator that specific properties have increased or decreased in value. If you’re interested in a property evaluation or statistics for specific neighbourhoods please email info@teamrealty.ca or contact one of our offices, or professional real estate representatives, we would be delighted to assist. News Release from the Ottawa Real Estate Board: Condo sales continue to bolster Ottawa resale market OTTAWA, December 6, 2016 – Members of the Ottawa Real Estate Board sold 995 residential properties in November through the Board’s Multiple Listing Service® System, compared with 986 in November 2015, an increase of 0.9 per cent. The five-year average for November sales is 939. “After a few breakaway months, the Ottawa resale market has come back down with sales typical of November,” says new Ottawa Real Estate Board President, Rick Eisert. “The condo market appears to be on the rise now, a welcome change compared to earlier in the year, with sales coming in at 16.2 per cent higher than November 2015. Several factors could have contributed to this increase – inventory levels trending downwards, steady prices, or buyers affected by the newly changed mortgage rules.” November’s sales included 230 in the condominium property class, and 765 in the residential property class. The condominium property class includes any property, regardless of style (i.e. detached, semi-detached, apartment, townhouse, etc.), which is registered as a condominium, as well as properties which are co-operatives, life leases, and timeshares. The residential property class includes all other residential properties. “Year-to-date unit sales to the end of November have now surpassed all previous year-end totals,” explains Eisert. “This year has been an exceptional year for sales for Ottawa Real Estate Board Members, and the year isn’t even over yet. The cumulative days on market have shown a steady decline for the first six months of the year, then has shown the same steady increase, so that the cumulative days on market in November (105 days) essentially mirrored that of January (110 days).” The average sale price of a residential-class property sold in November in the Ottawa area was $405,320 an increase of 6.5 per cent over November 2015. The average sale price for a condominium-class property was $277,650, an increase of one per cent over November 2015. The Board cautions that average sale price information can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of all properties sold. “In the residential market the two most active price points were $300,000 to $399,999 and then $400,000-$499,999 for the month of November, accounting for 50.3 per cent of the market. The condominium market was most active in the $150,000 to $249,999 price range, accounting for 55.2 per cent of the market,” says Eisert. “In addition to residential and condominium sales, OREB Members have assisted clients with renting over 2,900 properties since the beginning of the year.” The post Real Estate Update: Latest news in Ottawa Real Estate appeared first on Team Realty. Source: Blog

The Perks of Buying a Home in the Winter

There is a great majority of people who think that winter is not the best time to shop for a home. Contrary to popular assumption however, buying a home over the winter months may, in fact, be something worth considering. Sure, there might arguably be less homes for you to choose from, but the sellers might also be more motivated – playing to your advantage. You see it’s likely that, “the sellers will want to get the deal closed, especially for tax purposes. It’s the end of the year and they want to tie up loose ends. This is an advantage for buyers, especially if there are points to negotiate”. What’s more is that a smaller selection of homes to choose from can save you and your family a lot of time, allowing for you to find a home you love much sooner. According to Realtor.com, “it may be simpler to view the handful of homes that are for sale in the winter and choose the one that best suits your needs”. In addition to having a smaller selection of homes, there are also less buyers – leaving you with much less competition. What a lot of winter buyers might also tell you is that by shopping for a home in the off-season, you’re able to gain full insight into how your future potential home will hold up in the colder months. It goes without saying that there are homes out there that tend to weaken in the cold – depending, of course, on the age of the home, the location of the home, and/or the build of the home among other factors. It’s best to check for cold drafts, functioning heat and water systems, as well as the quality of windows and weather stripping. Buying a home in the winter time might be favourable to you and your family. Though most of us may prefer to shop when the trees are in full bloom and the yards are trimmed and at their finest, a winter wonderland that’s filled with snow and decorated festively could also leave you feeling inspired. So perhaps treat yourself and your family this Christmas by buying yourselves the home of your dreams! The post The Perks of Buying a Home in the Winter appeared first on Team Realty. Source: Blog

Staging Your Home for Home Buyers Over the Holidays

Selling your home in the (often dreaded) winter months of November-January, can render itself to be quite difficult for some. And although, for the most part, we tend to agree that our homes are more “visibly appealing” – on the outside – in the spring and summer months, there are several perks to selling your home and making it quite charming – on the inside – for homebuyers around the holidays! We can all admit to sometimes going a little overboard with our holiday decorating from time to time – and if we’re not a person who does, we know of someone who will. However, if you’re looking to sell your home around this celebratory time of year, it might be a good idea to hold back on the decorating (just a little bit). With homes arguably looking their best around Christmas time, it’s easy to get carried away when trying to appeal to a buyer’s eye, but “adornments that are too large [or simply having too many of them] can crowd your home and, in fact, distract buyers”. When you think about it, being mindful of this particular change will encourage shoppers to still notice your home rather than what’s in it. Remember, simplicity is key. It’s also been advised by HGTV in their article on selling-tips for your home during the holidays, to avoid offending buyers by decorating your home with too many religious themed items. Instead, try “opting for general fall and winter décor”. Something else that you should certainly consider when prepping your home for buyers in the winter months is to stage it so that they can imagine themselves potentially living it. “Make your home feel cozy and inviting during showings by cranking up the heat, playing soft classical music and offering homemade holiday treats. When you encourage buyers to spend more time in your home, you also give them more time to admire its best features”. This form of staging, along with the initial steps of subtle decorating, opens up a great opportunity to take good quality photos/videos of your home in order to help in with selling process. It is very possible for homebuyers to gravitate toward the appearance of a home during the holiday season (just as much as they will come spring and summer) if you work toward making your home just the right amount of festive. If you need assistance in the staging process, don’t worry – most realtors will offer you help by referring you to a reliable, professional stager. We hope that you have a safe and memorable holiday season. Happy staging! The post Staging Your Home for Home Buyers Over the Holidays appeared first on Team Realty. Source: Blog

