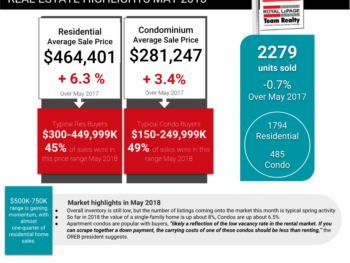

Ottawa Real Estate Market Snapshot: May 2018

Ottawa Real Estate Market Snapshot: May 2018: While inventory is still lower than normal, the number of listings coming onto the market this month is typical spring activity! Have questions? Looking for specific neighbourhood stats? Message us!! The following are hightlights from the Ottawa Real Estate Board’s latest News Release read the full story Members of the Ottawa Real Estate Board sold 2,279 residential properties in May through the Board’s Multiple Listing Service® System, compared with 2,294 in May 2017, a decrease of 0.7 per cent. The five-year average for May sales is 2,041. May’s sales included 485 in the condominium property class and 1,794 in the residential property class. “Although our overall inventory stock is down in both the residential and condo market, the number of listings coming onto the market this month is typical spring activity,” states Ralph Shaw, President of the Ottawa Real Estate Board. “The sheer number of home sales that took place in May indicates that inventory is turning over quickly– certainly a sign that Ottawa is a healthy real estate market.” The average sale price of a residential-class property sold in May in the Ottawa area was $464,401, an increase of 6.3 per cent over May 2017. The average sale price for a condominium-class property was $281,247, an increase of 3.4 per cent from May 2017.* “In the first five months of 2018, the value of a single-family home has increased about 8% and approximately 6.5% for condominiums,” Shaw notes. “This price acceleration is encouraging news for homeowners who have now seen an average of 3% price growth per year for the last five years.” “Much of the total increase in property values have been experienced since the beginning of this year. Not only will this help new homebuilders validate their pricing since construction costs and development fees are so high, but it also will give baby boomers incentive to sell their homes which will help put inventory back onto the market,” he explains. “While our inventory stays at historically low levels, especially in some neighbourhoods, there will continue to be upward pressure on home prices. We definitely have the demand for housing in this city not only because it is still very affordable but because all the fundamentals are solid here. However, our city does need to have a longer-term housing supply strategy so that we aren’t confronted with future affordability challenges,” Shaw advises. The $300,000 to $449,999 range remains the most active price point in the residential market, accounting for 45 per cent of home sales, while the $500,000 to $750,000 range continues to gain momentum, now representing almost one-quarter of residential home sales. “Between $150,000 and $249,999 was May’s most active price point in the condominium market, accounting for 49 per cent of the units sold,” Shaw reports. “Moreover, apartment condos represent 52 per cent of the sales. This is likely a reflection of the low vacancy rate in the rental market. If you can scrape together a down payment, the carrying costs of one of these condos should be less than renting,” he suggests. In addition to residential and condominium sales, OREB Members assisted clients with renting 1,020 properties since the beginning of the year. * The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.

Turn your Vacation into a Staycation: Activities for families in Ottawa

Turn your Vacation into a Staycation: Activities for families in Ottawa Summer is a wonderful time to spend a little quality time with friends and family; things are more relaxed, the kids are out of school and you won’t have to worry about a last minute snow storm interfering with travel plans (well here’s hoping!) . But organizing a family vacation, especially when you have young children, can be stressful (just think of the Griswalds). The packing, planning, stopping, driving, – the list could go on and on. Have you ever arrived at your destination tired, wishing you’d just stayed home? If the answer is yes, you can take the stress out of your vacation this year, and turn it into a “Staycation”! At this moment, you’re certainly considering this option, but wondering what there possibly could be to do in Ottawa for a family that already lives here? Have no fear; we have the answers you are looking for. Staycations are becoming a popular option for many families, as leaving home can be stressful, and expensive. In Ottawa, there are many options for families looking for things to do this summer during their family holidays including, but not limited to; museums, parks, festivals, Mooney’s Bay, Calypso Water Park, Saunders Farm and many more. These activities offer a change from your usual summer activities, without the stress of being far from home. Ottawa Museums & Parks Ottawa is a city that is home to many wonderful museums and exhibits just a short distance from your front door. These museums offer a wide variety of topics, from nature to history, to art galleries and more – Ottawa has a museum for every learning opportunity and interest. A more detailed list of museums and their special exhibits this summer can give you a better way to choose which museum to go to first! Don’t miss out on the brains, war history, gallery exhibits and more that will be making their way to museums in the Capital this summer. Saunders’ Farm Join Saunders’ Farm this summer for an array of family activities that will fill your staycation with laughter. From challenging mazes to an expanded pedal cart race track to hayride farm tours, a splash pad, and the new jumbo jumpers, Saunders’ Farm has activities for the whole family to enjoy. With reasonable family rates, and even offering a summer camp for kids – this is a stop you don’t want to miss out on. Beaches, Splash Pads, & Water Parks Keep cool this summer by visiting one of the city’s many splash pads, or have a relaxing family beach day at Mooney’s Bay Park, on the Rideau Canal. As one of the city’s four supervised beaches, you can relax knowing there are lifeguards on site each day. There is a picnic area, indoor change rooms, and a children’s playground to enjoy. Hike the Hog’s Back Nature Trails, see the Rideau Locks in action, or liven up your day with an interactive Pirate Adventure in Mooney’s Bay. This live theater cruise is on a real pirate ship in the heart of Mooney’s Bay. There are over 100 splash pads in Ottawa to choose from, each with their own assortment of activities and features. Some splash pads feature water cannons, spray loops, dumping buckets and more, each with their own “cool” functionality. Make it a family mission this summer to visit as many of the 100 splash pads located across the city or find your favourite ones to enjoy this summer sunshine! If you’re looking for something a little more thrilling than beaches or splash pads, look no further than Calypso Water Park, located here in Ottawa. Opening this year on June 6, the park features water activities for all ages. This park is home to the largest wave pool in Canada and features over 35 different water slides, two themed rivers, and 100 water games. Dive into the adventures of Calypso Water Park and keep the whole family cool and entertained this summer break. Action and Arcades With its very own escape room, laser tag, bumper cars, jungle gyms and more – FunHaven is Ottawa’s one-stop shop for family fun. Try your hand at their rock climbing wall, or challenge your family to an epic game of laser tag. Children 0-3years enter for free, and with tons of different arcade games and activities to choose from, there’s fun for the whole family to enjoy! House of Targ is another hidden gem of Ottawa, located in Old Ottawa South just down the street from TD place. If you’re looking for a cool space with a retro vibe, this is it! Ottawa’s only true classic arcade, at House of Targ you can play over 35 pinball and classic Arcade games (yes, even PACMAN!). While you might not think of this as a “family” outing, it is very kid friendly during the day and their perogies are AMAZING. After 8pm House of Targ has some of the best live rock, punk and metal shows in the city. Treat yourself After all that family time you might be looking for a wee bit of “me time”. Le Nordik Spa, is located at the entrance of Gatineau Park and is one of Ottawa’s most popular “staycation” activities for millennials and baby boomers alike. Offering relaxation using techniques from the Nordic countries you can take time to unwind and re-energize in Nordic baths, waterfalls, steam baths, saunas, and more. Book a massage or body treatment and even enjoy a meal – baby you’re worth it! And it’s only 10 minutes from downtown Gatineau-Ottawa. ByWard Market, City Fun & Other Ideas Tour the ByWard Market this summer and see what little shops and hidden gems you can discover downtown, or take a visit to Parliament Hill to tour the Parliament Buildings. Enjoy our regal Parliament buildings, stop at museums and shops throughout the day, and celebrate the nightlife Ottawa has to offer. Check out the ByWard Market’s website to view any festivals or entertainment happening during your time and plan to visit a festival or see a