Costs on Your Home Over the Christmas Season: Trimming the Holiday Stress

Christmas is indeed a time for many things. It is time well spent with our families and our friends, a time for celebration, a time for passing down holiday traditions (as well as creating new ones); and, of course, with the end of year approaching, it is a time of reflection and resolution. Moreover, with the abundance of festivities that our communities offer over the holidays, it’s a time to try new things, and to collect memories with your loved ones. With the joys of Christmas comes, of course, the stresses of the season. It’s only natural. We host parties, allow for relatives to spend a night (or two), and typically spend a little more money on maintaining our homes, among other things. This said, it’s important to plan accordingly. One of the biggest factors that tend to impact our pocketbooks is our hydro usage. And with all the hustle and bustle that is the holiday season, we must be cautious with when and how often we use it. Luckily, Hydro One has set, off-peak hours (that include weekends and holidays) with set, off-peak prices. What this means is that on Christmas Day, on Boxing Day, and even on New Year’s Day, these off-peak prices, when you utilize your main hydro sources between 7:00 PM and 7:00 AM, will apply. Furthermore, being mindful of your guest’s access/usage of such amenities as cable and/or WiFi is also key. It’s important to be diligent with whom you share your passwords with, and cautious as to how often you turn on your television in order to entertain. Failure to keep track can result in a relatively hefty bill at the end of the month. Less money spent, and less stress to be had. With respect to controlling your stress levels over the holidays, there are several ways that you can host and entertain your guests inexpensively and effectively. To avoid the cable costs of perhaps always having the game on, why not host a movie night instead? There’s nothing like reminiscing over the classics that we all grew up with. Games are also a great way to create memories on a low budget. They allow for us to bond with our friends and our families, all while creating new traditions along the way. Want to transform your home into the winter wonderland you’ve always imagined? Tree-trimming parties are an excellent way to decorate your home for the holidays, and host an unforgettable evening filled with laughs and creativity. So turn on those catchy Christmas tunes that we all (secretly) admire and enjoy, sing aloud to the words you know and love, cook up some munchies and capture all that this holiday season has to offer. Lastly, and above all else, remember the importance of togetherness. Volunteer. Donate to your local charities. At Royal LePage, we are committed to strengthening the communities we live in – that’s why we have The Shelter Foundation – our very own charitable foundation that helps women and children escape from violence and rebuild their lives. Contributing to a good cause is another great way to alleviate added stress over the holidays. To find out how you can donate, follow this link. Have a safe and happy Christmas! The post Costs on Your Home Over the Christmas Season: Trimming the Holiday Stress appeared first on Team Realty. Source: Blog

Top Housing Trends of 2016

The year is coming to a rapid close, and – as comparable to most facets in our lives – we choose to reflect on the 12 months that have passed, and are committed to planning for the next dozen that is to come. In the exciting world of real estate, there are many trends that tend to surface with each passing year. In 2016, some of those trends were as follows: One of the most recent housing trends that we saw in 2016 (and arguably one of the most talked about) were the changes to Canada’s housing rules. Over the last several years, our government has been known to change the mortgage requirements on numerous occasions which has (and continues to) deeply affect anyone who, is not only looking to perhaps qualify for government-backed insured mortgages, but also those who may be looking to purchase their first home and/or are looking to refinance their existing mortgage. We needn’t be too concerned, however. According to Phil Soper, President and CEO of Royal LePage, “Nationally, our real estate markets remain healthy, with home values showing modest to strong (yet rational) price appreciation in almost every Canadian city … Even in the hardest hit oil patch regions, prices have held up well, with small single-digit declines, year-over-year”. With ample amounts of new information to be discovered, it’s important that we all continue to become familiar with the details of these changes as they are extremely relevant to current and future homebuyers. We’ve also seen a shift in the amount of homes for sale in the resale market vs. those that are for sale as new builds. In other words, over the past year, we’ve seen a rather lacking inventory in the resale market, and a major increase in the construction and interest of newer homes. According to the Canada Mortgage and Housing Corporation (CMHC), we currently stand at a record-breaking total of 14,014 homes sold in 2016, compared to an all-encompassing total of 13,129 homes sold in 2015. At this growth rate, it is predicted that homes sold in 2017 could reach 15,400. What’s interesting is that with new homes being built quite consistently across our City, inventory increases, and more people tend to buy. In fact, single home new builds have increased in sales by 8%, and townhomes by a whopping 57%. Of course, much of the focus of these aforementioned housing trends have been quite logistical; and, although these rules and these numbers are evidently quite important, we mustn’t discount the several design trends that 2016 has brought to the forefront of our interior décor. We’ve seen such trends surface as the bold pops of paint colour (thanks, Benjamin Moore!) to the purity of white kitchens, to rusticity of barn-board sliding doors. Moreover, according to real estate professionals, homebuyers have been relatively persistent in requesting open layouts, multigenerational floor plans, first-floor master suites (with large closets), and extra-large garages. 2016 was a big year for the housing market and, as a result, we saw some pretty impressive reports, results, and trends. For more information about the year in a glance, you can contact us! We’ll gladly inform you on what has shaped our unforgettable year. The post Top Housing Trends of 2016 appeared first on Team Realty. Source: Blog

Ottawa Real Estate Update: December 2016

2016 was a record breaking year for Ottawa real estate resales! 715 sales in December brought the total number of properties sold throughout the year through Board’s MLS® to 15,537, a 6% increase over 2015. With more properties selling over $500K December also had the highest average sale price ever recorded $420,750, considerably higher than the 2016 average sale price of $371,987. Information below from the Ottawa Real Estate Board’s Latest new’s release on January 5th, 2017. 2016 proves to be a record-breaking year for Ottawa resales OTTAWA, January 5, 2017 – Members of the Ottawa Real Estate Board sold 715 residential properties in December through the Board’s Multiple Listing Service® System, compared with 703 in December 2015, an increase of 1.7 per cent. The five-year average for December sales is 656. The total number of residential and condo units sold through the Board’s MLS® System throughout all of 2016 was 15,537, compared with 14,653 in 2015, an increase of six per cent. Separately, residential and condo unit sales each outperformed the 2015 numbers. “No matter what is said in the history books about 2016, it proved overall to be a great year for Ottawa real estate,” says Rick Eisert, 2017 President of the Ottawa Real Estate Board. “While prices remained fairly flat over the course of the year, the unit sales recorded in five separate months were the highest on record, including December. The spring market picked up early in April with strong sales and this trend continued well into the fall. The monthly unit sale performance in 2016 was often bolstered by a strengthened condo market which recorded increases over 2015 for much of the year.” December’s sales included 165 in the condominium property class, and 550 in the residential property class. The condominium property class includes any property, regardless of style (i.e. detached, semi-detached, apartment, stacked etc.), which is registered as a condominium, as well as properties which are co-operatives, life leases and timeshares. The residential property class includes all other residential properties. “The listing inventory for both residential and condos trended lower all year, however units sold trended higher most months, outpacing 2015 by a fair margin,” says Eisert. “Cumulative days on market increased to 123 days in December, while the average for the year stayed steady at 91 days. Average residential sale prices remained virtually unchanged over last year, however we are seeing an increase in December compared to 2015, which could be a result of a higher concentration of properties sold in the $500,000 and up range.” The average sale price of a residential-class property sold in December in the Ottawa area was $420,750, an increase of 8.7 per cent over December 2015. The average sale price for a condominium-class property was $262,698, an increase of 4.9 per cent over December 2015. The year-to-date numbers for average residential sale price in 2016 was $397,778, an increase of 1.5 per cent over 2015. While the average condominium sale price was $260,982, an increase of 0.4 per cent over 2015. The Board cautions that average sale price information can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of all properties sold. “Looking at the whole year, the two most active price points in the residential market were $300,000 to $399,999 and then $200,000-$299,999, accounting for 54.6 per cent of the market. While the condominium market was most active in the $150,000 to $249,999 price range, accounting for 55.4 per cent of the market,” says Eisert. “In addition to residential and condominium sales in 2016, OREB Members have assisted clients with renting 3,053 properties, the sale of 19 farms units, and the sale of 340 commercial properties.” The post Ottawa Real Estate Update: December 2016 appeared first on Team Realty. Source: Blog