Home-Grown Issues: The impacts of home-grown marijuana and legalization

Home-Grown Issues: The impacts of home-grown marijuana and legalization Many Canadians are awaiting this July 2018 with much anticipation, as Bill C-45 will allow the legalization of marijuana, including their ability to grow up to 4 plants within their residence. However, without the proper protections and awareness in place this new legislation could cost home owners thousands, or even their mortgage. The increase of private residence grow-ops that will begin following legalization is a major concern for the real estate industry. Experts say that everyone from “buyers, to sellers, to real estate agents, and home inspectors” will be affected by the consequences produced by home grow-ops. Issues with Home-Grown There is currently no legal benchmark in the definition of a grow-op. This means, that whether it is a large-scale operation, or a single potted plant, the home is viewed in the same light. Although this doesn’t seem like a big issue to some, the underlying damages that can result from growing marijuana plants within a residence have serious ramifications on insurance, mortgages, and future sales. Damages and building inspections The humidity and power required to grow larger quantities of plants can lead to electrical system damages, and mold, fungus, and moisture issues within the home. These issues, and others can completely destroy the framework of the house. Building remediation is not mandated by the province with legalization, and there is no official registry of illegal grow-ops that allow future home buyers to be forewarned of the possible damages and health risks they may encounter. These damages don’t need to be evident for a home to be labeled a “grow-op”. As there is no “definition” of size to label as a grow op, the house can be stigmatized whether it is one or one hundred plants in the house, in the case of illegal operations. These houses can be heavily damaged, and often covered up to make the home saleable. “History has shown us that some shady property owners will go to great lengths to hide signs of a former grow operation” – Tim Hudak OREA CEO When it comes to future sales on a home with a grow-op label, evidence shows that these homes sell for less than the surrounding houses, even if the proper repairs have been performed. Legalization including home cultivation can lead to unsuspecting buyers purchasing homes that are damaged, and could leave building inspectors on the hook if any damages are missed prior to purchase. The Ontario Real Estate Association (OREA) is urging policy makers to include protective measures for home buyers, and the future of Ontario’s housing stock. Marijuana and Mortgages: As it stands currently, most mortgage lenders have a very conservative approach when in comes to homes where marijuana growth has been present. Typically, traditional mortgage lenders such as banks, will deny the mortgage altogether. This denial is based on the premise of resale value being decreased in homes where cultivation of marijuana has occurred. Without this knowledge, individual’s seeking to purchase a home can run into red-tape when it comes to financing a property once used to grow marijuana, and once legalization is in place – home cultivation can lead to damages in multiple homes and minimize the available houses that will be approved by bank lenders. This results in borrowers needing to use alternative lenders. The process of approval with alternative lenders, especially where growth of marijuana is concerned requires a lot more detailed paperwork, air/mold testing, and typically a case-by-case evaluation of each home to determine approval. Insurance Policies: If the home’s status is compromised, then the home becomes more difficult to insure. Without insurance companies who are willing to approve a home insurance policy, the mortgages will be unapproved by default. Because marijuana growth requires a large quantity of electricity, the home is at higher risk of fire. Fire insurance is a mandatory portion in ensuring approval of a mortgage. It is unclear at this point if insurers will adjust their policies post-legalization to account for these new possibilities. This could mean those who grow within the legal limit are still risking their home coverage to do so. Many insurers are discussing the possibility of introducing policies that allow for home-growing, but it is not yet determined how that may effect a home-owners insurance premiums. How is Home-Grown going to change Ontario? Simply put, the ability to grow up to 4 plants legally in ones home could jeopardize their current mortgage, insurance, and future sale-ability of their home. At this time, there is currently no legislation or protection in place that will guarantee home owners their home value, insurances, or mortgage approvals should they choose to go with the crowd awaiting home-grown this summer. There is certainly a lot to consider when it comes to homes and home-grown this July.

3 Tips For Making A Major Homeowners Insurance Claim

3 Tips For Making A Major Homeowners Insurance Claim Home insurance is one of the costs that come with home ownership. You pay your premiums to your insurance company and when disaster strikes, you expect that they will pay for most, if not all of the bill. But will they? Here are 3 tips to help you get the most out of your homeowner’s insurance claim. Know your limits, deductibles and what your coverage includes. Depending on your policy, your insurance company may or may not cover things like water damage. By reviewing your policy, you’ll know how much you can expect to pay out-of-pocket, which will help you decide which repairs are essential, and which can wait. You’ll also want to know whether your insurance company will pay actual cash value or replacement costs for personal property that has been damaged. Cash value may not be enough to cover replacement costs so get the details before you rush out to replace everything. Document all of your damage. Take photos of EVERYTHING before you start cleaning up or begin repairs. Document damage to every item. If you make any repairs before filing a claim, keep your receipts. After you file your claim, typically your insurance company will send an adjuster to your home to provide an estimate of the damage, but this can be well after you’ve started the cleanup and repair process. Providing photos and documentation to your insurance company is essential to ensuring they can make the most accurate assessment of the damage. If you disagree with the insurance company’s estimate, and decide to dispute, know your rights under your policy. Usually there is an appeal procedure that should include your right to submit a second estimate by a public adjuster that you hire yourself. This adjuster will work for you through the claim process to help ensure you get the full entitlement under your policy.

3 Tips For Making A Major Homeowners Insurance Claim

3 Tips For Making A Major Homeowners Insurance Claim Home insurance is one of the costs that come with home ownership. You pay your premiums to your insurance company and when disaster strikes, you expect that they will pay for most, if not all of the bill. But will they? Here are 3 tips to help you get the most out of your homeowner’s insurance claim. Know your limits, deductibles and what your coverage includes. Depending on your policy, your insurance company may or may not cover things like water damage. By reviewing your policy, you’ll know how much you can expect to pay out-of-pocket, which will help you decide which repairs are essential, and which can wait. You’ll also want to know whether your insurance company will pay actual cash value or replacement costs for personal property that has been damaged. Cash value may not be enough to cover replacement costs so get the details before you rush out to replace everything. Document all of your damage. Take photos of EVERYTHING before you start cleaning up or starting any repairs. Document damage to every item. If you make any repairs before filing a claim, keep your receipts. After you file your claim, typically your insurance company will send an adjuster to your home to provide an estimate of the damage, but this can be well after you’ve started the cleanup and repair process. Providing photos and documentation to your insurance company is essential to ensuring they can make the most accurate assessment of the damage. If you disagree with the insurance company’s estimate, and decide to dispute, know your rights under your policy. Usually there is an appeal procedure that should include your right to submit a second estimate by a public adjuster that you hire yourself. This adjuster will work for you through the claim process to help ensure you get the full entitlement under your policy.

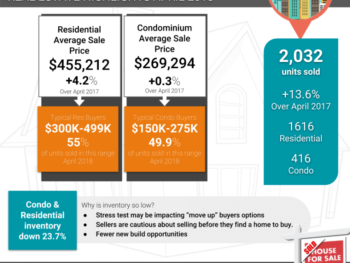

Hot Real Estate Market in an Icy April

The Spring market continues to buzz in Ottawa real estate, with the number of sales up over 13% in April in spite of inventory levels being down 23% over this time last year. Home buyers are seeing more competition, which is good news for sellers. Certainly we are seeing more multiple offers and higher sale prices, however, with prices still reasonable compared to income in Ottawa real estate these factors aren’t stopping buyers. Hot Real Estate Market in an Icy April May 3, 2018 Highlights from the Ottawa Real Estate Board “Full employment and reasonable house prices in proportion to incomes are fueling our market. Ottawa is not only a beautiful and dynamic capital but also one of the more affordable cities in Canada,” observes Ralph Shaw, Ottawa Real Estate Board President. “While prices and conditions do vary by area, the overall residential marketplace shows solid and steady performance on investment for homeowners, and offers a variety of property class options and price points for those looking to enter the market,” he advises. “While sales were strong this month, certain areas in Ottawa continue to experience limited supply with both condo and residential inventory down 23.7% from the same month last year. With our low inventory, potential sellers are reluctant to put their home on the market if they are uncertain of their ability to acquire another property.” “April’s colder than usual temperatures may have been one of the reasons potential sellers delayed listing their properties. However, there are other factors at play which are contributing to the lack of supply. Of course, the new mortgage stress test is affecting some homeowners who may no longer qualify to upsize their homes,” Shaw points out. “Further compounding the issue within Ottawa proper is a restricted supply of serviceable land, and thus fewer new build opportunities. We need both the new build and resale inventory to be robust enough to meet demand on a consistent basis,” he explains. “Moreover,” Shaw elaborates, “life adjustment sellers such as Boomers, lack suitable purchasing options due to urban engineering. Many of them do not want to live in downtown condominiums, preferring smaller homes with an attached garage and a decent sized yard where they can still host family BBQs and entertain. Our city council would benefit from the input of Ottawa’s long-serving REALTORS® who truly understand the variety of needs of local home buyers and sellers,” Shaw concludes.

Buying a Home: What The Extras Cost

Contracts and rentals to consider in home ownership When it comes to buying a home, there are always additional fees to be considering when you make an offer. Typically, a first-time home buyer needs to be aware of the costs associated with buying a home – legal fees, mortgage rates, home insurance, closing costs, property taxes, land transfer fees…But what about those little extras not everyone considers? The contracts and rentals associated with the home such as furnaces, hot water tanks, and in some locations even your septic tanks – and what that could cost you. The main point is to understand EXACTLY what you are buying. Some of these costs are minimal, and won’t make a significant impact on your decision when it comes to home buying. However, if you’re looking at a home that requires you to take over a rental furnace, for example, some furnace contracts can cost hundreds of dollars per month to maintain. What can you do to know what you’re getting yourself into before the costs start rising? To begin with, ensure that you have an experienced realtor who can go over all appliances, and their extra associated costs (such as a hot water rental tank). Then have your lawyer go over the information provided and share their opinion and expertise with you. Be sure to do your research when it comes to the costs of rental furnaces (if that is your situation) in the area that you are looking to purchase the home, and understand what their associated terms and costs are. Carefully consider all options when it comes to these expenses, and what exactly you agree to take over. Smaller appliances, such as hot water tank rentals, and propane tank rentals are relatively low cost/inexpensive to take over and have precise terms and conditions. When it comes to taking over a furnace or septic tank rental, be sure to thoroughly evaluate all the options in the contracts provided, as well as research the typical costs associated with such items.

Understanding Property Taxes

Property taxes are a necessary part of owning property in Ontario. Anyone in Ontario who owns land or a property has to pay a certain amount of tax to the municipal government. Although these taxes are unpopular, as all taxes are, property taxes are important because they are the main revenue source for Ontario’s municipalities. Property taxes are separate from other forms of taxes, and the amount that each person owes is based on a unique assessment for their particular property and the tax rate of the municipality the property is in. How property taxes are determined for each individual property is quite simple. Each municipality within Ontario has its own municipal tax rate, which is determined based on the municipality’s budget and expected revenue. Each municipality also has an education tax rate, which helps to pay for schools and related services within the municipality. These education tax rates can vary within a municipality, depending on where a property is located in relation to schools. On an individual level, every property in Ontario has an assessed value based on property assessments that are carried out periodically. In order to find the total amount of property taxes owed, a simple formula is followed. The municipal tax rate is added to the education tax rate that is applicable for the particular property (and in some cases other taxes are applied as well), and then the result is multiplied by the property’s assessed value. The resulting amount is the total property tax that you will owe for the year. For clarity, an example is below: Property’s Current Value (by assessment): $285,000.00 Total Tax Rate: 1.05% Property Taxes Owed: $2,992.50 It can be tricky to find details of the municipal tax rate in your area, especially since it can vary on what type of property you own, but there are also estimators online to help you with your budgeting. When tax time comes you will also receive a notice of the amount you owe from your municipal government, so you do not need to worry about sending in the wrong amount. If you live in a part of the province that is not incorporated into a municipality, the process for determining your total property taxes is very similar. The only difference is that you will multiply your property’s assessed value by the provincial land tax, instead of an individual municipality’s property tax value. Generally, the provincial land tax is lower than that of incorporated municipalities. It is important to remember property tax when it comes to budgeting for tax time, and it is always a good idea to use an estimator to get an idea of what you will have to pay, so that you are not caught off-guard by an unexpectedly higher rate.

Understanding Property Taxes

Property taxes are a necessary, though disliked part of owning property in Ontario. Anyone in Ontario who owns land or a property has to pay a certain amount of tax to the municipal government. Although these taxes are unpopular, as all taxes are, property taxes are important because they are the main revenue source for Ontario’s municipalities. Property taxes are separate from other forms of taxes, and the amount that each person owes is based on a unique assessment for their particular property and the tax rate of the municipality the property is in. How property taxes are determined for each individual property is quite simple. Each municipality within Ontario has its own municipal tax rate, which is determined based on the municipality’s budget and expected revenue. Each municipality also has an education tax rate, which helps to pay for schools and related services within the municipality. These education tax rates can vary within a municipality, depending on where a property is located in relation to schools. On an individual level, every property in Ontario has an assessed value based on property assessments that are carried out periodically. In order to find the total amount of property taxes owed, a simple formula is followed. The municipal tax rate is added to the education tax rate that is applicable for the particular property (and in some cases other taxes are applied as well), and then the result is multiplied by the property’s assessed value. The resulting amount is the total property tax that you will owe for the year. For clarity, an example is below: Property’s Current Value (by assessment): $285,000.00 Total Tax Rate: 1.05% Property Taxes Owed: $2,992.50 It can be tricky to find details of the municipal tax rate in your area, especially since it can vary on what type of property you own, but there are also estimators online to help you with your budgeting. When tax time comes you will also receive a notice of the amount you owe from your municipal government, so you do not need to worry about sending in the wrong amount. If you live in a part of the province that is not incorporated into a municipality, the process for determining your total property taxes is very similar. The only difference is that you will multiply your property’s assessed value by the provincial land tax, instead of an individual municipality’s property tax value. Generally, the provincial land tax is lower than that of incorporated municipalities. It is important to remember property tax when it comes to budgeting for tax time, and it is always a good idea to use an estimator to get an idea of what you will have to pay, so that you are not caught off-guard by an unexpectedly higher rate.

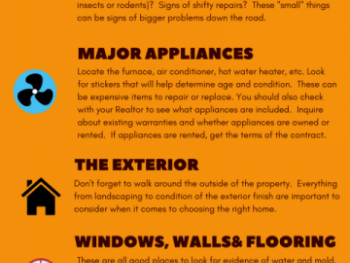

What Home Buyers Should be Looking for When Viewing a Property

You’ve done your research, found the perfect Realtor, crunched the numbers, created your list of must-haves and now it’s time to start the exciting process of HOUSE HUNTING! When you’re looking at homes for sale it isn’t always easy to look beyond the cosmetics. Not to worry, we’ve created this handy graphic to help home buyers to stay focused.