Canada’s Housing Rules in Full Swing

Happy New Year, folks! 2017 has finally arrived, and for the real estate world, change is in sight. As most of us already know, 2016 brought forth a lot of chatter about several significant changes (decided upon by our government) toward our country’s mortgage and housing rules. Those who will primarily be affected by these implementations will be anyone who, is not only looking to perhaps qualify for government-backed insured mortgages, but also those who may be looking to purchase their first home and/or are looking to refinance their existing mortgage. Having said that, the Government of Canada has been known to make multiple changes to our mortgage requirements in years past which, in turn, reassures us all that there is nothing to be too concerned about. In fact, we are reminded of what Royal LePage President and CEO, Phil Soper had to say about our real estate markets in a recent interview: “Nationally, our real estate markets remain healthy, with home values showing modest to strong (yet rational) price appreciation in almost every Canadian city … Even in the hardest hit oil patch regions, prices have held up well, with small single-digit declines, year-over-year”. We understand that, though the New Year has only just begun, some of us may need to be reminded of such aforementioned changes. Not to worry, here’s a quick summary that closely analyzes the changes to Canada’s housing rules, now in effect: Extending a “mortgage rate stress test” to all insured mortgages in order to ensure affordability. Launching “consultations on lender risk sharing” in order to limit the governments financial obligations if there just so happens to be a surplus of mortgage defaults. Implementing new restrictions on when the government “will provide insurance for low-ratio mortgages”. New rules that have been put in place regarding the “primary residence capital gains exemption” and how you – as a seller of your primary residence – are now obligated to report the details of the sale to the CRA. If you’d like to read up on more information about each housing rule, The Globe and Mail published an article that outlines the four most prevalent changes in more detail. Good news for First Time Home Buyers Furthermore, and in light of all these recent changes to our housing market, it had been announced in 2016 that our land transfer tax rebate program for first time home buyers would be doubling (from $2000 to $4000) as of this month, January 2017. So now that this program is in full effect, it comes as great news for those who are looking to purchase their first home. Buyers who purchase a property in the next few months will no longer be required to pay a land transfer tax on the first $386,000 of the cost of their homes. Needless to say, there is an ample amount of new information that is to be discovered this New Year as it is extremely relevant to current and future home buyers. It’s important that we become well aware of the details of these new changes and new rules, as well as the logic behind such recent changes. Your real estate representative and mortgage broker are a great resource for the latest information. If you have questions or you would like to speak with a real estate professional about how these new housing rules will impact your next real estate transaction please contact us at info@teamrealty.ca. We are here to help! The post Canada’s Housing Rules in Full Swing appeared first on Team Realty. Source: Blog

Your Home and Winter Travels

January is often a time to make travel plans. In fact, the winter months are quite possibly the most traveled; holiday visits to family members aside, some of us just simply need to get away and enjoy a little warmth in the sunny south. So if all the shoveling, ice scraping and bundling has got you down, it might be time for you to pack those bags! With all the excitement of travel plans, we mustn’t forget to consider the safety of our homes. Especially for “snowbirds”, there are periods of time where we might not be home for weeks at a time. As part of travel preparation, we should make certain that our homes are safe while we are away. It’s important to keep a few significant safety precautions front of mind when planning out your getaways, beyond the routine locking of your doors. Creating the illusion that someone is home is key. A few tips to keep your home safe while away: Set your lights on a timer so that your home is never in complete darkness. “You can also set the television and radio on a timer to create the typical noise and flickering lights of an average family home at night”. Arrange for a snow removal. Whether it’s a neighbour, a close friend or a snow removal service, this is an important part of keeping up the illusion that someone is home. Have someone check your mailbox regularly. An alternative to this would be to forward your mail. Canada Post has mail forwarding programs so that, if you’re away from your home for long periods of time, you can “rest easy, knowing you’re not missing important mail”. Invite a close friend or family member stay at your home while you are on vacation. Especially if you have pets, if you have someone you absolutely trust, this can be an awesome way to keep your home safe and save money on kennel or animal boarding. Traveling over the winter months should be something that you look forward to, stress-free (at all costs); and it’s doable if you plan accordingly and are diligent in taking the necessary precautions toward safeguarding your home. Happy travels! The post Your Home and Winter Travels appeared first on Team Realty. Source: Blog

New Year Reno-Resolutions

A new year tends to go hand in hand with a New Year’s resolution (or two). We’ve all been there: eat healthier, get healthier, save more, sleep more etc. etc. So what about the expansions, the over-hauls, and/or the restorations of our current homes? Typically, there are a large handful of us who include home renovations in their list of New Year’s to-dos, and we’re not necessarily talking about the sporadic spring clean and/or the occasional winter prep; but, instead, the opportunity to really do something for the structural improvement and/or visual well-being of our homes. So where do you stand on the home renovation scale? Perhaps this is the year to make it a part of your resolution list. According to CMHC, “Ontarians spent an estimated $25 billion on renovations last year, a figure that the housing agency says is forecast to keep increasing in the coming years”. In a recent article, courtesy of CBC, these increases in home renovations are because “the housing market itself is booming, and most buyers typically undergo some sort of renovation job within the first 12 months after they buy”. And if you think that the above statistic is high, consider the fact that there are even more people who choose to renovate their homes years after they’ve moved in a settled. That’s an extremely large portion of us who, at one point in time or another, will work toward truly making their home their own. What are your go-to’s when prioritizing your reno projects? In the latest Statistics Canada poll, some of the most popular have been to upgrade your basement, to paint and/or wallpaper, to improve your heating and/or air conditioning, and to landscape your front and/or back yard. After all, the majority of homes that currently stand in the province of Ontario were constructed in the 1980s and are just about due for “a few licks of paint – or more”. Renovating your home can be a fun way to challenge yourself to complete a few projects around the completion of your home. As years come and go, so do design trends, your home’s structural stability, and even family members. Don’t be afraid to make your home feel like new – personalize it and make it your own! It’s never too late. The post New Year Reno-Resolutions appeared first on Team Realty. Source: Blog