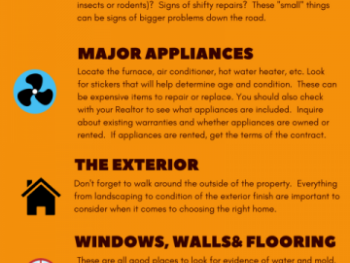

What Home Buyers Should be Looking for When Viewing a Property

You’ve done your research, found the perfect Realtor, crunched the numbers, created your list of must-haves and now it’s time to start the exciting process of HOUSE HUNTING! When you’re looking at homes for sale it isn’t always easy to look past the cosmetics. Not to worry, we’ve created this handy graphic to help home buyers to stay focused.

All About Homeowner’s Associations

When looking to buy a home, there are many options. Last week, we took a look at condos as compared to freehold properties but what about a freehold home with a homeowner’s association? In many cases, a homeowner’s association can appear very similar to a condo but this is not actually the case. It is very important to understand these differences before buying into a home with a homeowner’s association. Differences Between a Condo and Homeowner’s Association If you purchase a condo, you are purchasing your unit along with a share of the common element(s). These could include green spaces, amenities, private roads, or services and they are jointly owned by all condo owners. In the case of a homeowner’s association, those common elements are owned by a third party and your monthly homeowner’s association fees are paid to cover their maintenance and to allow usage of these amenities. In a homeowner’s association, you own your home and property but pay to use these common elements. Payment for these common elements is not usually optional so it is important to consider the cost and whether or not you will actually take advantage of them. Homeowner’s Association Fees Just like condos, homeowner’s association fees can vary dramatically depending on the amenities. They are generally charged monthly and go to cover anything from a parking lot or green space, or an amenity like a pool, golf course, or tennis court. The more that is offered, the higher the homeowner’s association fee. Restrictions Like a condo, a homeowner’s association may impose restrictions or bylaws. These restrictions can include exterior modifications, pets, or even people (some homeowner’s associations will not allow children to stay for long periods if the community is geared towards adult living). These restrictions can be strict so it is important ensure that the homeowner’s association bylaws fit your lifestyle. Perks of Buying a Home in a Home Owner’s Association Amenities – Some home owner’s associations offer great amenities. Ongoing Maintenance – Depending on what your homeowner’s association covers, it may mean that certain aspects of your property, or the property around your home is maintained. This can include snow removal and landscaping. Before You Buy As a buyer, you will need to sign a “Joint Use Agreement” and it is important to review this carefully to ensure that you fully understand the details of the homeowner’s association. By signing this agreement, you are agreeing to pay all monthly fees and abide by any bylaws that have been put into place. With all real estate transactions, it is important to work with a Realtor. A Realtor will be able to guide you through the decision making process to ensure that you know what you are buying.

Clean, Clean, Let it be Spring!

Spring Clean-Up Time in the Capital As spring speckles and the snow begins to melt, it’s time to get busy cleaning up our capital after Jack Frost’s long hold over us. Littered across this beautiful city, left out in the winter’s cold we’ll find discarded coffee cups, old cigarette butts, stray plastic bags and papers – the list could continue ad infinitum. Something about winter’s frozen grip seems to allow this build up of trash, so it’s only natural that the sun’s welcomed melt brings along with it a much needed clean up. The Capital region has a month-long challenge called Cleaning the Capital, sponsored by GLAD, which runs from mid-April to mid-May. By registering your clean-up project, cleaning supplies will be provided to your group. The official Capital Cleanup Weekend is April 27,2018 to April 29,2018 but your project does not have to take place during this weekend to be counted. The deadline to register for GLAD’s Cleanup project is May 15th, with May 31st being the deadline to submit your online cleanup report. Although the above is a wonderful initiative to get involved within your community, it is not the only way to be a part of this year’s Spring Cleaning season. Keeping your community clean, and helping your neighbourhood shine is not always a sanctioned event, that must be done in a certain way. Every single individual could unofficially participate in helping the community sparkle once again. Simply make the effort to pick up litter when you see it, grab that floating plastic bag on your morning walk and take it home with you. Bring an extra plastic bag when you take the kids to the park and pick up garbage along the way, throw that empty coffee cup into the recycling bin, or empty that car ashtray into a garbage bag at home. Community clean ups don’t often require largely sanctioned events, although they are extremely helpful. Every individual can help do their part, just one piece of trash at a time. Take care of your neighbourhood, so the light and beauty it provides, can take care of you.

All About Condos

When it comes time to buy a home, more and more people are making the decision to buy condos instead of a freehold home. Condos can be a great option if they match up with a buyer’s lifestyle, but it is important to do your research and know the differences between a freehold home and condo before you make the final decision of which to purchase. There are many different types of condos but they all have one thing in common: shared ownership of at least one common element. This element could be the building itself, in the case of an apartment building, or it could be a green space, private street, or an amenity like a pool. It is important that you do your research before buying a condo to understand exactly what you are buying. Condo Fees When you purchase a condo, you will be required to pay a monthly condo fee to pay for the shared element along with the fees associated with managing the condo. Condo fees can vary dramatically between different condos depending on the shared elements. As a general rule, the more amenities and services a condo provides, the higher the condo fee. Condo Restrictions Condos generally have their own set of bylaws which govern the entire condo. Some can be incredibly restrictive while others are very minimal. A person who has exclusive ownership of a home can do anything they want with the house or surrounding grounds, within the limits of local by-laws of course. Condo owners, on the other hand, are sometimes limited in the changes they are allowed to make to their property. This can range from simple restrictions on renovations that affect the home’s outside, to limitations on exterior decorations and even decorations that can be seen from the front windows, depending on how strict the rules are for an individual condo. These rules are set out by the condo association that oversees the condo, and are heavily dependent on the individual condo location. As shared owner of the condo and all that goes with it, each individual owner has a vote in decisions that affect all condos, but this rarely includes altering rules that have already been established. Perks of Buying a Condo Amenities – Some condos offer exciting amenities such as pools, fitness rooms, and party rooms. Insurance – Most condo fees cover some form of insurance on your unit, whether an apartment or detached home. This will reduce your monthly personal insurance costs. Restrictions can be good – Depending on what you are looking for, restrictions can be a good thing as it keeps the neighbourhood looking cohesive and can restrict the likelihood of an “eye sore” appearing. Major Maintenance – Some condo fees include the maintenance of all exterior components of your unit including the roof, windows, siding, and bricks. These can be major expenses for home owners. Ongoing Maintenance – Some condo fees cover ongoing maintenance fees such as snow removal, lawn mowing and landscaping. This could leave you with more free time if you don’t have to take care of these things on a regular basis. Before You Buy As part of your offer your real estate agent will include a condition relating to reviewing and approving the Status Certificate** of the condo association. This will allow your lawyer time to thoroughly examine the Status Certificate of the condo association. Make sure you review all of the information below and are satisfied with the answers: The financial status of the condo, including the reserve fund. Some condos are managed better than others. You want to ensure that the association has money in the bank to pay for repairs and incidentals because if they don’t, your fees may go up. The history of the condo fees. Have they been steady or been increasing rapidly? What your condo fees cover exactly. Have your lawyer review with you what the condo fees cover and what they do not. Do not make assumptions as all condos are different. Restrictions and condo bylaws. Condos come with advantages and limitations, just as owning a freehold home does. The important thing is to do careful research and decide which option best fits your needs and lifestyle. When researching condos, be sure to look around at multiple locations, as the rules, fees, facilities and size of condos can vary greatly from one area to another. And don’t forget, a Realtor will be there to guide you through every step of the process. **A status certificate is a document provided by the condominium corporation to buyers of resale condos that provides a snapshot of the unit as at the date that the certificate is issued. In most cases, if the building is serviced by a property management company, it is prepared by the property manager.