Buying Old Versus New Properties – Pros and Cons

When buying any commodity, new is often better than used. In the housing market, though, your best opportunity can come from an old home or, as in Ottawa, where the inventory of new homes is overstocked, you may be able to purchase a new home for the same price buyers paid years ago. Here are some advantages and risks of both options. Advantages of Buying Old Properties you can physically walk through and inspect the home similar listings have sold or are currently available to use for comparative market analysis when establishing price antique homes appeal to a large group buyers, renters and investors builders and developers can try to maximize land value by subdividing investors can renovate the property to increase profitability do-it-yourself enthusiasts can invest sweat equity to reduce repair or upgrade costs Advantages of Buying New Properties they have all the latest technology and comply with the Ontario Building Code you can choose custom finishings rather than inheriting someone else’s choice new homes come with a warranty new properties are generally lower maintenance low energy ratings make them cheaper, reducing ongoing operating costs financing may be easier since builders often arrange mortgages as part of the sale for investors, tax depreciation benefits could reduce the holding costs of the property Risks and Concerns of Buying Old Properties existing properties can have structural or mechanical issues so check the age of major components and employ a building inspector to identify hidden concerns if you need repairs or upgrades, a building inspection will help during negotiations easements or caveats on the title may affect your plans for the property check ownership on title and vendor warranties to ensure a smooth closing if renovating or sub-dividing, make sure your plans comply with zoning regulations competing, emotional buyers can drive up property prices during negotiations or auctions Risks and Concerns of Buying New Properties risk of construction delays and possible cost overruns that increase the price you pay HST/GST on a new home, which adds to your costs in a new subdivision, little, if any, infrastructure exists similar properties, in the same area, may be slow to grow in value apartments in a recently zoned area could be in over-supply and tough to rent out beware of growth corridors because you could have a long wait for profits choose developers carefully and run background checks on associated parties The post Buying Old Versus New Properties – Pros and Cons appeared first on Team Realty. Source: Blog

Financing Your Home Purchase – Mortgage Broker or Bank?

When it comes time to purchase a new home, where should you go for financing? You may have a relationship with a bank from past transactions (RRSPs, savings accounts, car loan), so it’s the first option that comes to mind. But, mortgage brokers are licensed specialists who have access to many lenders and mortgage rates, so they may be a better choice. Here are some pros and cons for each. Advantages of Mortgage Brokers do all the negotiating for you to find the lowest rate have knowledge of, and access to, the entire mortgage market have exclusive deals not available on the open market buy large quantities of mortgage products, so they can pass on volume discounts their commission is paid by the mortgage lender can advise which lenders will consider your case and which will not (useful for people with poor credit ratings) have access to lenders who specialize in servicing people with poor credit can sometimes negotiate a better interest rate or lower application fee from the lender may pay for inspections or appraisals to close the deal (they get less commission but gain word of mouth advertising and potential client loyalty) are highly mobile and flexible so they can meet in person, when and where you want work for themselves so they are not aligned to one institution Disadvantages of Mortgage Brokers some people are uncomfortable with a less familiar option first-time home buyers would not have pre-existing relationships with them lenders that offer good rates are often smaller, with unfamiliar names and reputations greater flexibility may lead to a mortgage you cannot actually afford (more risk) Advantages of Banks can combine services at the bank you’ve worked with, and learned to trust can meet face to face, on your own time, even at your home may have lower closing costs because they’ll pay for some of the costs sometimes they pay the appraisal fee can give you perks within the bank like waiving account or safety deposit box fees have home equity lines of credit loan officers are paid salary, commission or salary plus commission by the bank easier to make mortgage or line of credit changes if all products are with one bank Disadvantages of Banks can only access and offer their own rates and products often their rates are not as good as a mortgage broker’s rates only give discounts on their posted rates if you ask if your credit score is poor, they might not take you on you have to be able to negotiate or you’ll only get the standard deal with no extras you spend time and effort “shopping” for a good rate you may overlook the best rate The post Financing Your Home Purchase – Mortgage Broker or Bank? appeared first on Team Realty. Source: Blog

Time To Get Out The Spring Maintenance Checklist

In Ottawa, there are two sights that remind homeowners it’s time for spring maintenance: bikes on the road and geese in the sky. With the recent double-digit temperatures, it seems spring has won its annual wrestling match with winter. And, as spring fever sets in, you may want to store your parka and get at those spring maintenance chores. A great place to start is making sure the melting snow and runoff flows freely off your roof and away from your home instead of seeping in or collecting at the foundation. Improper drainage can cause problems like foundation flooding, soil erosion, water in the basement or leaks in the attic crawl space. Water damage is an expensive nightmare every homeowner wants to avoid. Here are some tips to take advantage of the weather and get a head start on spring. The Roof System A record-breaking snowfall dropped over 50 cm one February day, so Ottawa homeowners are well advised to perform a roof inspection in case the sheer weight of the snow caused damage. Depending on moisture content, snow weighs about 1.25 lbs/sq ft for each inch of depth, so 50 cm is a heavy load. Avoid a dangerous climb and use binoculars to survey the roof. Identify damaged shingles, soffits, fascia and flashing. If the roof is metal, check for corrosion. Inside the house, check the attic and roof deck for any structural deformations. Examine walls and ceilings for water stains or cracks. Nature can leave more garbage in spring than in fall, so gutter cleaning is high priority. Clear all debris from eaves troughs and downspouts. Check for water stains, especially under eaves and near gutter downspouts. Water stains can mean that your gutters are not containing the roof runoff and they should be repaired or replaced. Make sure downspouts drain away from your home’s foundation. If necessary, add extensions to carry water at least 3 to 4 feet away. If you have a masonry chimney, check the joints between bricks or stones for signs of water infiltration. Also, look for efflorescence which indicates groundwater is “wicking” into the masonry and it could need replacement. The Foundation Unblock the drainage paths around your home so the snow melt flows away from your foundation. Open access to sewer drains that are on the street in front of your property. Check inside the basement, inspecting the walls for evidence of a leaking foundation. If your home is on a slope, you may need to install a sump pump or an exterior drain pipe leading away from the foundation. Smooth low areas in the yard or near the foundation with compacted soil. Spring rains can cause yard flooding, which can lead to foundation flooding and costly damages. Also, when water collects in these depressions in summer, it creates a perfect breeding ground for insects. Although winter may still rear its blustery head, you’ll be happy you switched to spring fever mode and started the chores. The post Time To Get Out The Spring Maintenance Checklist appeared first on Team Realty. Source: Blog

Why Appreciate Your Real Estate Agent

When you decide to buy your first home, the initial excitement is often quickly followed by fear of the unknown. After viewing many attractive properties online, you have no idea where to start. Eventually, though, with the invaluable assistance of a real estate agent, you can purchased your dream home at a great price. Those who have experienced a number of property transactions realize just how many reasons they have to be thankful for the trusting relationship they developed with their agent. First, the money and time you save far exceeds the agent’s commission. From planting the For Sale sign to closing the sale, here are five more reasons to appreciate real estate agents. They’ll help get your house ready to sell A good listing agent acts as project manager in prepping your home for sale. They take on the burden of staging, advise on repairs, arrange photography and advertising, provide contacts, schedule open houses or viewings and provide feedback, all of which reduces the drama during a stressful time. “For sale by owner” means you advertise, solicit calls, answer questions, make appointments and rush home from work in time to find … no one shows up. They know how busy you are with the other parts of your life A good agent understands you have responsibilities outside your real estate transaction and will make life easier by accommodating your schedule. She will take your late night call, discuss your concerns and support your decision NOT to move ahead with a deal. For example, one buyer signed an offer that his agent brought to the soccer field where he was coaching his kids. They have access to opportunities because they’re well-connected Often, deals succeed because of the networks and relationships forged over time by a good agent. Well-connected agents can help you find off-the-market properties, arrange a speedy inspection or get your offer the attention it needs in a competitive bidding situation due to their contacts with bankers, contractors, inspectors and other deal-makers. They understand that negotiating is a tricky business An agent can represent you in tough negotiations and prevent things from getting too personal. As a buyer, this puts you in a better position to get the house you want and, as a seller, allows you to avoid the irritation of penny-pinching or insulting (to you) offers. Agents smooth things to keep negotiations going, whereas direct negotiations are easily sidetracked by emotions. They know about real estate contracts and conditions You may be intimidated, initially, by the paperwork, especially the Offer to Purchase. However, a real estate agent completes the same contracts and conditions on a regular basis, so they are familiar with which conditions to use, when they can safely be removed and how to use the contract to protect their clients, whether buying or selling. Even better, they spend the time to educate you at every step. The post Why Appreciate Your Real Estate Agent appeared first on Team Realty. Source: Blog

5 must-do’s for first-time home buyers

This homeownership.ca article by real estate lawyer Mark Weisleder gives the essentials for the novice buyer. Start by calculating what you can afford (general rule is 30% of gross income). Then, figure out what is important to you and search for properties with those features. Ask the seller about flooding, leaks, mould, insurance claims and neighbourhood problems. Pay for a thorough home inspection by a qualified inspector and buy an after-sale warranty. To read more click here. The post 5 must-do’s for first-time home buyers appeared first on Team Realty. Source: Blog

Boost Your Curb Appeal with 4 Doable DIY Projects

Most sellers realize that preparing the interior of their homes for viewing is essential. In this article, Bob Villa explains it is just as important to stage the exterior of your house as it is to prepare the inside rooms when you are selling. For example, a clean, well-maintained yard will signal that you have taken care of the property during your time as owner. Power washing the garage door, driveway and fences will add to that impression. If you are upgrading the paint, determine whether accent painting (shutters, columns, etc.) or a whole-house job is required. And, use traditional colours (classic white, creamy off-white, warm taupe, blue-gray, or pale yellow) that appeal to the greatest number of potential buyers. A lush, colourful garden, potted plants, manicured shrubs and window boxes will help you make a memorable first impression. Improving the entrance can be as simple as adding a distinctive mailbox or sophisticated numbers. but you might also consider new doors or fixtures. To read more click here. The post Boost Your Curb Appeal with 4 Doable DIY Projects appeared first on Team Realty. Source: Blog

The Number of Real Estate Appraisers Is Falling. Here’s Why You Should Care

According to this realtor.com post, the number of real estate appraisers is dropping to the point where parties on both sides of real estate transactions could suffer. Since most residential mortgages need an appraisal before a sale closes, a shortage of appraisers will affect buyers, who rely on accurate valuations to structure their offer, and sellers, who can lose a deal if appraisals come in low. The Appraisal Institute notes the number of appraisers has dropped 20% since 2007 and predicts a 3% annual decline for the next decade. Fewer appraisers means longer waits, which could delay a closing. That delay means that buyers (borrowers) might have to pay for longer mortgage rate locks and sellers, who need the equity from the sale to purchase their next home, might miss opportunities to bid. A shortage also means appraisals will likely cost more. Even worse, there could be quality issues as appraisers work outside areas where they are geographically competent; they could miss nuances of the unfamiliar market. To read more click here. The post The Number of Real Estate Appraisers Is Falling. Here’s Why You Should Care appeared first on Team Realty. Source: Blog

Unchecked Emotions Can Cause Costly Property Mistakes

We are sometimes enthralled by the presentation of a property, but ignoring the things we cannot see or overlooking obvious problems and risks can lead to disastrous consequences. To the extent possible, put your emotions aside and make buying property a business decision based facts and data. Getting Too Attached To A Property Impulse decisions in real estate can cost major dollars and can have life altering effects. If you fall in love with a house, you may be tempted to waive conditions or pay more than planned in the rush to close the deal. The problem is, when we get too emotionally attached, we keep altering our “walk away” price to the point where it doesn’t exist. Set a threshold and when you past it, walk away. Knowing What You Can Afford It’s important to put optimism aside and truly understand your financial position, now and in the future, so you don’t overextend yourself. Life changes (unexpected bills, children, rising interest rates, unemployment) will affect your cash position, so you need to know what you can afford. Meet with your financial adviser to establish your budget before entering the market and stick to the plan. Being Tempted By Cheap Properties Cheap properties may seem attractive, but they usually come with risks. Chant the maxim, “if it’s too good to be true, it’s too good to be true,” when considering these properties. Then, find out why the property is listed at such a low price. In these instances, vendors may be desperate to offload their properties because of serious concerns like structural flaws or pest infestations. Finally, decide if you will accept these concerns in return for the cheap price. Understanding Property Negotiations Most sellers have some built-in buffer for negotiations, so the key is finding the lowest price at which the vendor is willing to sell. But, it can be difficult to remain logical during negotiations since you’re bidding on properties you really like. An attitude of indifference is likely to secure a better price than if you appear anxious. And, never allow your emotions to interfere and become insulted by the seller’s position or counter offers. They are trying to get the best deal they can, just as you are. The post Unchecked Emotions Can Cause Costly Property Mistakes appeared first on Team Realty. Source: Blog