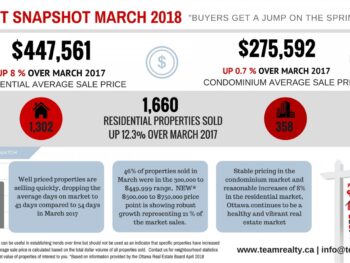

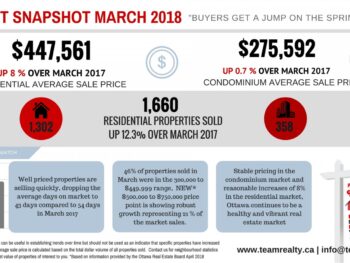

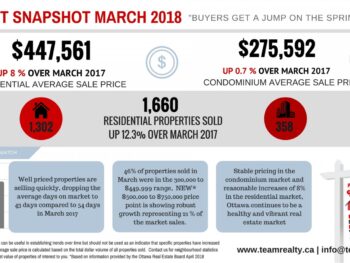

March Market Snapshot

Buyers Get a Jump on the Spring Market taken from the Ottawa Real Estate Board April 5, 2018 Members of the Ottawa Real Estate Board sold 1,660 residential properties in March through the Board’s Multiple Listing Service® System, compared with 1,478 in March 2017, an increase of 12.3 per cent. The five-year average for March sales is 1,339. March’s sales included 358 in the condominium property class and 1,302 in the residential property class. “Inventory continues to fall below normal average, but we are still seeing more sales than last year because listings are not staying on the market,” states Ralph Shaw, President of the Ottawa Real Estate Board. “Properties that are priced well are selling quickly with days on market dropping to an average of 43 days from an average of 54 days on market in March 2017.” The average sale price of a residential-class property sold in March in the Ottawa area was $447,561, an increase of 8 per cent over March 2017. The average sale price for a condominium-class property was $275,592, an increase of 0.7 per cent from March 2017. The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood. “The most active price point in the residential market continues to be the $300,000 to $449,999 range, accounting for 46 per cent of the market. In addition, the $500,000 to $750,000 market is a price point that is showing robust growth representing 21 per cent of the residential homes sold in March,” Shaw acknowledges. “In the condominium market, between $175,000 and $274,999 is the most buoyant price point, accounting for 51 per cent of the market. We continue to believe it is due to low interest rates and the lack of supply of rental inventory pushing renters into the market,” he adds. “Overall, as a result of the stable pricing in the condominium market and reasonable increases of 8 per cent in the residential market, Ottawa continues to be a healthy and vibrant real estate market,” Shaw concludes. In addition to residential and condominium sales, OREB Members assisted clients with renting 551 properties since the beginning of the year.

March Market Snapshot

Buyers Get a Jump on the Spring Market April 5, 2018 Members of the Ottawa Real Estate Board sold 1,660 residential properties in March through the Board’s Multiple Listing Service® System, compared with 1,478 in March 2017, an increase of 12.3 per cent. The five-year average for March sales is 1,339. March’s sales included 358 in the condominium property class and 1,302 in the residential property class. “Inventory continues to fall below normal average, but we are still seeing more sales than last year because listings are not staying on the market,” states Ralph Shaw, President of the Ottawa Real Estate Board. “Properties that are priced well are selling quickly with days on market dropping to an average of 43 days from an average of 54 days on market in March 2017.” The average sale price of a residential-class property sold in March in the Ottawa area was $447,561, an increase of 8 per cent over March 2017. The average sale price for a condominium-class property was $275,592, an increase of 0.7 per cent from March 2017. The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood. “The most active price point in the residential market continues to be the $300,000 to $449,999 range, accounting for 46 per cent of the market. In addition, the $500,000 to $750,000 market is a price point that is showing robust growth representing 21 per cent of the residential homes sold in March,” Shaw acknowledges. “In the condominium market, between $175,000 and $274,999 is the most buoyant price point, accounting for 51 per cent of the market. We continue to believe it is due to low interest rates and the lack of supply of rental inventory pushing renters into the market,” he adds. “Overall, as a result of the stable pricing in the condominium market and reasonable increases of 8 per cent in the residential market, Ottawa continues to be a healthy and vibrant real estate market,” Shaw concludes. In addition to residential and condominium sales, OREB Members assisted clients with renting 551 properties since the beginning of the year.

March Market Snapshot

Buyers Get a Jump on the Spring Market April 5, 2018 Members of the Ottawa Real Estate Board sold 1,660 residential properties in March through the Board’s Multiple Listing Service® System, compared with 1,478 in March 2017, an increase of 12.3 per cent. The five-year average for March sales is 1,339. March’s sales included 358 in the condominium property class and 1,302 in the residential property class. “Inventory continues to fall below normal average, but we are still seeing more sales than last year because listings are not staying on the market,” states Ralph Shaw, President of the Ottawa Real Estate Board. “Properties that are priced well are selling quickly with days on market dropping to an average of 43 days from an average of 54 days on market in March 2017.” The average sale price of a residential-class property sold in March in the Ottawa area was $447,561, an increase of 8 per cent over March 2017. The average sale price for a condominium-class property was $275,592, an increase of 0.7 per cent from March 2017. The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood. “The most active price point in the residential market continues to be the $300,000 to $449,999 range, accounting for 46 per cent of the market. In addition, the $500,000 to $750,000 market is a price point that is showing robust growth representing 21 per cent of the residential homes sold in March,” Shaw acknowledges. “In the condominium market, between $175,000 and $274,999 is the most buoyant price point, accounting for 51 per cent of the market. We continue to believe it is due to low interest rates and the lack of supply of rental inventory pushing renters into the market,” he adds. “Overall, as a result of the stable pricing in the condominium market and reasonable increases of 8 per cent in the residential market, Ottawa continues to be a healthy and vibrant real estate market,” Shaw concludes. In addition to residential and condominium sales, OREB Members assisted clients with renting 551 properties since the beginning of the year.