Here’s What Pushes People to Buy Homes in 2015

If you want to sell your property quickly, at near the asking price, it is important to know why people are buying. In this post, Realtor.com chief economist, Jonathan Smoke, suggests we pay attention to the five main triggers for home buyers: they have grown tired of their home and want a change, interest rates are exceptionally low, housing prices are favourable in many markets, they need or want more living space and they have the money to spend. To read more click here. The post Here’s What Pushes People to Buy Homes in 2015 appeared first on Team Realty. Source: Blog

Canadian Home Prices Are Growing At One Of The Fastest Paces In The World

The Canadian real estate market continues to boom, according to this Financial Post offering. With a year-over-year increase of 8.2%, Canada ranked 4th of the 23 countries studied in Scotiabank’s report Global Real Estate Trends, behind Ireland (13.3%), Sweden (10.5%) and Australia (8.3%). However, the report warns the trend could change if economic uncertainty and high unemployment counterbalance the attraction of low borrowing costs. To read more click here. The post Canadian Home Prices Are Growing At One Of The Fastest Paces In The World appeared first on Team Realty. Source: Blog

5 tips for eco-friendly renovations

If you are renovating, you should consider the green strategies suggested in this realestate.com post by Danielle King. For example, add insulation to the roof and external walls and you could save 25% on energy costs. Replace inefficient windows or add window film since up to 40% of your heating can be lost through windows in winter. Energy efficient appliances, LED lighting and solar panels will also contribute savings, while protecting the environment. Implement water collection techniques to use rainwater for toilets and the garden. Include water efficient faucets and showerheads. Add high-flow taps that make baths and washing machines fill quickly. Use low/no Voltatile Organic Compound (VOC) materials where possible, and non-toxic paints.to read more click here. The post 5 tips for eco-friendly renovations appeared first on Team Realty. Source: Blog

8 Mistakes That Could Screw Up Your Home Sale

Usually we hear “buyer beware”, but real estate author Michael Corbett advises sellers to beware and gives 8 reasons why in this trulia.com post. Always work with professional help, including a real estate agent. Their expertise, experience, neighbourhood knowledge and resources will help you plot a course through the selling process. Overpricing is a temptation to be avoided since most buyers are savvy and have the advice of an agent. Ensure that you use high quality photos because 90% of buyers shop for home online. Complete repairs like leaky faucets before listing your home to avoid negotiations over what the repairs will cost potential buyers. Spend time cleaning and removing clutter since untidiness makes your home seem smaller. Stage your backyard as if it were another room and maintain the landscape so it appeals to your viewers, especially in summer and fall when we enjoy outdoor activities. Disclose all information including issues that may jeopardize a sale to avoid liability after the sale. Finally, remember this is a business deal and emotions can get in the way. A low ball offer is an opportunity to negotiate, not a reason to be insulted. To read more click here. The post 8 Mistakes That Could Screw Up Your Home Sale appeared first on Team Realty. Source: Blog

What’s the best property type for your first home?

Inexperience can cause first time home buyers to be confused by the multitude of available options. This post by Caroline James is an excellent introduction to the advantages and disadvantages of five popular property choices: a large detached house on a suburban block, a small home on a sub-divided lot, a townhouse, an apartment in a small block and an apartment in a high rise block. To read more click here. The post What’s the best property type for your first home? appeared first on Team Realty. Source: Blog

Is It Time to Downsize? Ask Yourself These 4 Questions First

If you’ve reached the time of life where you are contemplating downsizing your home, the first question to ask, according to this Realto.com post, is what kind of lifestyle do you want after downsizing? By defining how you want to live, you can narrow your search and focus on housing that will meet those requirements. For example, if you want to escape the bluster of winter and relax on a beach, local climate conditions and geography will drive your hunt. Or, if you like social activities, you would seek active adult communities where you can interact with like-minded people. The next step is to consider the financials by asking what will you budget look like? After that, ask yourself if you have enough equity in your home to make a profit. If you have enough equity, you can buy your next home outright or bring a sizable down payment on closing day. Finally, ask if you will be able to find another home that’s affordable in a seller’s market. For those with some financial clout, realtor Debra Whitfield recommends using an equity line of credit on your current home or a home equity conversion mortgage to buy your next home, before selling your current property. That gives you time to find a suitable property instead of being rushed to select whatever happens to be on the market after your house is sold. To read more click here. The post Is It Time to Downsize? Ask Yourself These 4 Questions First appeared first on Team Realty. Source: Blog

Why Homeowners Should Beware of Icicles

Ottawa’s freeze-thaw weather patterns often create sparkling icicles that look magical. But, they actually identify a dangerous — and potentially costly — hazard, an ice dam. Imagine coming home from work to find water streaming down your interior walls and soaking into the hardwood of your foyer. What would you do? What Is An Ice Dam After frantically tracing the flow, you would find that a pool of water had formed behind a thick ridge of ice in the gutters – hence the term ice dam. Snow on the roof had been melted by heat loss, causing water to collect behind the dam. And, the water was seeping through the shingles and into the house exposing it to significant potential damages. After calling three roofing companies and getting no answer, you climb up a ladder to the second level, stand on a stool at a precarious angle, hold the gutter for support with one hand and use the other to smash the ice with a hammer. Eventually, you clear the dam but not before almost sliding off the roof … twice. How To Remove An Ice Dam Luckily, in this hypothetical case, there was only minor water damage, but the do-it-yourself approach was very risky and you did bend the gutter. Homeowners experiencing the effects of an ice dam — or those worried about a leak — should hire a professional roofing company to remove any ice buildup and assess for further preventive measures. Safe removal of snow and ice should be accomplished by qualified technicians, who are fully trained in fall-arrest prevention, use the appropriate safety gear and equipment and have full insurance coverage. Instead of using hammers, chisels and salt, they will steam away the ice and remove excess snow with rakes designed for the purpose. How To Avoid Ice Dams To prevent ice dams, you must keep heat from reaching the roof, so the snow won’t melt in the first place. That goal is accomplished by insulating and ventilating the attic space to maintain the roof surface at, or near, outdoor temperatures. Any breach into the attic from the heated living space needs to be insulated. For homes with finished attics, this may involve opening up the ceiling. Periodically check your roof for snow coverage because the snow’s weight alone, which should not exceed 20 to 25 lbs/sq ft, can cause damage. Depending on moisture content, snow weighs about 1.25 lbs/sq ft for each inch of depth, so 20 inches is a considerable burden. And, if you see icicles, investigate further. Professional roofers can provide accurate measurements, remediation or maintenance on a scheduled or as-needed basis. The post Why Homeowners Should Beware of Icicles appeared first on Team Realty. Source: Blog

Congratulations to our Award Winners

At Royal LePage Team Realty helping YOU is what we do and we couldn’t do that without a dedicated network of real estate professionals. We would like to take this opportunity to congratulate our 2015 Award winners and thank them for their hard work and dedication. We are so proud to work with those who consistently go above and beyond to ensure their clients are provided with excellent real estate service. Looking forward to an awesome 2016! jQuery(document).ready(function($) { var mpImageSlider = $(“.motopress-image-slider-obj#56e5df6483fc4”); if (mpImageSlider.data(“flexslider”)) { mpImageSlider.flexslider(“destroy”); } if (!true) mpImageSlider.css(“margin-bottom”, 0); mpImageSlider.flexslider({ slideshow: true, animation: “fade”, controlNav: true, slideshowSpeed: 3000, animationSpeed: 600, smoothHeight: false, keyboard: true }); }); jQuery(document).ready(function($) { var mpImageSlider = $(“.motopress-image-slider-obj#56e5df6484e44”); if (mpImageSlider.data(“flexslider”)) { mpImageSlider.flexslider(“destroy”); } if (!true) mpImageSlider.css(“margin-bottom”, 0); mpImageSlider.flexslider({ slideshow: true, animation: “fade”, controlNav: true, slideshowSpeed: 3000, animationSpeed: 600, smoothHeight: false, keyboard: true }); }); The post Congratulations to our Award Winners appeared first on Team Realty. Source: Blog

Why Listing In January or February Can Make Sense

Although it may seem odd, listing in the winter months can be advantageous for sellers. Statistically, there are indeed more buyers in the spring market. However, there are also more homes for sale, including properties similar to yours. With more competition for the pool of buyers, your chances of finalizing a deal may actually be reduced. Here are several reasons to list in January or February. Financial Planning And Taxes Many families check their finances at year end and start planning their tax returns. And, because of the holiday festivities, it’s often the time for discussions and decisions about gifting, inheritance, upgrading to a larger home or downsizing to a smaller one and homeownership versus renting. Whether it’s a new buyer who moves quickly or a previously active buyer who re-engages, these house hunters are around in January and February and will look at your home if it’s for sale. If You List They Will Come Because of online advertising, buyers look at listings all day, every day. They have apps on their phone, get listings texted and emailed to them, and don’t care about the time of year. They realize the home won’t show as well in the dead of winter, so providing photos of your home during these times of year will enable buyers to envision it in the warmer seasons. Winter Buyers Are Highly Motivated Buyers looking in January and February are serious. They know what they want, have often been at it for many months and are tired of the real estate hunt. This is your target buyer and, in part, they’re why it’s better to list in January than to wait until spring. Your property will certainly stand out if it’s the only one like it listed. Offering your home for sale in the “offseason” means less competition which changes the market’s supply-and-demand balance. The demand is far greater than the supply. And, because of the reduced inventory, the seller can often take a little more time to consider offers and negotiate a higher price. The post Why Listing In January or February Can Make Sense appeared first on Team Realty. Source: Blog

First Time Homebuyers Government Incentive Programs

Thinking of buying your first home? If so, it may be time to get on with it, especially considering the possibility that interest rates will rise. Using government incentive programs that encourage first time homebuyers to enter the real estate market, you can realize additional savings. And, mortgage financing has been almost free for some time, but economic signals point to those costs rising. Mortgage rates may increase Several factors are threatening to push Canadian mortgage rates higher even as the Bank of Canada tries to hold its overnight lending rate down. Fixed mortgage rates are linked to long-term Canadian government bond yields, which are tied to U.S. bond yields. Those rates have risen since September as investors have come to expect the U.S. Federal Reserve to boost rates based on the U.S. economy. Borrow from yourself The Canadian government’s Home Buyers’ Plan (HBP) allows first time home buyers to borrow up to $25,000 from their RRSP for a down payment to buy or build a qualified home, tax-free. If you purchase with someone who is also a first time homebuyer, including your spouse, you can both access $25,000 from your RRSP for a combined total of $50,000. The HBP is considered a loan, so if you participate in the Plan, you must repay the amount you withdrew within a 15-year period, in the amount of 1/15 per year. If you repay less than that amount, the difference is added to your taxable income and you are taxed at the applicable rate. Reduce your income tax The federal Home Buyers’ Tax Credit helps recover closing costs (legal expenses, inspections, land transfer taxes) so you can save more for money for a down payment. At current taxation rates, it works out to a rebate of $750. If you buy in Ontario, there is another rebate of up to $2,000 available to help offset the land transfer tax. In Toronto, you can also receive a rebate up to $3,725 for municipal land transfer taxes. With the current economic uncertainty and the advantages of government incentive programs, now may be the right time for first time home buyers to lock in a mortgage at the low rates and buy a home. The post First Time Homebuyers Government Incentive Programs appeared first on Team Realty. Source: Blog

Saving Strategies for Every Age

We all want to save more money, but doing it requires a plan. And, the best approach to saving depends on the stage of life you’re in because each phase has unique financial commitments. Although individual circumstances vary, these generation-specific suggestions will point you in the right direction. Millennials (19-35) Millennials, born between 1980 and 1996, are actually better than Gen Xers at money management, according to financial journalist Vera Gibbons. But, they tend to live in the moment and prefer instant gratification to long-term financial planning. And, because personal finance is not a core subject in school, they may not know much about how to manage money. Try these strategies. each payday, set aside money to “pay yourself first” and use it for an emergency fund learn fine art of delaying gratification so you have the self control to say no to yourself avoid paying rent, which can cost up to 30% of your income, by living at home pay off student debt with an income-based loan repayment plan use a budgeting tool so you know where your money is going give yourself a weekly allowance to keep discretionary spending in check make small, manageable reductions to your expenses which leaves more for savings contribute to your employer’s retirement plan manage your credit score as it affects your ability to obtain mortgage or other financing Gen Xers (36-50) For Generation Xers, born between 1965 and 1979, have less time to build a nest-egg for retirement, so it’s imperative to contribute regularly to their retirement savings during these peak income earning years. Managing cash flow at this stage is particularly challenging. Consider these options. avoid buying more home than you can afford using cash will make you think harder before letting it go pay yourself first entertain at home rather than going out overestimate expenses and make small, manageable spending reductions contribute to your employer’s retirement plan Baby Boomers (51-69) Most Baby Boomers, born between 1946 and 1964, are in better financial shape than their younger counterparts, but only 60 percent report having retirement savings and 93 percent are providing financial support to adult children. So, they face the dangerous combination of being under-saved and long-lived. Here are a few ideas to safeguard your future. delay retirement or return to work to generate income explore the downsizing option and/or ways to leverage home equity accelerate retirement savings and allocate investments properly consider long-term care insurance reduce expenditures and eliminate high cost items like transportation plan to retire in, or move to, an area with lower expenses adjust your standard of living The post Saving Strategies for Every Age appeared first on Team Realty. Source: Blog