Buyers Toolkit – Springtime

Buyers Toolkit – Springtime Spring is in the air, and the real-estate market is ramping up for the beginning of buyers’ season. Things tend to move faster in the spring and houses for sale are often sold shortly after they are listed. As a potential home buyer, it is important to be prepared as possible before you start looking at potential homes – that way, the chance of losing your “dream home” to another buyer is greatly decreased. You may be wondering … “What are some of the important things that can help you stay on-top of, and ahead of this year’s spring market?” Have no fear, in this toolkit we have everything you need to know, and do, to make the buying experience go smoothly for you! Your “Tools”-What you want to be prepared with ahead of time: Mortgage Information & Pre-approval Find out what mortgage you qualify for, and get your mortgage pre-qualification. By taking this step you’ll know exactly what you can afford to buy and when you’re ready to make an offer, you can be confident knowing you are staying within your financial boundaries. A financing condition is pretty standard in an agreement of purchase and sale; after your offer is accepted by the seller the time you have to meet the conditions is best spent finalizing your financing on a specific property rather than starting the approval process. A Realtor Although that seems like a no-brainer, making sure you have hired the realtor who is right for you is very important when it comes to purchasing a home. Do some research, ask questions, interview a few realtors, check online profiles and reviews. You’ll be spending a lot of time with your real estate agent; make sure you trust them, that they’re knowledgeable and that you’re comfortable with them. Quick and easy contact with your agent is another key piece when it comes to signing and sealing a deal. Your List of Needs vs. Wants Knowing what you’ll need in your future home, and things that you want (your wish-list) is one of the most important aspects when it comes to looking for a new home. Needs are things that you must have in your new home (e.g. minimum number of bedrooms, a yard for the dog, a safe neighbourhood) whereas the wants’ or your “wish-list” are things you don’t necessarily need, but you’d like to have (Example: Granite countertops). Your “must-have” list will help you rule out homes for sale that aren’t suited for your needs rather than spending valuable time on those that don’t. This process can also open up your search options if some of the things on your need list actually turn out to be wants. Pro-Con List It’s important to keep a list of the pros’ and cons’ of each property that you visit, in order to have a better recollection of the home that is best suited for your family. Remember to check small details in each home, like testing the lights, and plumbing, and make note of the neighbourhood characteristics. Trust Your Gut When it comes to knowing what home is the right choice for you, you can use the simple tools listed above to help make an informed decision, however the most important aspect of home-buying is knowing when to trust your gut. The spring market moves quickly, and sometimes being prepared, and trusting your instincts are the two key factors standing between you, and successfully making an offer on your future home in time. If the potential home is in your price range, and has the combination of needs and wants you desire – don’t take the time to sleep on it, or you may lose the opportunity to make an offer. Trust your intuition and keep in close contact with your realtor to have the best support and knowledge while making these decisions. There are many different aspects that are key elements to finding the right home. Working with your realtor to negotiate for a fair price, finding the neighbourhood you’re comfortable with, and ensuring you have the right credit and down-payment for the home you’re interested in are just some of these factors. The home buying process doesn’t need to be complicated – tool kit in hand, and realtor by your side, will make this spring market a piece of cake for you. Let us know how we can help! Contact us info@teamrealty.ca

Landlords and Legalization: What budding weed laws may mean for Landlord

Landlords and Legalization: What budding weed laws may mean for Landlords With the legalization of marijuana on the horizon, property owners of rental units are wondering what that will mean for them. As all the rules and regulations surrounding cannabis use have yet to be ironed out, it’s only natural that landlords are beginning express concern, or in some cases excitement surrounding the opportunities legalization will present. The legalization of medical cannabis passed in 2001, but as Canada moves forward to legalize the use of cannabis across the country, there are many different views surrounding the changes. With multiple angles to consider, it’s no wonder that landlords across the country are beginning to question, challenge, and prepare for the pending legalization. What are the pro and con sides of the debate surrounding legalization for landlords, and how might rental properties be affected by the new legislation? Firstly, one of the stipulations surrounding the new legislations is that marijuana can only be smoked in private residences. With this stipulation, there are two clear opinions stemming from landlords surrounding the pending legalisations: Against – due to questions of property value, maintenance, and lack of control over their rental units For legalisation – viewing legalisation as an opportunity in the rental market, as there will be a need to fill Looking initially at those against legalization, and their concerns surrounding property values, costs of fumigation, and loss of control within their rental units, it is understandable why landlords are questioning how they will be able to control their properties once smoking weed becomes a legal right, contained to private residences. Much like how many landlords have clauses surrounding not allowing pets within their units, it is likely that there will be a surge in rental units that are anti-weed smoking, meaning that tenants are not permitted to smoke weed in these units. Although it is a tricky situation to regulate, as smoking weed is going to be a legal right, it is possible to see landlords increasing their rents, and tightening up conditions of leases in order to accommodate the new legislation and the costs that could be ensued. In the same way that landlords try and regulate the type and number of pets permitted in each unit, it is possible that they will attempt to make these same regulations surrounding marijuana in order to protect their property from damages, the need to fumigate, and to ensure the well being and happiness of al their tenants. A potential surge in rent increases could lead renters to be searching for weed-friendly apartments, (much like pet-friendly apartments), which could see a rise in vacancies in some places, along with some renters seeking out the option to purchase a private residence in order to enjoy their space freely, and as they see fit. On the other hand, some landlords are viewing this new legislation as an opportunity to take advantage of what will be a need in the market, much like those who take advantage of the need/want for pet-friendly rental options. The legalisation of marijuana opens a new need in the rental market for properties that will allow tenants to smoke, and grow their plants hassle free. With this opportunity, landlords can specialize their units with these new stipulations in mind, allowing those who wish to be able to smoke without hassle to find living arrangements that are both suitable, and enjoyable to them. With some landlords pushing to ban cannabis smoking in rental units, it is possible that cannabis users could end up with no where left to go, unless units like these exist. Although they may see a slight increase in the cost of renting these units, the ability to partake in cannabis use without issue is attractive to those seeking to exercise their legal rights. Much like those individuals who look specifically for rental units that allow pets, these tenants may result in fewer vacancies and longer tenancies, as the accommodations will be difficult to find with many landlords being against the new stipulations. Although the desire to smoke and grow cannabis would not be a requirement to live in a rental unit such as this, new tenants would have to be okay with the fact that the building does allow tenants to partake in their legal right, and therefore would minimize possible complaints surrounding smoke and pot smell. Although there is much to still be decided and ironed out in terms of details on these types of rental properties, it is certain to be a wise investment and a new opportunity to take advantage of within the market. The new legislation is a topic of discussion all around, surrounding use, growth, and ability to purchase marijuana, and it’s regulation. Landlords are preparing themselves for the coming changes, whether they are pro, or con, in terms of the new legislation and how their properties may change for existing and new tenants. It is possible there will be a rise in tenants seeking out marijuana friendly rental units, willing to pay premium prices for personal privacy and their ability to smoke hassle free.

Wanted: Ottawa Homes for Sale

Wanted: Ottawa Homes For Sale When the calendar rolled over into 2018 many real estate experts across Canada were speculating the housing market to “cool off” with tighter mortgage rules and higher interest rates impacting home buyers. While that may be the case in other real estate markets, in the Ottawa Real Estate market the biggest factor in February’s 2.8% drop in the number of sales (year over year), is that listing inventory is scarce. “There is no doubt our sales number would have been much higher if we had more properties available for sale. Buyer demand is there, but our inventory in both residential class and condos continues to decline. This is creating a supply side issue in the Ottawa real estate market” -Ralph Shaw, OREB President The Ottawa Real Estate board’s recently released statistics show that home buyers are still actively searching for properties in spite of the low inventory, which is a trend that is continuing from 2017. F If the decrease in supply in both the residential and condo markets continues into the Spring, it may put an upward pressure on prices. If you are thinking of selling this is a great time to get your home on the market. Below we’ve included the latest news release from the Ottawa Real Estate Board. Please note: average sale price information can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of all properties sold. We have access to current statistics and trends in our neighbourhoods and communities, it’s our job to stay on top of the market trends! We have up to date Real Estate Market Reports readily available for you and we love to chat real estate – contact us anytime! News Release Below: March 5, 2018 Posted by the Ottawa Real Estate Board Members of the Ottawa Real Estate Board sold 979 residential properties in February through the Board’s Multiple Listing Service® System, compared with 1,002 in February 2017, a decrease of 2.3 per cent. The five-year average for February sales is 922. February’s sales included 250 in the condominium property class and 729 in the residential property class. “There is no doubt our sales numbers would have been much higher if we had more properties available for sale. Buyer demand is there, but our inventory in both residential-class and condos continues to decline. This is creating a supply side issue in the Ottawa real estate market,” concludes Ottawa Real Estate Board President, Ralph Shaw. “If this trend continues, the market will move to favour sellers, and buyers will find themselves competing for a limited number of listings.” “Compounding the supply issue is the fact that after a record year last year, new construction is hindered getting to market because builders just cannot find enough land as a result of the urban boundary and land prices going up,” Shaw points out. “Given this environment, it’s a good opportunity for Sellers to get their property on the market,” he advises. The average sale price of a residential-class property sold in February in the Ottawa area was $429,600, an increase of 2.7 per cent over February 2017. The average sale price for a condominium-class property was $273,174, an increase of 5.6 per cent from February 2017. The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood. “The most active price point in the residential market continues to be the $300,000 to $449,999 range, accounting for 47 per cent of the market. While the most active price point in the condo market, between $150,000 and $249,999, accounts for 56 per cent of the market,” Shaw notes. “The reality is that condo sales are driving the number of properties sold at the moment. Due to demand, the condo market is experiencing some price recovery. Units in the lower price points of the condo market are likely moving rapidly because of the limited supply in the rental market which is yet another factor at play. The lack of availability is essentially forcing renters into condo ownership,” he explains. “Ottawa is beginning to experience similar indicators that have ultimately led to challenging real estate markets in our larger metropolitan cities. It starts with supply shortages which eventually lead to affordability issues. The city in particular needs to have an intelligent vision about how to support and stimulate all aspects of the market from new construction through to the rental market availability,” Shaw elaborates. “With this being a civic election year, we look forward to talking with our council and mayoral candidates about what measures need to be taken now to support affordability, before we develop the supply challenges of Toronto or Vancouver,” he cautions. In addition to residential and condominium sales, OREB Members assisted clients with renting 348 properties since the beginning of the year.

New Mortgage Rules – Renewing and Refinancing

New Mortgage Rules – Renewing and Refinancing January 1st, 2018 Canada’s new mortgage rules came into effect and it was big news. These new rules appear to have the greatest impact on those looking to qualify for a new mortgage but if you are looking to renew or refinance your mortgage, you may be impacted as well. At the centre of the new rules is a stress test requiring applicants to qualify at a rate at least 2% higher than the rate they will be paying, regardless of the down payment they are making on the home. The new rules may limit your options but rest assured, you will not lose your mortgage over these changes. Mortgage Renewals If your mortgage is up for renewal, lenders do not need to apply the stress test to renew an existing mortgage. This means that as long as you stay with the same lender and don’t change any of the terms of your mortgage, you will have no problems. But, if you want to shop around for the best rate, you will need to pass the stress test with any other financial institution. This may limit your options and may force some Canadians to accept a higher or uncompetitive rate if they are unable to pass the stress test. Mortgage Refinancing If you are planning on refinancing your mortgage, even if it is with the same lender, you will need to qualify at the higher stress test rates. This will affect Canadians who are looking to borrow money against their homes for renovations or repairs. If you are looking to refinance, you will have to qualify for the new loan at a rate that is 2% higher than your existing rate. This may mean that some Canadians may have to settle for a smaller loan or forego plans altogether. Take Aways The most important thing to remember not to panic, you will not lose your home over these new rules. Many Canadians will be able to pass the stress test for renewals and refinancing, but in any case as long as you stay with your existing lender, you will remain approved for the entire term of the mortgage. To better understand how these changes may affect you, it is always advisable to speak to your mortgage broker or bank well before your renewal date; it is best to understand your options in advance. If you are looking to buy a home in 2018, especially in the Ottawa real estate market, getting your financing in order before you start serious house hunting, is increasingly important. It will help you act quickly and with confidence when you find your dream home! Let us know how we can help!

Is it time to invest in a second “nest”?

College students, and living options If you’re the parent of a college/university age student, and you haven’t considered it yet, perhaps now is the time you will. As spring is just around the corner, it’s time to think about what investments you can make, and an investment that shouldn’t be overlooked is buying a home. More specifically, buying a home for your college-aged student to live in during school. Should you purchase a home in your students’ university/college town for them to live in during their schooling? What are the benefits, and drawbacks of investing in a second home? Would this investment bring you a profit? These questions, and many others are part of considering getting a home for your student to live in. Why buy a home for your student? College and university are expensive endeavours no matter what you do, but with a little planning, you can find ways to cut corners and minimize costs. One of the ways that can be done would be by purchasing a home for your student to live in while they’re in school. By buying a home, you have a hand in your students’ quality of life, and are involved in their living situation (in terms of sketchy roommates, and sneaky landlords). Your student can learn the responsibility of owning a home, without burdening all of the financial costs (as they would have roommates), as well as ensuring they have a stable living situation, that has fewer costs than finding an apartment to rent throughout their school years. What are the benefits of buying your student a home? There are a multitude of benefits that come along with buying a home for your student to live in including, but not limited to: having stability in their housing, fixed expenses, and the rental income that can come from having roommates. If you have more than one student enrolled, having a place they can both live is easier than having them both go apartment hunting. Their friends can become their roommates (and your tenants), which can allow the mortgage to be paid, and then some. Depending on the size of the home, the income from having tenants along with your children, is that their rent will not only cover the mortgage, but any other maintenance related expenses that your student would need to pay for, or work for, such as the cost of snow-removal. Having a fixed bill payment each month will allow your student to further understand how bills are paid, what the true cost of living is, and how to properly budget. There are so many benefits in the option of buying a home for your student to live in, but a major benefit is removing the costly expense of moving, and storing furniture year after year. In many university towns, students who return home for the summer need to leave their current lease, and pay for 4 months of summer when they won’t be living there. Many students need to store furniture for the summer, which is an additional expense, as well as the gas, time, and travel expenses that come along with moving multiple times. As students continue to live in your second home, its value will increase, and when your students finish school, you can have the option of selling this home at a profit. Of course, there is always the question of “What if they don’t stay there?” – perhaps your student may be interested in travelling abroad, or changing schools later on – but that doesn’t take away from the investment you’ve made. If your student chooses to study abroad for a year, you will have tenants in place already and the house will continue to build equity. Investing in a home is always a sound decision that holds a variety of opportunity for you, and your student. The investment is always best returned to those who intend to hold onto the “second nest” for longer than their children are enrolled in university/college, as it gives them time to build more equity and increase the value/profit that may come from the sale of this home. Who can help? In the same manner you would contact your Realtor to look into purchasing a home near you, contact a Realtor to discuss the area, opportunities for growth, and what the rental community is like in that city. It is also an option to purchase a home in Ottawa that is closer to campus for your student to live in – purchasing a second home as an investment is an option that exists regardless of where your student decides to go to school. If your student is going to school out of town, contact a Royal Lepage Realtor in their soon to be “home” to use their extensive knowledge of the housing market, and area in order to make an informed decision. Realtor’s can even help you find tenants for your second nest, should you need them to!