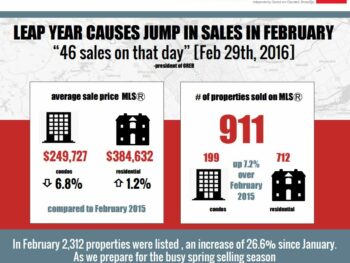

Real Estate Snapshot February 2016

What a difference a day makes! An extra day in February saw 46 sales on that day (February 29th) as per the Ottawa Real Estate Board’s news release March 3rd. See the full Ottawa Real Estate market snapshot for February and the full story from the Ottawa Real Estate Board below. With spring around the corner, we’re starting to see more homes come on the market, if you’re thinking of selling now is a great time to get your home listed with a real estate professional. While statistics are useful in establishing trends they should not be used as an indicator of an increase or decrease in value of specific properties. If you are curious about the value of your home and/or specific neighbourhood statistics we would be happy to provide you with a no cost no obligation market evaluation of your property. Contact any one of our 23 offices or email us at info@teamrealty.ca From the Ottawa Real Estate Board March 3rd, 2016 Extra day in leap year causes jump in sales for February Members of the Ottawa Real Estate Board sold 911 residential properties in February through the Board’s Multiple Listing Service® system, compared with 850 in February 2015, an increase of 7.2 per cent. The five-year average for February sales is 908. “Although the weather was very unpredictable this month, with many highs and lows and several winter storms, the Ottawa resale market only saw activity pick up,” says President of the Ottawa Real Estate Board, Shane Silva. “Residential and condo sales combined increased by 52.3 per cent since last month. However, we need to factor in the leap year, which added an extra day to the month of February, and 46 sales on that day.” February’s sales included 199 in the condominium property class, and 712 in the residential property class. The condominium property class includes any property, regardless of style (i.e. detached, semi-detached, apartment, townhouse, etc.), which is registered as a condominium, as well as properties which are co-operatives, life leases and timeshares. The residential property class includes all other residential properties. “In February, 2,312 homes were listed, up 26.6 per cent since January, and inventory on hand at the end of February rose by 10.7 per cent since January,” says Silva. “We’re starting to see more homes coming onto the market in preparation for the busy spring selling season. If you’re thinking of putting your home on the market, this is a great time to do so.” The average sale price of a residential-class property sold in February in the Ottawa area was $384,632, an increase of 1.2 per cent over February 2015. The average sale price for a condominium-class property was $249,727, a decrease of 6.8 per cent over February 2015. The Board cautions that average sale price information can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of all properties sold. “The highest concentration of properties sold continues to be in the $300,000 to $400,000 price range, followed by the $200,000 to $300,000 range,” says Silva. “These price ranges continue to have the highest concentration of properties sold – residential and condo – while two-storey, bungalow, and one-level condos have the highest concentration of buyers. In addition to residential and condominium sales, OREB Members assisted clients with renting 414 properties since the beginning of the year.” The post Real Estate Snapshot February 2016 appeared first on Team Realty. Source: Blog

7 Deadly Sins of Home Renos

Homeowners who renovate only to boost resale value should aim for a return on investment (ROI) of three dollars for every dollar invested. Resale renos should be neutral in colour and conservative in tone so they appeal to the maximum number of potential buyers. And, cost control always trumps elegance. In fact, some renovations can actually damage your home’s value. These supposed improvements not only add nothing to your bottom line, they may make your home less attractive to potential buyers and bring down its value. Here are seven such expensive mistakes to avoid. Pools A pool will chase away numerous buyers due to maintenance, public liability, insurance and local government laws regarding fencing and safety barriers. Don’t waste the money. Skip the Sunroom Unless you want the exposure to nature, avoid this addition which yielded only 48.7 percent ROI according to Remodelling magazine’s 2015 statistics. Converted Garage Some homeowners see converting a garage as a cheaper way to add more living space than building an addition – and it is. But, many buyers prefer a garage to protect assets from the cold and snowy conditions. And, a garage is much more valuable than an extra room. Fancy Faucets and Lighting Fixtures For kitchen or bathroom renos, avoid ornate fixtures for two reasons. First, you reduce the pool of buyers due to the cost. Second, stylized fixtures will appeal only to a small number of potential buyers, those who share your taste, further reducing your chances to sell. Eliminating a Bedroom or Powder Room In older homes, combining smaller rooms in the public living space might add to the value and appeal to homeowners who like large, open spaces. Eliminating a powder room, however, is a bad idea. And turning a bedroom into a master closet or combining two bedrooms to create a large master suite may not pay. As Kevin Brown Jr., president of Praedium Real Estate Services points out, “You’ve eliminated a whole living space.” Elaborate Landscaping A basic make over is the surest way to make money back from your outdoor outlay. Avoid overspending. Things That Are Invisible Adding insulation, window upgrades, or air conditioning does not increase the value of a property as much as some sellers believe. This type of feature can add to the marketability, not the value. The post 7 Deadly Sins of Home Renos appeared first on Team Realty. Source: Blog

The Do’s and Dont’s of Basement Storage

This article from Bob Vila gives eight handy tips to consider when using your basement for storage. The suggestions include taking advantage of vertical space by building up and not out, using open shelves for frequently-used items and built-in cabinets to conceal toys or cleaning supplies, storing off-season gear in sealed bins to protect from moisture and dust, using a pulley-hoist to store heavy or bulky items from the ceiling, protecting tools stored in the open with a coating of machine oil to prevent rust and running a humidifier in the basement to suck moisture from the air and combat mold or mildew. To read more click here. Source: Blog

James Dean

Sales Representative

Royal LePage Team Realty

1335 Carling Avenue

Ottawa, Ontario

K1Z 8N8

Office: 613-725-1171

Direct: 613-293-2088

Fax: 613-725-3323

Toll Free: 1-800-307-1545

James@JamesDean.ca