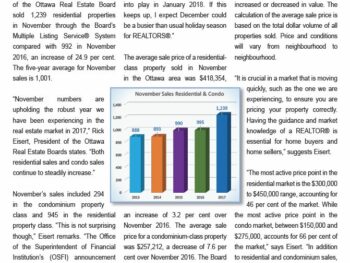

Ottawa Real Estate Market Update : Low Inventory Continues Into 2018

The Ottawa Real Estate board’s recently released statistics show that home buyers are still actively searching for properties. Sales were up over 7% (year over year) in spite of the low inventory, which is a trend that is continuing from 2017. January 2018 listings 994 (RES) and 406 (CONDO) compared with the 5 year 1,396 for residential and 500 for condominiums. If the decrease in supply in both the residential and condo markets continues into the Spring, it may put an upward pressure on prices. If you are thinking of selling this is a great time to get your home on the market. Below we’ve included the latest news release from the Ottawa Real Estate Board. Please note: average sale price information can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of all properties sold. We have access to current statistics and trends in our neighbourhoods and communities, it’s our job to stay on top of the market trends! We have up to date Real Estate Market Reports readily available for you and we love to chat real estate – contact us anytime! News release from the Ottawa Real Estate Board OTTAWA, Feb. 5, 2018 Members of the Ottawa Real Estate Board sold 712 residential properties in January through the Board’s Multiple Listing Service® System, compared with 664 in January 2017, an increase of 7.2 per cent. The five-year average for January sales is 638. “While January is typically the month we see the lowest number of listings come onto the market, the numbers for this month are very low,” Rick Eisert, 2017 President of the Ottawa Real Estate Board, observes. “The five-year average for new listings in January is 1,396 for residential and 500 for condominiums. January 2018’s listings were at 994 and 406 respectively.” “We saw this trend throughout 2017, and the result is our resale market is being challenged by decreasing supply in both the residential and condo markets. Furthermore, as the supply continues to be reduced, it will tend to put an upward pressure on prices. This is simple supply and demand economics,” he adds. The average sale price of a residential class property sold in January in the Ottawa area was $427,487, an increase of 8.8 per cent over January 2017. The average sale price for a condominium-class property was $263,744, a decrease of 8.6 per cent from January 2017. The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood. January’s sales included 173 in the condominium property class and 539 in the residential property class. “Sales in the residential property class this month were on par with January 2017 with a minor decrease of 1.1 per cent. Unit sales in the condo market, however, have seen an increase of 45 per cent from 119 units sold in January 2017 to 173 units in January 2018,” Eisert explains. “The most active price point in the residential market is the $300,000 to $449,999 range, accounting for 47.5 per cent of the market. While the most active price point in the condo market, between $150,000 and $249,999, accounts for 55 per cent of the market,” states Eisert. “There is a marked increase in the number of condo units sold in the lower end of the market specifically. This is likely due to the attractive lower price point and the fact that the demand is there.” “For homeowners thinking of selling, this is a good time to get your property on the market before spring,” Eisert advises. “Since inventory is currently low, sellers will certainly get attention because selection for buyers in some areas, in particular, is quite limited.” In addition to residential and condominium sales, OREB Members assisted clients with renting 166 properties since the beginning of the year.

Winterlude 2018

The Winter months in the Capital are arguably some of the most enjoyable for its residents and their families. Christmas has passed, yuletide memories have been made, and we’ve welcomed the New Year with wide opened arms. And with the anticipation of new beginnings in 2018, we take in a deep breath of fresh, brisk air and bundle up to embrace what this year has to offer; including the great outdoors. In fact, with the many winter-filled activities that our City and surrounding areas have to offer this Winterlude season, it’s nearly impossible to sit idle as the cold passes us by. Here are a few activities that you and your family can partake in this winter to celebrate Winterlude’s 40th birthday year: Lansdowne’s Winter Garden: beginning February 2nd and ongoing to the 19th, Lansdowne Park at Aberdeen Square will be transformed into a “glowing winter garden of sculpted snow and lanterns”. Bring your friends, your families and your hot chocolates as you walk through and enjoy this open space of winter magic. Confederation Park: quite possibly Winterlude’s centerpiece. Throughout the duration of this year’s festivities, Confederation Park will once again become our City’s central space of enchantment and masterpiece. Open daily from 9AM-11PM (and on February 19th from 8AM-5PM) the Park’s Crystal Garden will have you in awe as renowned Canadian artists turn simple blocks of ice into magnificent works of art. Snowflake Kingdom: 350 Laurier Street in Gatineau is now home to the Ice Hog Family – Winterlude’s favourite mascots. Surrounded by a vast winter playground of several activities and Canadian winter traditions (including the legendary Super Slides), the Snowflake Kingdom is the spot for you and the kids! Check out the park’s hours of operation and special events here! Sens Rink of Dreams: Who’s up for a leisurely skate, a delicious Beaver Tail and a stroll through the Ottawa Sports Hall of Fame? If these activities sound like your ideal winter’s day, then City Hall is calling your name. Located directly across from the heart of Winterlude at Confederation Park, the Marion Dewar Plaza at City Hall is the perfect spot for you and the family to enjoy some quality time and create some lasting memories. On-site skate rentals are available! Winterlude officially launches on February 2nd at 9:30AM at Jacques-Cartier Park North. Be sure to dress warm and bring the family along to meet the Ice Hog Family at Snowflake Kingdom to kick-start 2 weeks of fun-filled festivities! 40 never looked so good!

SPRING into ACTION: Sellers

SELLERS Now’s the time to spring into action if you’re a prospective home seller. Getting your home prepared for the spring market now, will help you move quickly and efficiently when the time comes to list. Spring is the optimum time to sell a home, as the largest numbers of buyers are actively searching for a new home during the months of April, May, and June. If you’re looking for tips, tricks, and ideas to get your home market ready, then you’ve come to the right place! Purge & Pack: What better way to clear out the winter blues, than to clear out the clutter in your home. Take this as a reason to stay warm inside, as you begin to go through attics, closets, basement, and/or garages to determine what to keep, what to donate, and what could be packed away early. Decluttering and depersonalizing are both important steps in preparing your home. Boxing up items will make your space look larger, and neater when it comes time to putting your house on the market, and will stop you from unnecessarily moving unneeded clutter from your current home, to the next. Renovations: Major renovations aren’t necessary to sell your home, however small, DIY projects around the house can increase value, while also making your home look more appeal to potential buyers. Some quick fixes can include, but aren’t limited to: replacing old doorknobs, replacing stray cabinet handles to ensure consistency across your kitchen, replacing the caulk in your bathroom (tub, shower, around the sink), updating light fixtures and ensuring all bulbs have been replaced, or even repainting the trim throughout your house. These small projects and many others can deliver big returns in the end. For more small DIY home projects/renovations that you could use in your home, check sites like Pinterest, for details. Clean: Let yourself be stung by the “spring cleaning” bug early, and start looking at the “overlooked” areas of your home. Open the windows to let the fresh air circulate, make sure your baseboards are clean, and your heaters are dust free. Adding that bit of sparkle is free, and goes a long way when it comes to selling your home. Wash the inside and outside of all your windows, and be sure to polish up all mirrors, as that extra attention both brightens your home, and makes it more inviting for buyers. Once you’ve cleaned all those hard to reach places, prepare yourself for the staging of your home. Stage The most important part of selling your home, is to set the stage so potential buyers can fantasize, and envision your home as their own. Once your home is on the market, you’ll need to be keeping it as clean as possible, almost encouraging the idea that “no one lives here”. Home staging is about creating an illusion, to create a comfortable, inviting atmosphere, that allows potential buyers to feel at “home” in your home. Use towels, throws, and pillows in light, soft spring colours (such as yellows, pinks, lavender, blues) to lighten up a room, and set up fresh flowers (such as lilacs) to add a gentle, natural fragrance to your home. Contact A Realtor: Realtors are professionals when it comes to the processes of both buying, and selling homes. Your choice of a listing agent can make a big difference in the time it takes to sell your home, and the profits that you may see from that sale. Ensuring that you select a realtor with a great marketing plan, and local knowledge is important for you to get the most out of your home, and during your search for a new one. Realtors have a wealth of knowledge, and experience, so while you are in search, take the recommendations that come from friends and family into consideration, and interview those that have the right experience with homes in your price range. Finding a good realtor is a vital aspect of listing your home, and knowing you’ll have their support and dedication leading up to, and throughout your listing, and well as during the final sale and paperwork is always a relief.

SPRING into ACTION: Buyers